Are you ready to dive into the exciting world of value investing? I know I am!

I am thrilled to share that I've been on this investing journey for over a decade now, and let me tell you, it has been a wild ride!

I remember when I first started out, I had no idea how to calculate intrinsic value of a stock. It was a frustrating time, and I know many of you are feeling the same way.

But don't worry, I'm here to help you navigate the choppy waters of value investing and come out on top. I know firsthand just how tough it can be to find a technique that really works for you.

There are countless tips, tricks, and methods out there, and it can be overwhelming to decide which one to follow...

...and that's why I want to share with you the value investing method that has worked wonders for me, my friends, and all of our students here at WealthyEducation.

Now, let me be clear - every investor has their own unique way of calculating intrinsic value.

It all depends on which valuation method they prefer, and there's no one-size-fits-all approach.

But the method I'm going to teach you is the same one we teach in our investing courses, and it has proven to be incredibly effective.

So, if you're ready to take your investing game to the next level, buckle up and let's get started!

Trust me, with a little bit of patience and some hard work, you'll be well on your way to becoming a master value investor in no time!

What is Intrinsic Value?

Let's talk about why finding the actual value of a company is SO important! It's like unlocking a secret code to the potential success of your investment.

Picture this: You're thinking of investing your hard-earned money in a company. But, how do you know if the price you're paying for its shares is worth it? This is where intrinsic value comes in.

So what does intrinsic value mean?

This is the true value of a business, which may be higher or lower than the current market price.

It represents how much the business is really worth, beyond just its current selling price.

Now, as a savvy investor, you know that it's crucial to estimate this value so you can make smart decisions about buying and selling stocks.

By doing regular stock valuations, you'll get a much better sense of the companies you're looking to invest in, and whether they're currently over- or undervalued.

And here's the exciting part...

Knowing whether a company is undervalued or overvalued means you can really take advantage of the "buy low, sell high" approach that makes value investing so profitable.

So don't be a "fake investor" - get to know the intrinsic value of your stocks and make some serious profits!

Intrinsic Value Definition

Intrinsic value refers to the inherent worth or value of something, regardless of its market or exchange value.

It is the actual value of an asset or investment, based on its characteristics and qualities, rather than its perceived value in the market.

Intrinsic value can be applied to various types of assets, such as stocks, real estate, commodities, and even currencies.

For example, the intrinsic value of a stock is determined by factors such as the company's actual financial performance, growth prospects, and management quality, among others.

Similarly, the intrinsic value of a piece of real estate is determined by its location, size, condition, and potential for income generation. The intrinsic value of gold is determined by its rarity, durability, and unique properties.

In the finance world, you can use intrinsic value to figure out how much a company or asset is truly worth.

You need to look at a bunch of different factors, like how much money the company is making (revenue), how much profit it's earning (earnings), how much cash it has on hand (cash flow), and how many assets it owns (assets).

You also need to take into account the potential for growth, debt-repayment capacity, and profitability in the future to ballpark the fair value of that company.

So why is all of this important?

When you calculate intrinsic value, you can tell whether a company is undervalued (meaning it's worth more than the market thinks) or overvalued (meaning it's worth less than the market thinks).

This information is super helpful if you're thinking about investing in a company or asset – you can use it to make smarter decisions and get the most bang for your buck.

Ethics vs Philosophy

Intrinsic value is also an important concept in ethics and philosophy because it helps you understand what things are valuable in and of themselves, rather than just as a means to an end.

Therefore, intrinsic value ethics is the study of what things are intrinsically valuable and how we should act to promote and protect those values.

This can include things like the value of human life, the value of nature, and the value of art.

In contrast, intrinsic value philosophy takes a broader approach to the concept of intrinsic value.

It looks at the value of things beyond just living beings and considers the value of ideas, concepts, and principles.

For example, in philosophy, you might ask questions like "What is the meaning of life?" or "What is the nature of reality?" that go beyond the scope of intrinsic value ethics.

Intrinsic vs Extrinsic Value

Have you ever thought about what makes something valuable? Have you ever heard of anything that has intrinsic and extrinsic value?

When it comes to value investing, there are two main ways of assessing the worth of a company or asset: extrinsic and intrinsic value.

Intrinsic value refers to the actual value of a company or asset based on its inherent characteristics, such as its cash flow, earnings, liabilities, and assets.

Extrinsic value, on the other hand, refers to the value placed on a company or asset by external factors, such as market demand, hype, or the opinions of other investors.

For example, a company may have a high market value simply because it's currently in vogue with investors, or because of a media buzz surrounding a particular product or service.

While extrinsic value can play a role in short-term market fluctuations, it's ultimately the intrinsic value of a company or asset that determines its long-term potential.

So, next time you're considering an investment opportunity, make sure that you'll take a closer look at the intrinsic value and assess the true worth of that investment before making a decision.

Intrinsic vs Instrumental Value

Instrumental value refers to the usefulness or practicality (ability to generate returns for investors) of an asset or investment. This means that an asset may have instrumental value even if its intrinsic value is low.

This value is often influenced by external factors like market sentiment and investor behavior, which can cause prices to rise or fall regardless of the asset's intrinsic value.

For example, a dividend-paying stock may have high instrumental value because investors believe it will generate high returns, even if its intrinsic value is not strong.

Similarly, a piece of real estate may have a low intrinsic value due to its location or condition, but it may have high instrumental value if it can be easily rented out for a steady stream of income.

While instrumental value is important, it's not the focus of value investing.

Value investors are primarily concerned with intrinsic value, which is the foundation of their investment philosophy.

Intrinsic Value vs Market Value

It's important to note that intrinsic value is not the same as market value.

Market value can go up and down depending on a whole bunch of things like economic conditions, political events, and even what people are thinking and feeling. It can be pretty unpredictable!

In contrast, intrinsic value is based on the fundamental qualities of an asset, like its quality, rarity, and usefulness.

This means that intrinsic value can be a more reliable way to measure the long-term worth of an investment.

That way, you can make a more informed decision about whether it's a good investment for you.

For example, if you have a vintage guitar that was played by a famous musician, its current market value might go up and down depending on how people feel about that musician.

But its intrinsic value, the fact that it's a rare, unique piece of musical history, is always going to be there, no matter what's happening in the market.

So if you're thinking about investing in something, it's always a good idea to take a look at its intrinsic value and consider that alongside the market value.

Now that you understand the definition of intrinsic value, let's find out how to calculate it.

How Does Warren Buffett Calculate Intrinsic Value?

Did you know that Warren Buffett is considered one of the most successful investors in history? One of the reasons for his success is that he's great at figuring out how much a company is really worth.

So, how does he do it?

Although Buffett hasn't revealed his exact formula, he has provided some insight into his thought process, and he emphasizes the importance of analyzing a company's financial statements as well as its qualitative aspects.

Well, instead of relying on a specific formula, Buffett takes a comprehensive fundamental analysis approach by analyzing a range of factors.

He looks at the financial and operational performance of a company, its potential for future growth and profitability, and the quality of its management team, among other things.

For example, he likes to look at how well the company has been doing financially and how it might do in the future. He's interested in companies that have been making a lot of money compared to how much they've invested.

He also pays attention to things like how good the company's management is, and whether the company has a strong position in the market.

Besides quantitative factors, Warren Buffett also takes into account qualitative aspects such as a company's brand name, loyal customer base, and competitive moat which makes it difficult for competitors to enter the market.

At the end of the day, Buffett believes that focusing on intrinsic value is the key to successful long-term investing, and his track record certainly speaks for itself.

How to Calculate Intrinsic Value of a Stock

Understanding the intrinsic value of stocks is an essential part of making informed investment decisions.

Intrinsic value calculation is the process of determining the underlying value of a stock based on its current financial performance and potential for future growth.

You can start by gathering information about the company. Look at its financial statements, including income statements, balance sheets, and cash flow statements.

You'll also need to determine the discount rate, which is the rate of return you could get from a different investment of similar risk. Once you have this information, you can start calculating intrinsic value.

There are several financial models you can use, including discounted cash flow analysis, price-to-earnings ratio, and dividend discount model.

The discounted cash flow analysis method involves projecting future cash flows and discounting them to their present value, while the price-to-earnings ratio method involves comparing the company's stock price to its earnings per share.

The dividend discount model calculates a stock's intrinsic value based on the future dividends the company is expected to pay.

It's important to note that finding intrinsic value is not an exact science, and there are a lot of factors that can influence the final value.

In this article, I'll walk you through my foolproof method for estimating intrinsic value – the discounted free cash flow model.

So, what exactly is the discounted free cash flow model?

It's a valuation method that estimates the intrinsic value of a company by discounting its expected future cash flows back to their present values.

This means that the model takes into account the expected growth of the company, the cash it generates, and the cost of capital, among other factors.

By doing this, you can get a more accurate estimate of what the company is worth, regardless of its current stock price.

Now, let's take a look at the 6-step process below.

To find intrinsic value of a stock, you can follow the steps listed below:

- 1Find all required financial data

- 2Calculate discount rate and use it to discount the future value of the business

- 3Perform a discounted free cash flow (DCF) analysis

- 4Calculate the company's net present value (NPV)

- 5Calculate the company's terminal value (TV)

- 6Put the net present value and the terminal value together

Intrinsic Value Formula

The intrinsic value of stock formula based on the discounted free cash flow (FCF) model involves a few steps.

First, you need to estimate the company's future cash flows. This can be done by analyzing historical financial data and making projections based on the company's future growth prospects.

Next, you need to discount those future cash flows back to their present value. This takes into account the time value of money and the risk associated with the investment.

Finally, you need to subtract the company's debt and add its cash and other assets to arrive at the estimated intrinsic value of the company.

Here's the exact formula for estimating intrinsic value of stock:

Now let's dive into each step and learn how to do all the math!

Step 1: Find All Needed Financial Figures

Before performing the calculation, it's worth taking a small step to find all the necessary numbers, and then you just need to plug them into the formulas given above.

In general, there is a total of 14 financial figures that you'll need to find before perfoming your cash flow analysis:

- 1Current Share Price: the price at which a company's stock is currently selling.

- 2Shares Outstanding: the total number of shares that are issued and currently owned by the company's shareholders.

- 3Free Cash Flow: this figure represents the company's capacity for generating free cash, which is used for its future expansion, paying off debts and enhancing its shareholder value.

- 4Long-term Growth Rate: the expected rate at which the company will grow.

- 5Business Tax Rate: the business income tax paid to the government. This tax rate varies among different countries.

- 6Business Interest Rate: the effective rate that the company is charged on its loans and borrowings.

- 7Perpetuity Growth Rate: often known as "terminal growth rate" or "implied perpetuity growth rate". The rate that the company is expected to grow at after our cash flow projection period. We'll use the country's GDP growth rate as a Perpetuity Growth Rate.

- 8Market Value of Debt: the total dollar market value of a company's short-term and long-term debts.

- 9Market Value of Equity: often known as "market cap". The total dollar market value of a company's outstanding shares.

- 10Stock Beta: often known as "beta coefficient". Beta is a measure of how much the price of the company's stock tends to fluctuate.

- 11Risk Free Rate: the minimum rate of return that investors expect to earn from an investment without any risks. We’ll use a return of the 10-Year Government’s Bond as a Risk-Free Rate.

- 12Market Risk Premium: the rate of return over the Risk-Free Rate required by the investors. For calculating the discount rate, you can use the market risk premium data we've calculated here.

- 13Total Business Debt: the total liabilities of the company.

- 14Total Business Cash: the total cash and cash equivalents of the company.

Step 2: Calculate Discount Rate (WACC)

In my opinion, the discount rate is the most crucial component of our discounted cash flow analysis (DCF valuation method) .

If you frequently perform stock valuation, you would realize that we cannot use the same discount rate for every single stock.

The key mistake that many investors make is that they use a random discount rate, says 5%, 6%, or 7%, to compute the discounted cash flows of their stock.

After several years of being an independent investor, my experience tells me that every single stock will come up with a different discount rate.

Here are some real-world examples (I selected a number of random stocks):

# | Ticker Symbol | Business Name | Estimated Discount Rate |

|---|---|---|---|

1 | AAPL | Apple Inc. | 8.69% |

2 | AMZN | Amazon.com, Inc. | 10.65% |

3 | MCD | McDonald's Corp. | 5.05% |

4 | NKE | NIKE, Inc. | 4.56% |

5 | GOOGL | Alphabet Inc. (Google) | 6.68% |

6 | PZZA | Papa John's International Inc. | 6.46% |

7 | CGNX | Cognex Corporation | 9.74% |

8 | GEL | Genesis Energy LP | 8.36% |

9 | DIS | The Walt Disney Company | 9.64% |

10 | TXRH | Texas Roadhouse, Inc. | 4.87% |

Now let me recall all the formulas that we use to calculate the Discount Rate.

Firstly, we'll need to calculate the After-tax Cost of Debt as follows:

Then, we'll use the Capital Asset Pricing Model (CAPM) to calculate the company's Cost of Equity. The CAPM formula looks like this:

And finally, we'll calculate the Weighted Average Cost of Capital (WACC) and use this rate as a discount rate:

As you can see, we need to take several steps to come up with the Discount Rate. There are 4 essential elements presented in our formulas:

So, if you use the same Discount Rate for every stock you value, you will have to assume that all of your stocks have the same Cost of Debt and Equity, and the same Market Value of Debt and Equity.

And you know, that just doesn't happen!

Step 3: Calculate Discounted Free Cash Flows (DCF)

After having the discount rate, we'll use it to perform the discounted cash flow analysis. There are 3 steps that you'll need to follow:

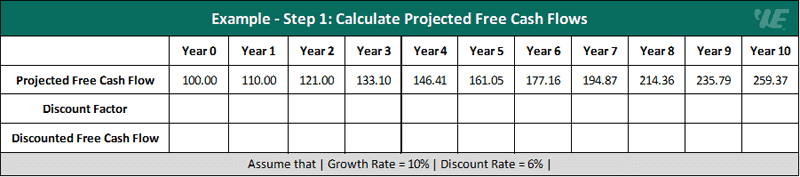

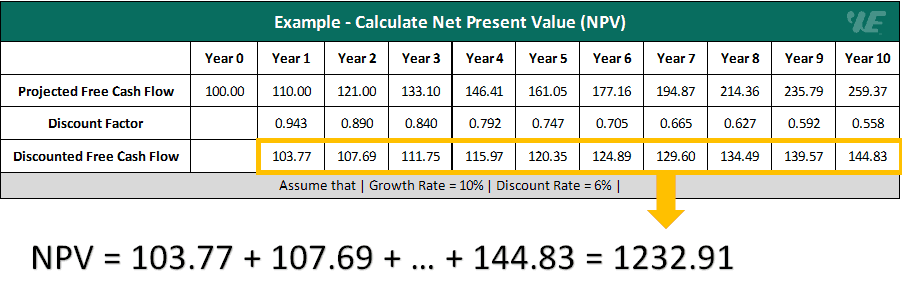

Now let's take a look at this example:

Assume that the company in which you are looking to invest, has a trailing-twelve-month free cash flow of $100 million and is expected to grow by 10% every year. We'll use a discount rate of 6%.

Firstly, we use the long-term growth rate of 10% to project the future free cash flow of the company in the next 10 years. We assume that the business will consistently grow by 10% every year.

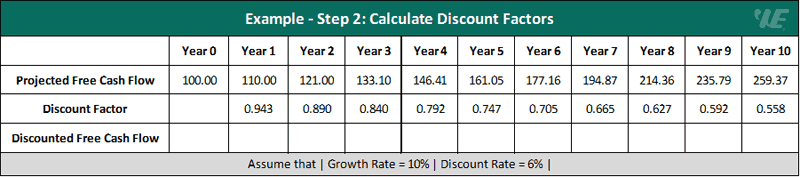

Next, we use the discount rate to calculate the discount factors, as follows:

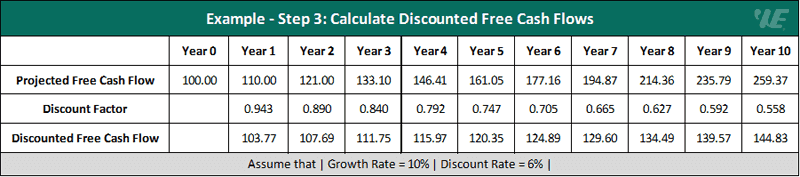

The final step is to discount the future cash flows to arrive at the present value of each individual year's cash flow. We simply take the projected cash flow and multiply it by the discount factor, like this:

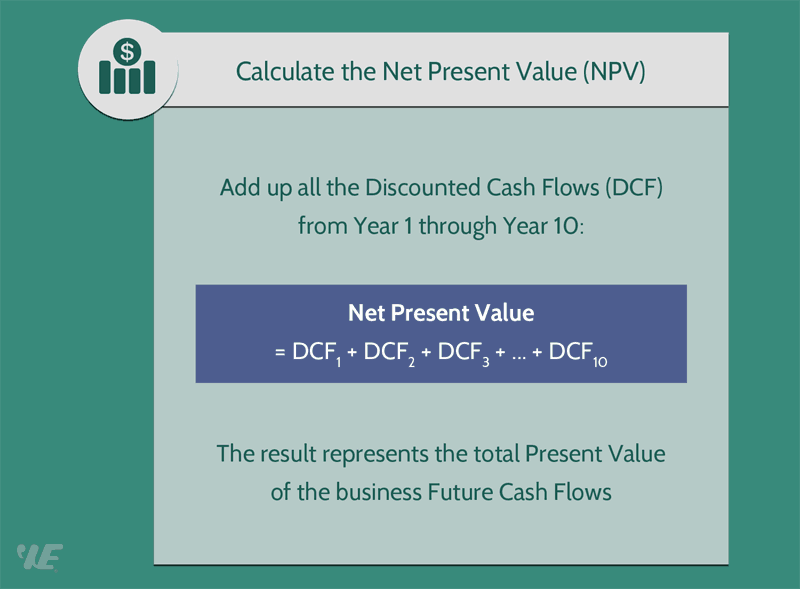

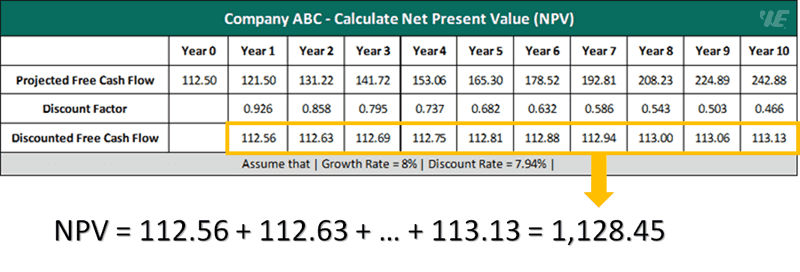

Step 4: Calculate Net Present Value (NPV)

Once we have all the discounted free cash flows of the business, we can now calculate the Net Present Value using the NPV formula:

In our example, to come up with the present value, we simply sum all the discounted cash flows together:

The result represents the total present value of the company's future cash flows. It's worth noting that this value is NOT the firm's intrinsic value yet.

Some investors make a serious mistake that they treat the net present value as their stock's intrinsic value.

Actually, I made the same mistake when I first started out, and this mistake taught me a valuable lesson.

If you use the present value of a company's future cash flows as its intrinsic value, you are basically saying that that company will stop operating at the end of your projection period.

That is simply not true.

Chances are the business will continue to operate after 10 years (unless it goes bankrupt due to some unexpected financial issues).

And that's why we need to take one further step to calculate the perpetuity value of the business.

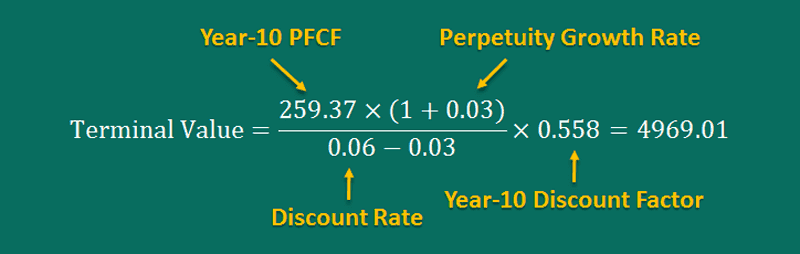

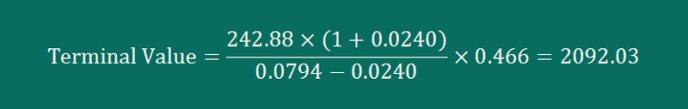

Step 5: Calculate Perpetuity Value (Terminal Value)

The perpetuity value, or terminal value, is simply the total present value of a company's future free cash flows beyond our forecast period.

This value will then be discounted back to the end of the projection period (year 10) at the discount rate, or the weighted average cost of capital (WACC).

The complete formula for calculating terminal value looks like this:

We will not use the firm's long-term growth rate to estimate its terminal value. We'll use another growth rate, which is called "perpetuity growth rate".

Why?

The reason is simple - the expected long-term growth rate is normally higher than the economy's growth rate.

Logically, a business cannot grow faster than the economy forever.

So, if you use a growth rate that exceeds the GDP growth rate, you will have to assume that your stock will be able to outpace the economy forever.

For valuation purposes, we'll use the GDP growth rate as a terminal growth rate, where we assume that our stock will grow at the same pace as the economy after our forecast period.

Now let's take a look at this example. Assume that we have:

Plugging these figures into the above formula, we can now calculate the business terminal value, like so:

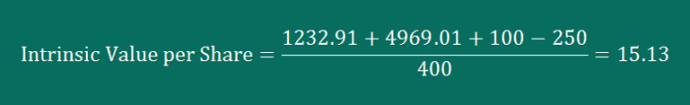

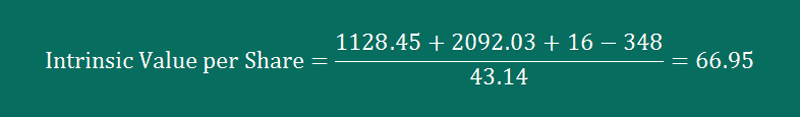

Step 6: Sum The NPV and Terminal Value

After calculating the present value and the terminal value, we simply put these values together so that we can come up with the company's intrinsic value.

Next, we'll adjust the calculated value by adding the business net cash, and then divide the result by the total number of shares outstanding.

You can easily calculate the company's net cash by subtracting its total liabilities from its total cash and cash equivalents ("less debt, plus cash").

The intrinsic value equation looks like this:

Now let's calculate the true value of the stock in our example.

Assume that the company's stock is currently selling at $12.56 a share, with 400 million shares outstanding. It has $100-million cash on hand, and a total debt of $250 million.

Plugging these figures into the given formula, we'll arrive at a real value per share of $15.13:

Knowing how to find intrinsic value of a stock isn't enough. You'll need to analyze the result and then determine whether this stock is undervalued or overvalued.

For this purpose, we'll compare the value per share with the current share price.

As you can see that the stock in our example is currently selling at $12.56 a share, while its real value per share is greater than $15.13. So, this stock is undervalued.

Read also: How to Find Undervalued Stocks Using PEGY Ratio

How to Find Intrinsic Value Example

Now let's consider a quick example so that you can understand clearly how to perform a DCF analysis to find the intrinsic value of a stock.

Example - Company ABC

Company ABC's stock is currently selling at $58.41 a share. It has 43.14 million shares outstanding with over $2.52 billion in market capitalization. Financial analysts predict that this company will potentially grow by 8% annually.

Looking into the company's financial statements, we find that this company has:

Other data:

Requirements:

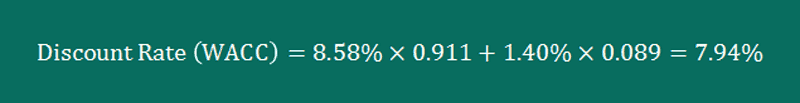

How to Find WACC (Discount Rate)

First of all, we'll calculate the weighted average cost of capital (WACC) of this company, and then use this rate as a discount rate.

What we need:

Calculations:

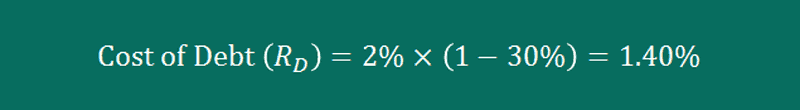

Calculate After-tax Cost of Debt (Rd):

Calculate Weight of Debt (Wd):

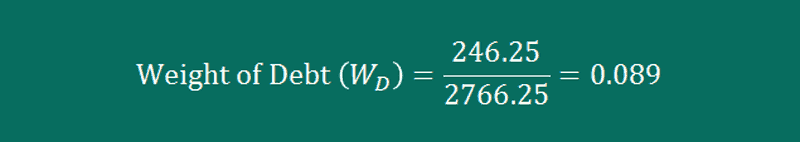

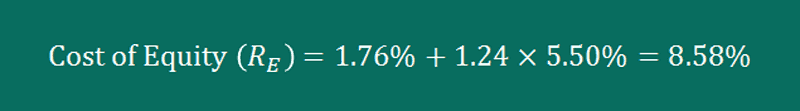

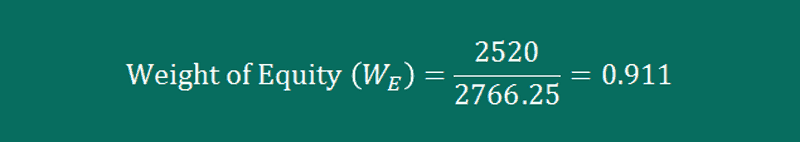

Calculate Cost of Equity (Re):

Calculate Weight of Equity (We):

Calculate Weighted Average Cost of Capital (WACC):

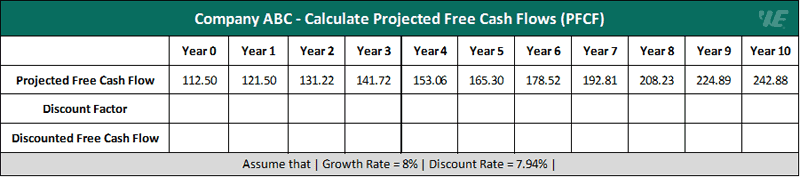

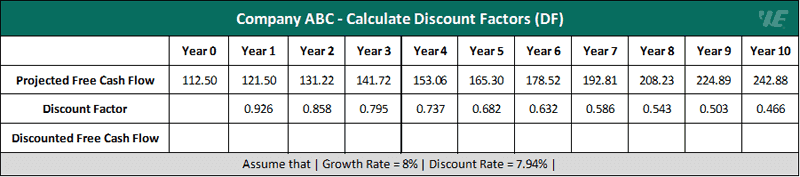

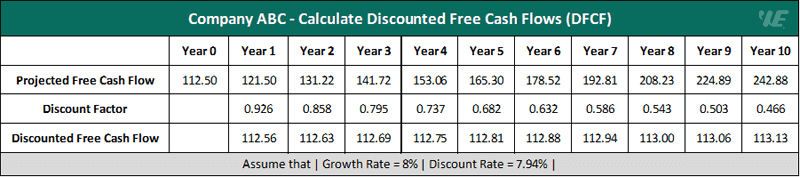

How to Find Discounted Free Cash Flows (DFCF)

Our next step is projecting the future free cash flows of this business.

We'll use the long-term growth rate to forecast the future free cash flows of this company in the next 10 years, and then discount each year's cash flow to the present.

What we need:

Calculations:

Calculate Projected Free Cash Flows (PFCF):

Calculate Discount Factors (DF):

Calculate Discounted Free Cash Flows (DFCF):

How to Find Net Present Value (NPV)

To calculate the Net Present Value of Company ABC, we simply sum all the discounted free cash flows together, like this:

How to Find Terminal Value (Perpetuity Value)

Our next step is calculating the company's terminal value.

What we need:

Calculation:

How To Calculate The Value Of A Company

Finally, you can follow the steps below to find this company's intrinsic value:

Calculation:

Company ABC's stock is currently selling at $58.41 a share, while its true value per share is $66.95. The result tells us that this company is currently undervalued.

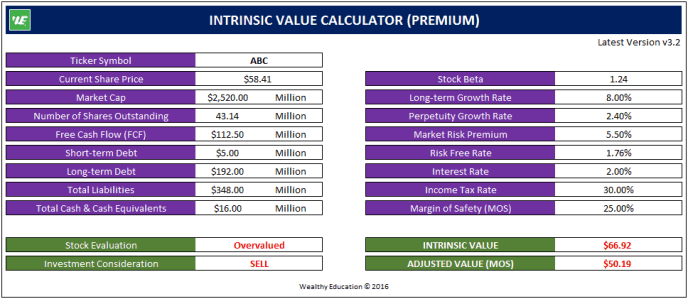

The Best Intrinsic Value Calculator

Are you tired of spending hours and hours on stock valuation? I know I was!

When I first started investing in stocks, I sucked big time at this valuation process, because it took me forever to get the real value of just one stock.

And with thousands of companies listed on the stock market, it's no easy feat to find a good investment.

But guess what? I've got some great news for you!

My team and I have developed an Intrinsic Value Calculator that is going to revolutionize the way you invest in stocks!

No more wasting time on manual calculations - this amazing tool is going to save you loads of time and energy.

And the best part? You get instant results! In just a few clicks, you'll know the intrinsic value per share of your stock and whether it's undervalued or not.

Believe me, as a fellow value investor, I know how important it is to automate as much as possible, and the intrinsic value of stock calculator is an amazing solution for that.

Now let me show you how this amazing tool works...

All you need to do is add some required information about your stock, and voila! The calculator does all the hard work for you!

As you can see, we instantly get the intrinsic value per share of $66.92, and the tool automatically helped us determine that the stock is currently undervalued.

And that's it - everything is done for you! Give it a try here and see for yourself how easy and exciting stock valuation can be!

The Bottom Line

Awesome job! You've now got a complete roadmap for figuring out if your stocks are undervalued or overvalued.

I hope this comprehensive guide on how to calculate the intrinsic value of a stock will help you a lot in your value investing career.

But don't worry, being a value investor doesn't have to be a daunting task!

Sure, it takes some elbow grease to really dive into the nitty-gritty of a company's financials and prospects, but the payoff can be HUGE.

And the best part is, you can practice your newfound knowledge without risking a single penny by using a FREE paper trading account.

So put in the effort, hone your skills, and soon enough you'll be a pro at spotting value where others might miss it.

Who knows, you might even inspire others to become passionate value investors too!

Other Related Topics

This section is packed with interesting concepts and ideas that are closely connected to the concept of intrinsic value.

But they don't quite fit into our main discussion, so I put them here for you to explore a little more.

Does Money Have Intrinsic Value?

Money is an integral part of our lives. We use it every day to buy goods and services.

But have you ever stopped to think about the intrinsic value of money? What gives money its worth?

So, what type of money has value based on intrinsic worth?

Is money valuable simply because we all agree that it is, or does it have some inherent worth?

Intrinsic value refers to the inherent worth of something, which is not based on its monetary value.

When it comes to money, some argue that it has no intrinsic value because it is simply a piece of paper or a digital entry in a bank account.

However, others argue that certain types of money do have intrinsic value.

Money can be defined as a medium of exchange that is accepted in transactions. The intrinsic value of money refers to its inherent value, regardless of its exchange value.

In other words, the value that money possesses in and of itself, independent of its buying power.

Not all types of money have value based on intrinsic worth. For example, fiat currency, such as the US dollar, is not backed by a commodity like gold or silver.

Its value is based on the government's guarantee that it will be accepted as a medium of exchange.

Does Gold Have Intrinsic Value?

Gold is often considered the benchmark for measuring intrinsic value because it has been used as a currency for thousands of years.

However, the truth is that gold does not have intrinsic value.

When we talk about intrinsic value, we refer to something that has value on its own, without being assigned value by external factors.

If we think about it, gold only has value because we assign value to it.

Gold has no inherent value other than what we give it. In other words, gold's value is not intrinsic; it is extrinsic.

Some argue that certain forms of money, such as gold-backed currencies, have intrinsic value.

These types of currencies are backed by a physical commodity, such as gold, and are thought to have value beyond the trust that people have in the government that issues them.

But even in this case, the intrinsic value comes from the underlying commodity, not the money itself.

Does Crypto Have Intrinsic Value?

In modern times, cryptocurrency is often touted as money with intrinsic value.

Some argue that the value of cryptocurrency lies in its blockchain technology and its decentralized nature.

However, others argue that cryptocurrency lacks intrinsic value because it is not backed by any physical commodity.

While it may not have the same physical properties or government backing as other forms of currency, it has value because people believe it does.

The underlying blockchain technology has the potential to revolutionize a wide range of industries, from finance to supply chain management.

However, the value of cryptocurrency is not tied to the technology alone, but rather to the perception of the technology and the network of users who accept it as a medium of exchange.

While cryptocurrency does not have intrinsic value, it has extrinsic value based on its market demand and supply.

What is an Intrinsic Value of Option?

In simple terms, the intrinsic value of an option is the difference between the current price of the underlying asset and the strike price of the option.

It's the amount of profit you could potentially make if you were to exercise the option right now.

Let's break this down further with an example.

Say you purchased a call option for a stock with a strike price of $50. The current market price of the stock is $60.

The intrinsic value of this call option would be $10 ($60 - $50 = $10).

This means that if you were to exercise the option right now, you would be able to buy the stock at the strike price of $50 and immediately sell it at the market price of $60, making a $10 profit.

On the other hand, if you purchased a put option for the same stock with a strike price of $50, and the current market price of the stock is $40, the intrinsic value of this put option would be $10 ($50 - $40 = $10).

This means that if you were to exercise the option right now, you would be able to sell the stock at the strike price of $50 and immediately buy it at the market price of $40, making a $10 profit.

As you can see, the intrinsic value of a call option and a put option works in opposite ways.

The intrinsic value of a call option increases as the market price of the underlying asset increases, while the intrinsic value of a put option increases as the market price of the underlying asset decreases.

What is an Intrinsic Value of Bond?

The intrinsic value of the bond refers to the actual value of a bond, taking into account all factors that may affect its worth.

This includes the bond's coupon rate, maturity date, and credit rating.

To calculate the intrinsic value of a bond, you can use the intrinsic value of bond formula, which takes into account the present value of future cash flows, including coupon payments and the bond's principal value at maturity.

Calculating the intrinsic value of a bond is important for several reasons.

Firstly, it helps you determine whether a bond is overpriced or underpriced, which can guide your investment decisions.

Secondly, it allows you to compare different bonds to see which offers the best value for your money.

And finally, understanding the intrinsic value of a bond can help you assess the overall health of the bond market, which can be valuable information for anyone looking to invest in this area.

How About an Intrinsic Value of a Person?

Have you ever stopped to think about what makes a person valuable? Is it their intelligence? Their appearance? Their accomplishments?

While these things can certainly be impressive, they do not define a person's intrinsic value.

The intrinsic value of a person is something that exists within them, regardless of their external circumstances. It is what makes them unique, special, and irreplaceable.

The intrinsic value of a person refers to their inherent worth as a human being. It is not something that can be earned or lost based on external factors, such as wealth or status. Rather, it is an essential part of who they are.

One example of this is the unconditional love that a parent has for their child.

The child may not have accomplished anything noteworthy, but they are still valuable simply because they exist.

This is because their intrinsic value is not based on what they do, but rather on who they are.

Intrinsic value of a person examples can also be found in the arts.

When we appreciate a piece of music, a painting, or a sculpture, we are acknowledging the intrinsic value of the artist.

We are recognizing that their work is not just a product, but an expression of who they are.

It is a reflection of their unique perspective, experiences, and emotions. This is why art is so powerful.

It reminds us that every person has something to offer, whether it is through their words, their music, or their art.