Welcome to the fascinating world of terminal value calculations!

Whether you are looking to invest in a company or start your own business, understanding how to calculate terminal value is crucial.

This financial concept can be quite challenging to grasp, but fear not, with the right guidance, you will be able to master it with ease.

So, what is terminal value?

In simple terms, it represents the present value of all future cash flows that are expected to continue indefinitely after a company's projected growth rate has stabilized.

In other words, it is the estimated value of a business beyond the forecast period.

Terminal value is vital because it helps investors and entrepreneurs determine the overall value of a company, making it easier to make informed decisions.

However, calculating it can be a daunting task, particularly for those without a finance background.

But do not fret, as we have you covered!

In this comprehensive guide, we will walk you through the process step-by-step, breaking down complex financial jargon and providing practical tips to help you calculate terminal value accurately and with ease.

We will cover everything from the basic concept of terminal value to the different methods of calculating it.

The methods we will explore include the discounted cash flow model, which involves projecting cash flows for a finite period and then estimating the terminal value using assumptions about the perpetual growth rate.

We will also discuss the various assumptions involved in calculating terminal value, such as the terminal growth rate and the discount rate used in the discounted cash flow model.

Moreover, we will delve into the terminal value formula and how it contributes to determining a company's overall value.

Whether you are a beginner or a seasoned investor, you will find valuable information in this guide.

So, what are you waiting for?

Dive into our guide and start mastering the art of calculating terminal value using different approaches today!

What is Terminal Value, Horizon Value, and Perpetuity Value?

Terminal value is a vital metric in determining the value of a business or project.

It is essentially an estimate of the future cash flow that extends beyond the projection period, also known as the terminal year.

This calculation is done through various methods such as the perpetual growth method or the constant rate method.

The perpetual growth method assumes that cash flows will grow at a certain rate indefinitely, while the constant rate method estimates terminal value by assuming that cash flows will remain the same after a certain point.

To estimate terminal value, it is important to use the appropriate discount rate that reflects the risk associated with the project or business.

A good estimate of terminal value is critical in the discounted cash flow valuation as it accounts for a significant percentage of the total value.

It is also referred to as horizon value or perpetuity value, as it represents the cash flow beyond the projection period.

There are various ways to estimate the value of a business, and terminal value calculation is one of them.

It is crucial to project cash flows accurately and use the perpetuity growth method to estimate the value based on future expectations.

In doing so, it is important to consider factors such as liquidation value, which reflects the value of assets if the business were to be liquidated.

In summary, terminal value is a crucial aspect of determining the value of a project or business, and estimating it accurately requires careful consideration of various factors.

It allows for a reflection of returns well beyond the projection period, providing a more comprehensive view of the business's potential.

Why Do We Need to Calculate Horizon Value of a Stock?

When it comes to stock valuation, investors often make the mistake of relying solely on the Net Present Value (NPV) method, which assumes that the company will cease operations after the projected cash flow period ends.

However, this method is not a realistic approach to determine the true value of a stock, especially since a company may continue operating well beyond the projected period.

This can lead to inaccurate long-term forecasts and ultimately, a poor valuation result.

To arrive at a more accurate terminal value, we need to incorporate a perpetuity value into the projected cash flows.

The perpetuity formula is used to estimate the present value of a series of cash flows that are expected to continue indefinitely.

The perpetuity growth model assumes that the company's earnings will grow at a constant rate, which is then discounted back to its present value.

Another approach to calculating the terminal value is by using the terminal multiple or implied terminal.

This method assumes that the company's earnings will remain constant beyond the projected period and applies a multiple to the projected cash flow to determine the realizable value of the stock.

Ultimately, to properly estimate the intrinsic value of a stock, we need to combine both the present value and perpetuity value approaches.

This growth method assumes that the company's earnings will continue to grow at a constant rate, which is then discounted back to its present value.

By incorporating these terminal value assumptions into our analysis, we can arrive at a more accurate estimate of the stock's realizable value.

Terminal Value Formula

There are 4 essential steps that you need to follow to estimate a company's terminal value:

- Find all required financial data

- Implement the discounted free cash flow (DCF) analysis

- Calculate the company's perpetuity value (PV)

- Use the discount rate to estimate the company's perpetuity value

Now let's dive into each step and learn how to do all the math!

How to Calculate Terminal Value

Step 1: Find the Following Figures

You need to determine 4 of the following figures before proceeding further:

- Free Cash Flow (FCF) – is a measure of your company’s financial performance which can be calculated by deducting capital expenditures from the operating cash flow.

- Long-term Growth Rate – This is a term financial analysts use to predict the rate at which a company will grow in the long-run.

- Perpetuity Growth Rate (Terminal Growth Rate) – Since horizon value is calculated by applying a constant annual growth rate to the cash flow of the forecast period, the implied perpetuity growth rate is how much the free cash flow of the company grows until perpetuity, with each forthcoming year. In most cases, we’ll be using the GDP growth rate as the perpetuity growth rate.

- Discount Rate – This is the interest rate incorporated into discounted cash flow (DCF) analysis which helps you determine your respective cash flows’ future value. The discount rate takes into account the time value of money as well as the risk of uncertainty revolving around future cash flows. So, the greater this uncertainty is, the higher the discount rate will be.

Step 2: Implement Discounted Cash Flow (DCF) Analysis

In order to determine the feasibility of an investment opportunity, a discounted cash flow (DCF) valuation method can be applied.

A DCF analysis brings ‘future-free’ cash flow projections into play and discounts them in order to determine the present value estimate, which in turn is used to evaluate the feasibility of an investment.

For example, if the value determined through DCF analysis is bigger than the cost of the current investment, you have a good opportunity on your hands.

Calculating discount rate is real simple once you know what elements are involved.

There are 4 crucial steps to implement the DCF Analysis:

Project Future Free Cash Flows (FFCF)

To project your company’s future-free cash flows over the next 10 years, use the trailing twelve-month Free Cash Flow and the estimated long-term growth rate.

Here’s the formula for projecting future free cash flows:

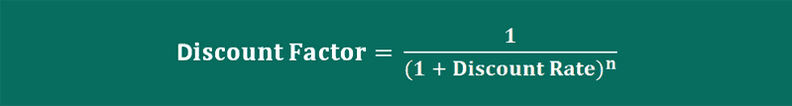

Calculate Discount Factors (DF)

You can use the Discount Rate to calculate Discount Factors.

Here’s the formula you need to use to calculate discount factors:

Calculate Discounted Cash Flows (DCF)

Now you need to multiply each year’s respective cash flow by the discount factor in order to determine the discounted cash flow (DCF).

The formula for calculating DCF is like so:

Calculate Net Present Value (NPV)

This is a very simple step which requires summing up all the discounted cash flows.

If you’re wondering how to calculate present value, use this formula:

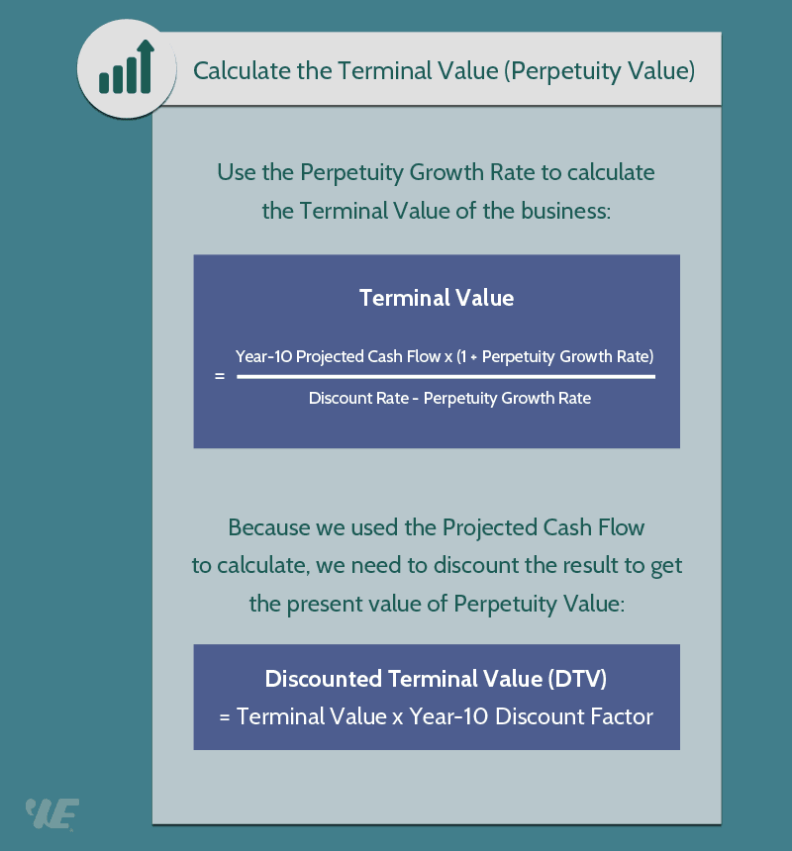

Step 3: Perform Terminal Value Calculation

Now that you’ve estimated the free cash flow over the projected forecast, you must determine what value the company’s cash flows may be after that forecast period expires; especially when the company has reached a “middle-age maturity” period.

The trouble with cash flow forecasts is that it’s not only complicated enough to forecast cash flows for five years or more, but even more so the longer a company remains in existence.

However, using a horizon value formula, you can make calculated assumptions on a company’s long-term cash flow growth which goes well beyond 10 years, for instance.

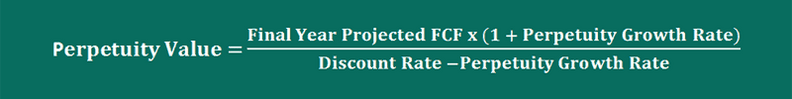

The best way to calculate the perpetuity value is to make use of the Gordon Growth Model.

The formula to calculate terminal value looks like this:

Note: We’ll be using the Final Year’s Projected FCF in order to arrive upon our TV, not the Discounted FCF.

Step 4: Calculate a Present Value of Perpetuity

Since we have used the Projected FCF to arrive upon our horizon value, we must discount it to the present.

All you have to do is take the value we calculated in Step 3 above, multiply it with the Final year’s Discount Factor, and we’ll have our Discounted Terminal Value, also known as Present Value of Perpetuity.

The formula looks like this:

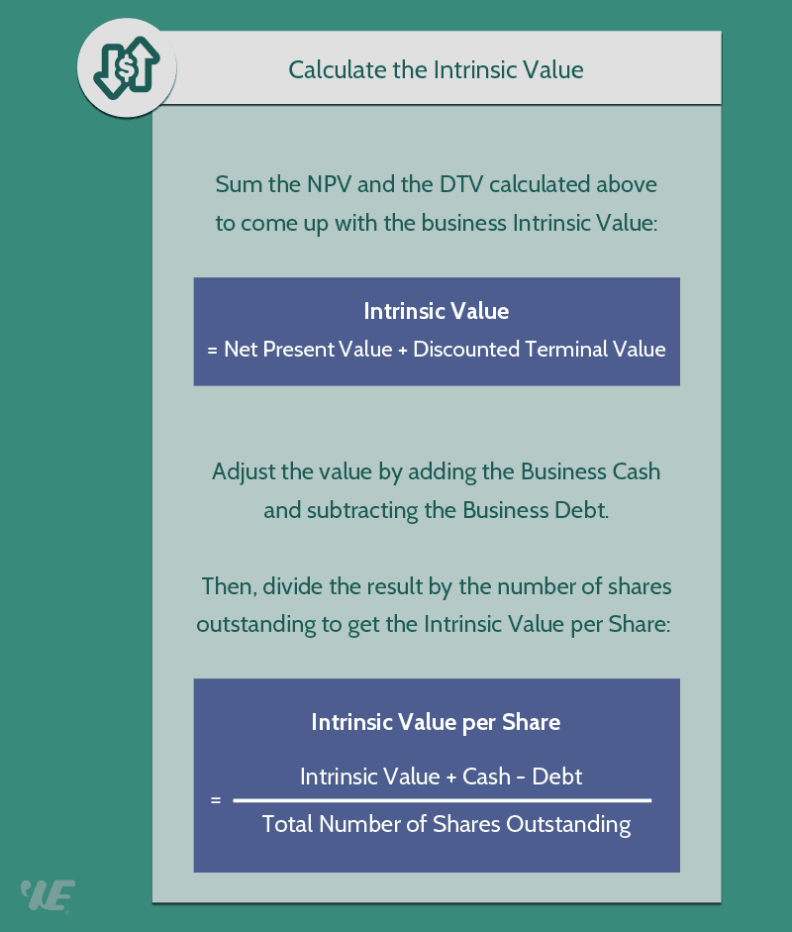

Now you can use the present value of perpetuity to calculate your stock’s intrinsic value.

Simply add up the Net Prevent Value and Discounted Terminal Value, and then divide that figure by the total number of outstanding shares, like so:

Terminal Value Calculator

Terminal Value Example

Now let's take a look at some examples, so that you can understand clearly how to calculate the TV of a company in which you want to invest.

Case Study #1 - Calculate Horizon Value

Now that we’ve understood how it all comes together and have the formulas to make the necessary calculations, let’s put it all into context, shall we?

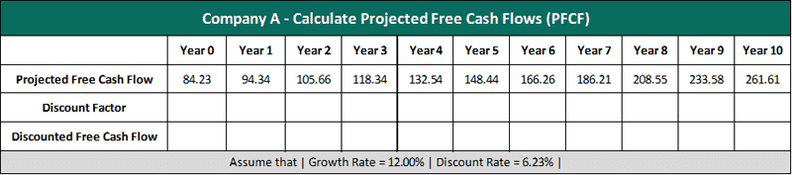

Company A is selling shares at $25.2 a piece. It has 43 million outstanding shares and has a free cash flow of $84.23 million. Financial experts forecast that the company may grow by 12.00% annually.

If the perpetuity growth rate is 2.36% and the discount rate is 6.23%, what’s the horizon value of Company A’s stock?

4 essential figures we need:

- Free Cash Flow = $84.23 million

- Long-term Growth Rate = 12.00%

- Discount Rate = 6.23%

- Perpetuity Growth Rate = 2.36%

Requirement:

- Find horizon value of this company's stock

Find the company's Discounted Free Cash Flow (DFCF)

We'll use the LT growth rate to project the future free cash flows of this firm in the next 10 years, and then discount each year's cash flow to the present.

What we need:

- Free Cash Flow = $84.23 million

- Long-term Growth Rate = 12.00%

- Discount Rate = 6.23%

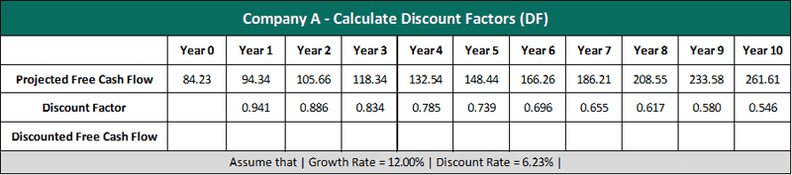

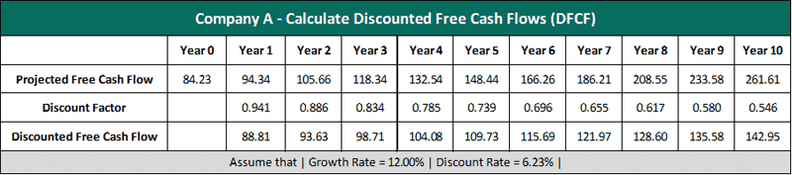

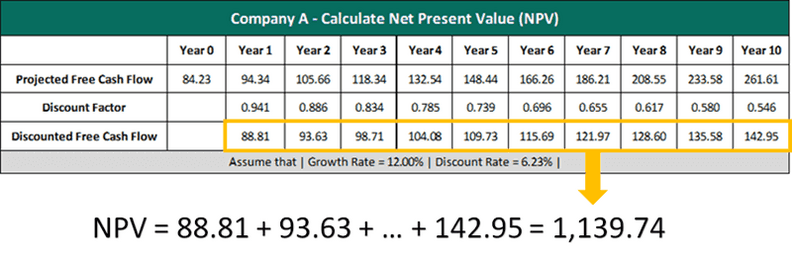

Calculations:

Calculate Projected Free Cash Flows (PFCF):

Calculate Discount Factors (DF):

Calculate Discounted Free Cash Flows (DFCF):

Calculate Net Present Value (NPV):

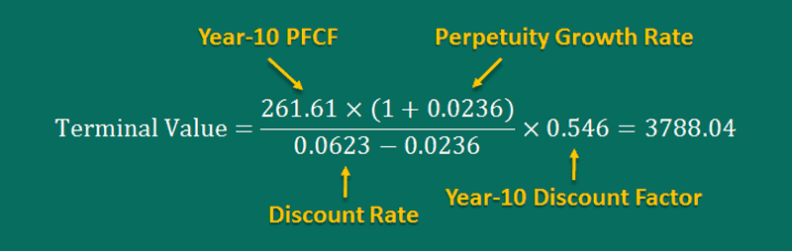

Find the company's Horizon Value

Our next step is to calculate the business horizon value.

After having this value, we simply multiply it by the Year-10 Discount Factor to calculate the present value of perpetuity.

What we need:

- Terminal Growth Rate = 2.36%

- Discount Rate = 6.23%

- Year-10 Projected Free Cash Flow = $261.61 million

- Year-10 Discount Factor = 0.546

Calculation:

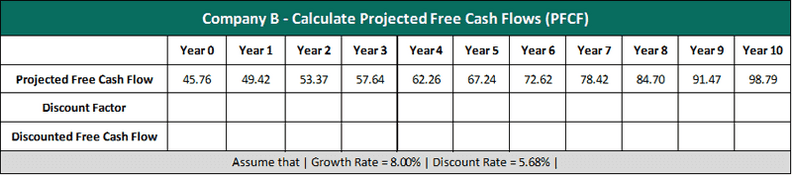

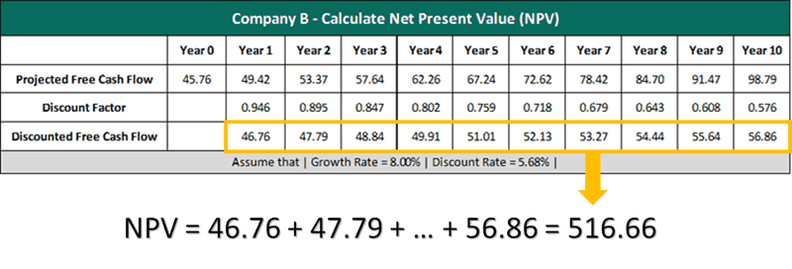

Case Study #2 - Calculate Perpetuity Value

Just to test our know-how a little more, and truly put these methods to the test, here’s another example:

Company B is selling their shares at $15.1 a piece. It has 34 million outstanding shares. The company’s free cash flow is valued at $45.76 million. Financial experts have projected that the company will grow by 8.00% each year.

If the perpetuity growth rate is 2.36% and the discount rate is 5.68%, what would be the stock’s perpetuity value?

Food for thought!

4 essential figures we need:

- Free Cash Flow = $45.76 million

- Long-term Growth Rate = 8.00%

- Discount Rate = 5.68%

- Perpetuity Growth Rate = 2.36%

Requirement:

- Find perpetuity value of this company's stock

Find the company's Discounted Free Cash Flow (DFCF)

We'll use the long-term growth rate to calculate projected free cash flows of this stock in the next 10 years, and then discount the cash flow of each year to the present.

What we need:

- Free Cash Flow = $45 million

- Long-term Growth Rate = 8.00%

- Discount Rate = 5.68%

Calculations:

Project this company's Future Free Cash Flows (FFCF):

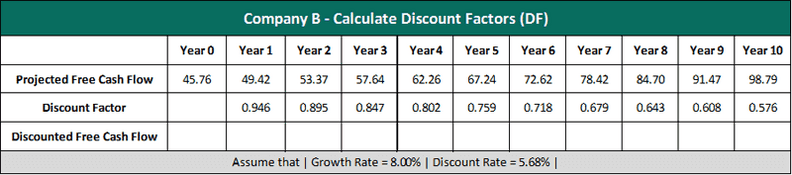

Calculate this company's Discount Factors (DF):

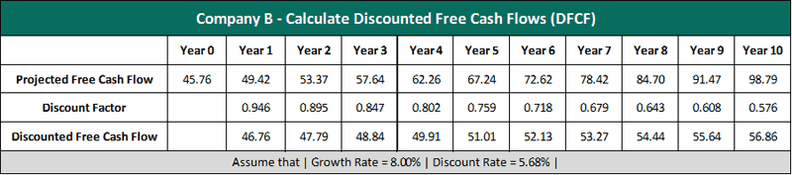

Calculate this company's Discounted Free Cash Flow (DFCF):

Calculate this company's Net Present Value (NPV):

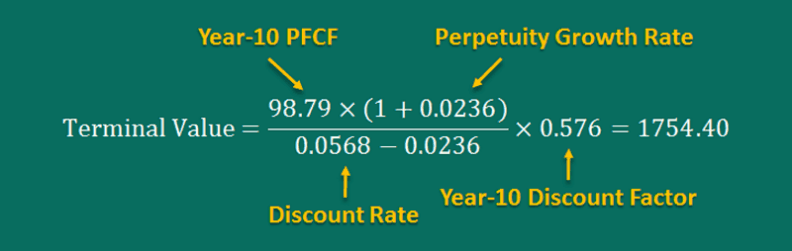

Find the company's Perpetuity Value

Our next step is estimating the company's perpetuity value.

After having this value, we simply multiply it by the Year-10 Discount Factor to calculate the present value of perpetuity.

What we need:

- Perpetuity Growth Rate = 2.36%

- Discount Rate = 5.68%

- Year-10 Projected Free Cash Flow = $98.79 million

- Year-10 Discount Factor = 0.576

Calculation:

Frequently Asked Questions

Q: What is Terminal Value?

Terminal value is the estimated value of a business or investment at the end of a specific period. It is used in financial ratio analysis to determine the overall worth of a company or investment at the end of a forecast period.

Q: How is Terminal Value Calculated?

Terminal value is typically calculated using the perpetuity formula, which involves estimating the company's future cash flows and then calculating the present value of those cash flows as if they were a perpetuity. Another common method is the exit multiple method, which involves estimating the company's future earnings and then applying a multiple to those earnings.

Q: What is the Importance of Terminal Value in Business Valuation

Terminal value is an essential component of business valuation, as it represents the bulk of the value of a company or investment. Accurately estimating the terminal value is crucial for making informed investment decisions and determining the appropriate price to pay for a company or investment.

Q: How Does Terminal Value Impact Investment Decisions?

Investors use terminal value to evaluate the long-term potential of an investment. A higher terminal value indicates greater potential for future growth and can make an investment more attractive. On the other hand, a lower terminal value may suggest that an investment has limited growth potential and may not be a good choice for long-term investment.

The Bottom Line

Calculating the value of a business or investment is crucial to unlocking its potential for growth and success.

One way to estimate the value of a business beyond a certain time frame is by calculating the terminal value.

Terminal value is calculated by taking into account various factors such as projected cash flows, long-term growth rates, and the appropriate discount rate.

One commonly used method to calculate terminal value is the perpetuity growth method.

This method assumes that the business will grow at a steady rate indefinitely.

To calculate the terminal value using the perpetuity growth method, you need to first estimate the value of the business at the end of the projection period.

Then, you use the formula:

Terminal Value = (Final Year Cash Flow x (1 + Perpetuity Growth Rate)) / (Discount Rate - Perpetuity Growth Rate).

This formula calculates the present value of all future cash flows beyond the projection period.

Another method to calculate terminal value is the exit multiple method, which uses an implied enterprise value to calculate the terminal value.

This method takes into account a multiple of earnings or cash flow to calculate the terminal value.

It's important to note that calculating the terminal value is just one component of estimating the value of a business.

To calculate intrinsic value, you need to consider both the terminal value and the value of the business up until that point, then discount it back to the present using the appropriate discount rate.

The discount rate takes into account the opportunity cost of investing in the business.

Overall, understanding how to value a business is essential for any business or investment owner.

By using some financial analysis ratios and the right tools, you can gain a clearer understanding of the value of your investment over time.

So keep learning and practicing, and don't be afraid to take risks.

Who knows what kind of amazing opportunities await!