Bearish stock patterns have been my bread and butter for years.

Trading these setups has helped me turn my trading around and earn a consistent 50% return year after year.

But success has its price: I've been burned more times than I care to admit, and the mistakes I've made cost me money, time, and even relationships.

If I could go back and start over again, I'd have learned how to spot all bearish patterns sooner and would have saved myself a lot of heartache and money in the process.

The key to success with bearish chart patterns is knowing when to sell, and when to cut your losses. But that's easier said than done.

This is why I decided to write this complete guide to show you exactly how to trade these formations like a pro.

I'll tell you exactly what to look for, and I'll even give you access to a strategy that you can use over and over again.

Now let's jump right in.

What is a Bearish Pattern?

Bearish stock patterns are technical analysis patterns that show an impending decline in the price of a stock or security.

They signal the potential for a downtrend by revealing an increase in selling pressure and a series of lower highs and lower lows in the price action.

You can find these bearish trading patterns forming after a prolonged uptrend and before a strong market correction or reversal.

They are usually followed by a consolidation or sideways period before the stock price continues its downward movement.

As the bearish momentum is building up, more and more sellers enter the market and pressure the price down further.

You can expect a sharp decline or sell-off to follow when you see the price breaking (and closing) below key support levels, such as moving averages, trend lines, and Fibonacci retracement levels.

As a trader, you can use bearish stock patterns to time your entry into a short position, locking in a profit as the price drops.

Types of Bearish Price Action Patterns

If you're only familiar with bullish chart patterns, you might think that bearish trend patterns aren't worth your time.

Well, I'm here to tell you that's not true.

Bearish stock chart patterns can be just as profitable as bullish ones. In fact, they can be even more profitable if you know what you're doing.

As professional traders, we can profit on both sides of the market and take advantage of the swings in either direction.

There are two major categories of bearish technical patterns:

- Continuation patterns

- Reversal patterns

Bearish continuation patterns signal a continuation of the ongoing downtrend after a short-term pullback or consolidation period.

These patterns usually form in the middle of a downtrend and mark the beginning of another leg down in price.

Bearish reversal patterns, on the other hand, form near the end of an uptrend and signal a potential reversal to the downside.

Which type of stock bearish patterns should you focus on?

The answer is both.

You don't want to miss any bearish chart signals because both types have the potential to make you a lot of money when traded correctly.

However, keep in mind that each stock bearish pattern has a different trading strategy associated with it and a different risk-reward ratio as well.

So make sure you focus on the ones that are most suitable for your trading style and risk tolerance level.

How to Profit From Trading Bear Market Patterns

Do you trade during bear markets?

If you do, then you know that trading this way is more difficult, as there are fewer opportunities and more volatility.

But that doesn't mean you can't make money trading bear markets. In fact, trading the downside can be very profitable if you know exactly what you're doing.

And there are two ways to do this.

First, you can employ counter-trend trading strategies to trade against the direction of the trend.

For example, if the market is bearish, you can wait patiently until it drops to a potential support level and starts making higher highs and higher lows.

When you see a bullish reversal pattern forming on the chart, you can buy the dip and ride the trend back up to the previous resistance level.

Second, instead of trading against the trend, you trade with the trend. You can trade in the direction of the price movement.

So if the bearish trend continues, you can wait for a bearish continuation pattern to form and go short when the price breaks below the bottom trend line of the formation.

Trading in a bear market can be just as profitable as trading in a bull market.

But there are more opportunities available, fewer traders trade against you, and it's easier to catch the moves.

While you don't want to miss out on any fantastic bear market chart patterns, keep in mind that the market has to find its bottom first before any big moves happen.

Formation

A bearish stock pattern forms near the end of a prolonged uptrend or in the middle of a downtrend after a short-term pullback or consolidation period.

These patterns are characterized by a series of lower lows and lower highs, followed by a sharp decline.

The decline can be so steep that it can cause many traders to panic and sell out of fear for the safety of their capital.

This results in additional selling pressure and lower prices until the momentum runs out and the market sentiment turns from negative to neutral or positive again.

And that's when the bulls step in and buy back in at bargain prices. This is when you see the bullish reversal patterns begin to develop on the chart.

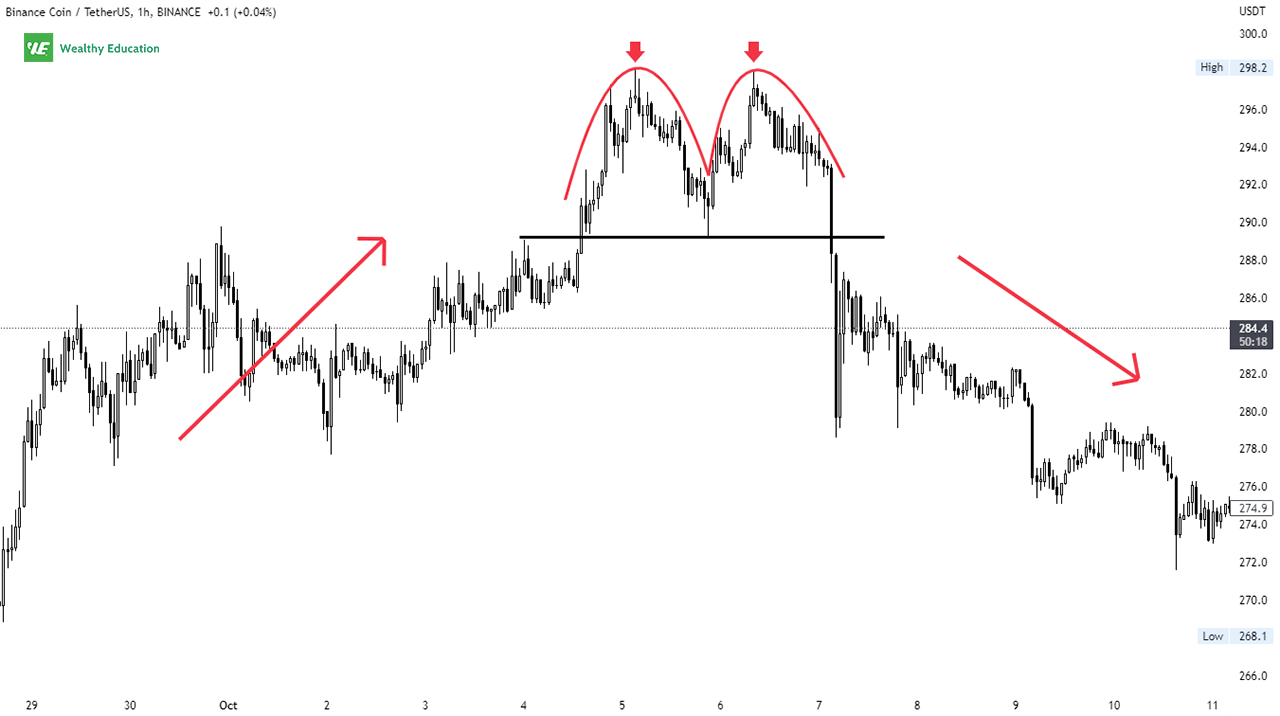

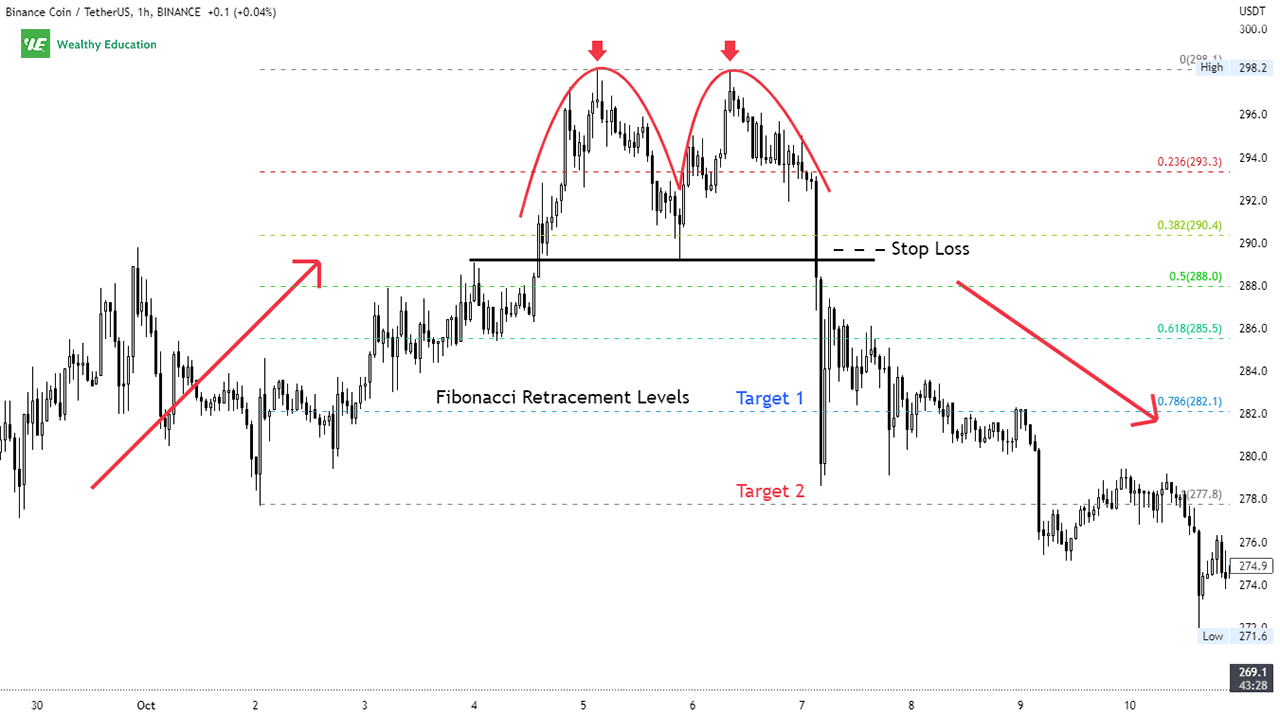

The chart below shows a good example of a bearish chart pattern.

Binance Coin (BNB/USDT) formed a double top pattern on a 1-hour chart in early October before dropping sharply from $298.2 to $271.6.

The breakout of the bearish formation caused an influx of selling activity as the bears took control of price action.

This showed a shift in trader sentiment toward pessimism (negative) and a major change in trend to the downside.

As you can see, these declines are usually sudden and severe, as the price falls off a cliff with no hesitation or delay.

That's because fear spreads quickly among the masses once a trend changes direction from bullish to bearish.

These massive drops usually last for weeks or months until the market finds a new bottom and a new long-term support level.

The Most Bearish Chart Patterns

If you're shorting the market, you want to focus on the best bearish chart patterns you can find.

But if you go short at the wrong times, you could eventually end up losing more than you expected.

And that's because most traders have no idea about which bearish market patterns are actually bearish - and which ones are just fakeouts.

Keep in mind that all bearish chart patterns are validated only when the price breaks down below an important support level and moves lower.

This usually triggers a massive sell-off in prices that lasts for days or even weeks at a time.

And this is exactly why you need to identify the "real" ones before trading them.

So if you're looking for the best opportunities to short the market, you won't have to search long because I've compiled the definitive list of the most bearish stock patterns for you right here!

Bearish Chart Patterns | Type | Location | Rating |

|---|---|---|---|

Head and Shoulders | Reversal | Uptrend | |

Reversal | Uptrend | ||

Continuation | Downtrend | ||

Reversal | Uptrend | ||

Reversal | Uptrend | ||

Reversal | Uptrend | ||

Reversal | Uptrend | ||

Reversal | Uptrend | ||

Reversal | Uptrend | ||

Continuation | Downtrend |

Whether you've been trading for one week or 10 years, these downtrend patterns will help you see the big picture of the market and time your entries accordingly.

Now that you get familiar with different bearish patterns, let's dive right in and get your hands on the most reliable way to trade them.

How to Trade Bearish Stock Patterns

If you want to create a repeatable trading strategy that minimizes your risk and maximizes your profit potential - you need to know what to look for.

A bearish stock chart pattern occurs when a stock makes a large move upward and then plunges dramatically.

These bearish price patterns show the potential for a downtrend by revealing increasing selling pressure in the market.

So the strategy is to first look for signs of exhaustion among buyers, especially around major resistance levels.

You can use technical oscillators, such as the Relative Strength Index (RSI) or Stochastic, to zero in on overbought conditions among buyers that typically signal exhaustion and a potential reversal to the downside.

Then, you can expect the price to drop to key support levels where the bulls can no longer defend it, allowing the bears to take over.

You will see prices going sideways or consolidating for a while at these levels before breaking below them.

Finally, you can expect a steep decline in price or a sell-off when the support levels are broken and the downward breakout is confirmed.

You can enter a short (or sell) position as soon as the price closes below the breakout candle.

You want to see at least 2 consecutive candlesticks close below the breakout point to confirm your bearish pattern's validity.

That way, you'll eliminate false breakouts and filter out all the noise in the market.

In most cases, the price will keep going down until the market reaches another support zone where sellers can’t continue pushing prices lower.

So this is where you can set your profit target to lock in your profits and exit the trade.

You can easily identify these price levels by looking for previous major support and resistance areas on the charts and using the Fibonacci Extension tool.

Useful Trading Tips

Becoming a successful chart pattern trader doesn't happen overnight. It takes a lot of hard work and determination on your part.

And it takes a good understanding of the chart pattern you're trading with and the trading psychology behind it.

I've been trading the market for years, and I've helped countless traders master their trading psychology.

But there is one thing I've discovered - no matter how much you know, or how powerful your strategies are, without the right mindset, you'll constantly run into problems.

In fact, most traders don't know how powerful their own psychology is. They let their emotions get the best of them, and more often than not, they lose money.

That's why you need to overcome these mental barriers as soon as possible and trade the market with confidence, regardless of the situation you find yourself in.

Here are some useful trading tips:

- Start with a plan: Before you start trading, you need to have a plan in place. This should include your trading strategy, risk management plan, and goals. Having a plan can help you make more informed decisions and avoid making emotional trades.

- Set realistic goals: It's important to set realistic goals for yourself as a trader. This will help you stay focused and motivated, and it will also help you avoid making unrealistic or overly optimistic predictions.

- Manage your risk: Risk management is an important part of trading. This means carefully considering the potential risks and rewards of each trade, and setting stop-losses to protect yourself from large losses.

- Be disciplined: Successful traders are disciplined and stick to their trading plan, even when things don't go as expected. This can be difficult, but it's important to avoid making emotional trades and to stay focused on your long-term goals.

- Keep an eye on the news: The financial markets are constantly influenced by news and events, so it's important to stay informed. Keep an eye on the latest news and developments and be prepared to adjust your trades accordingly.

- Learn from your mistakes: No one is perfect, and even the best traders make mistakes. The important thing is to learn from them and try not to repeat them in the future. Take the time to analyze your trades and figure out what went wrong, and use this knowledge to improve your trading strategy going forward.

By following these tips, you can increase your chances of success and improve your trading skills over time.

However, keep in mind that nothing can take the place of experience - so make sure you keep practicing and developing your bearish pattern trading skills as time goes by.

Final Words

There you have it - the most comprehensive guide on how to trade downtrend stock patterns.

To look for a profitable short-selling opportunity, you should first be able to identify the best bearish pattern on a price chart.

All you need to do is to wait for the price to break below the support level of the pattern.

This is known as a breakdown, and it shows that the bearish trend is likely to continue. Once the breakdown occurs, you can enter a short position.

Make sure that you always have a trading plan in place and use a stop-loss order to limit your risk exposure in case the market moves against you.

If you can identify the right setups and trade them correctly, you can make a lot of money even in a bear market.

I hope the strategies I've covered here will help you develop your own trading strategy so you too can profit from stock market bearish patterns.

It's also important that you should spend time doing quality research and learning how to trade properly to generate consistent profits in the market.

Think of it like building a solid foundation for your trading skills.

The more you practice and the more you learn, the better you'll get at identifying the right downtrend chart patterns and executing profitable trades in the long run.