Bullish stock patterns can be very profitable if you know what to look for and when to enter and exit the market.

If you've been trading for long enough, I'm sure you've experienced it many times:

You see a nice uptrend, you watch the stock climbing higher and higher, and you cash in on some good profits along the way.

Uptrends are a beautiful thing. That's why professional traders like to hunt for 'em and try to catch them before everyone else does.

They can accomplish this by recognizing all bullish patterns and identifying key support levels where a reversal could happen.

But spotting these formations isn't as easy as it sounds...

That's why I decided to put together this guide to teach you everything you need to know about uptrend stock patterns and how to trade them for big profits.

If you're new to chart patterns, don't worry - I won't overwhelm you with technical jargon and confusing charts.

Instead, I'll explain everything in layman's terms so you can easily grasp the concepts and apply the knowledge to your trading strategy right away.

Imagine having that information available at your fingertips! You can easily earn a consistent 40%+ per year - all without taking any unnecessary risks.

Now, I know you like making money as much as I do, so let's get to it.

What Is a Bullish Pattern in Stocks?

Bullish stock patterns are technical analysis chart patterns that indicate an upside potential and favorable outlook for the stock price.

These patterns occur after a significant decline in price or when the market drops to an important support level (short-term market correction).

They signify a bull market rally to come and a shift from negative to positive sentiment among traders and investors.

As a trader, you can use bullish trend patterns to evaluate current market conditions (supply and demand) and identify profitable trading opportunities.

You can determine whether the market is currently oversold and ripe for a rebound, or it's near an important support level where a potential bottom has formed.

In either case, you can expect a strong uptrend to follow once the stock breaks above the pattern's upper trend lines.

Bullish stock chart patterns are often followed by sharp price spikes and massive buying volume, especially when they form at key support and resistance levels.

A breakout above the upper boundaries of the pattern implies an increase in bullish momentum and paves the way for further gains in the stock price.

Types of Bullish Pattern

There are two main categories of bullish technical patterns:

- Continuation patterns

- Reversal patterns

The former indicates a continuation of the ongoing uptrend, while the latter signals an upside reversal of the prevailing downtrend.

Professional traders love to trade stocks with bullish patterns because most of them lead to explosive moves in the stock price when a breakout occurs.

If you've got your eye on the market, and you're watching for all bullish chart signals, you probably want to know which one is the most profitable.

Well, the answer is simple: there's no single best strategy, as no single pattern is more profitable than any other.

Some technical analysts use a combination of these two types of bullish patterns to create more complex and profitable trading setups.

On the other hand, some professional traders prefer to focus on just a few reliable bull market chart patterns to avoid being overwhelmed and making emotional decisions.

Keep in mind that each bullish stock chart pattern carries a different risk and reward ratio, as well as profit potential.

So it's up to you to determine which ones work best for your trading account and risk tolerance.

What You Need to Know About Bullish Trading Patterns

Bullish pattern trading strategies involve going long when the price is trending upward or building up to an upside breakout above a major resistance level.

But there's just one problem: many traders don't fully understand how to recognize them, so they miss out on lucrative trades.

Even though bullish trading patterns offer a lot of benefits, they are often misunderstood by traders.

That's because most traders approach the market with preconceived ideas about which technical patterns are profitable, and which should be avoided.

As long as you don't learn how to read bullish price action patterns properly, you won't know what you're missing.

Trust me, this can potentially cost you a lot of money in the long run. Not to mention, it can also lead to frustration and anxiety in your trading career.

In addition, if you're not familiar with different bullish patterns and their implications, you'll find it difficult to spot them on the trading chart.

As a result, you'll run the risk of misidentifying the patterns and missing out on great opportunities in the market.

Formation

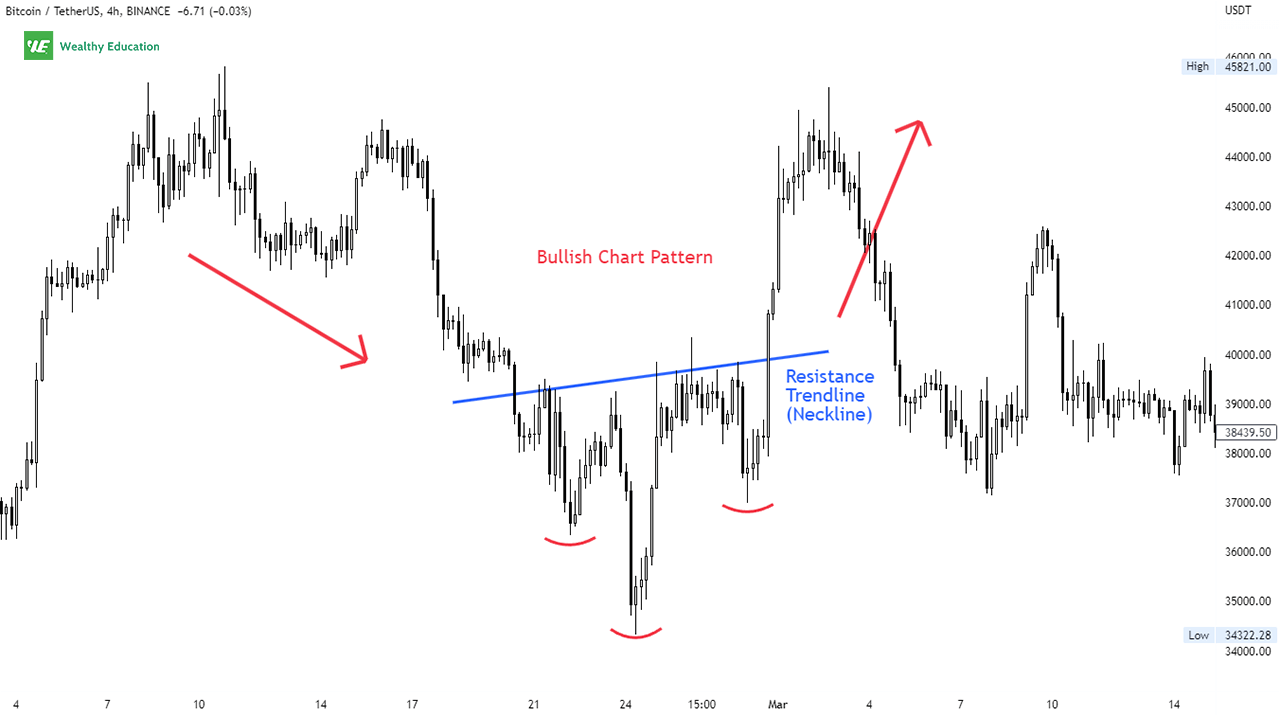

A bullish stock pattern forms after a short-term market correction or a sharp bearish move in the stock price.

These formations appear when an ongoing downtrend is exhausted and the price moves back up again, indicating that a new uptrend is starting to take shape.

This happens when the market rallies back to its moving averages, or when it bounces off important support levels like trend lines or Fibonacci retracement levels.

The bulls want to see a stock perform well on the upside, so they fuel the uptrend by buying the stock on dips.

More and more buyers entering the market create strong upward momentum and bullish sentiment in the market.

Eventually, the price action hits a resistance level and begins consolidating or going sideways before breaking out to the upside.

This consolidation period allows traders to "catch up" with the stock. This period can last anywhere from a few hours to a few weeks or even months in some cases.

Finally, the bulls get tired of waiting, and they start buying aggressively to take over control of the market once again.

This leads to the formation of popular stock market bullish patterns, including double bottoms, inverted head and shoulders, and diamond bottom patterns.

The Most Bullish Chart Patterns

What is the most bullish chart pattern? - That's a great question!

The answer to this question depends on the time frame that you're looking at and the market conditions that you're in.

Most of these bullish formations usually appear after a significant downtrend or after a corrective period in the market.

They signal an imminent bull market rally and a potential shift in market sentiment from bearish to bullish.

So the most bullish stock pattern should form after a downtrend when the market shows signs of exhaustion and there's a lot of buying demand on the dip.

However, keep in mind that not all formations are created equally in terms of their potential and profitability.

If you are a beginner trader, or you've been trading for a while and you're not making consistent profits, you should focus on learning the best bullish chart patterns.

Below is a detailed list of all bullish chart patterns that you need to be aware of:

Bullish Chart Patterns | Type | Location | Rating |

|---|---|---|---|

Reversal | Downtrend | ||

Double Bottom | Reversal | Downtrend | |

Cup and Handle | Reversal | Downtrend | |

Continuation | Uptrend | ||

Reversal | Downtrend | ||

Reversal | Downtrend | ||

Reversal | Downtrend | ||

Reversal | Downtrend | ||

Continuation | Uptrend | ||

Reversal | Uptrend |

How to Trade Bullish Stock Patterns

The bullish pattern stock trading strategy is pretty straightforward.

All you need to do is to wait for an upward breakout from the formation and place a buy order as soon as the price closes above the breakout candlestick.

It's important that you wait for confirmation because a breakout without enough volume doesn't hold any weight, and could eventually lead to a false breakout.

You need to wait for at least 2 consecutive candlesticks to close above the resistance line (or the breakout point) to confirm the validity of the breakout.

If the volume is low on the breakout, you can wait for a throwback or retracement to test the resistance (now support) line before entering your long position.

This way, you can eliminate the risk of encountering a fakeout or a bull trap where the price moves in the opposite direction after the breakout.

As with all chart patterns, it's important to understand the risk and reward associated with each pattern to trade them properly.

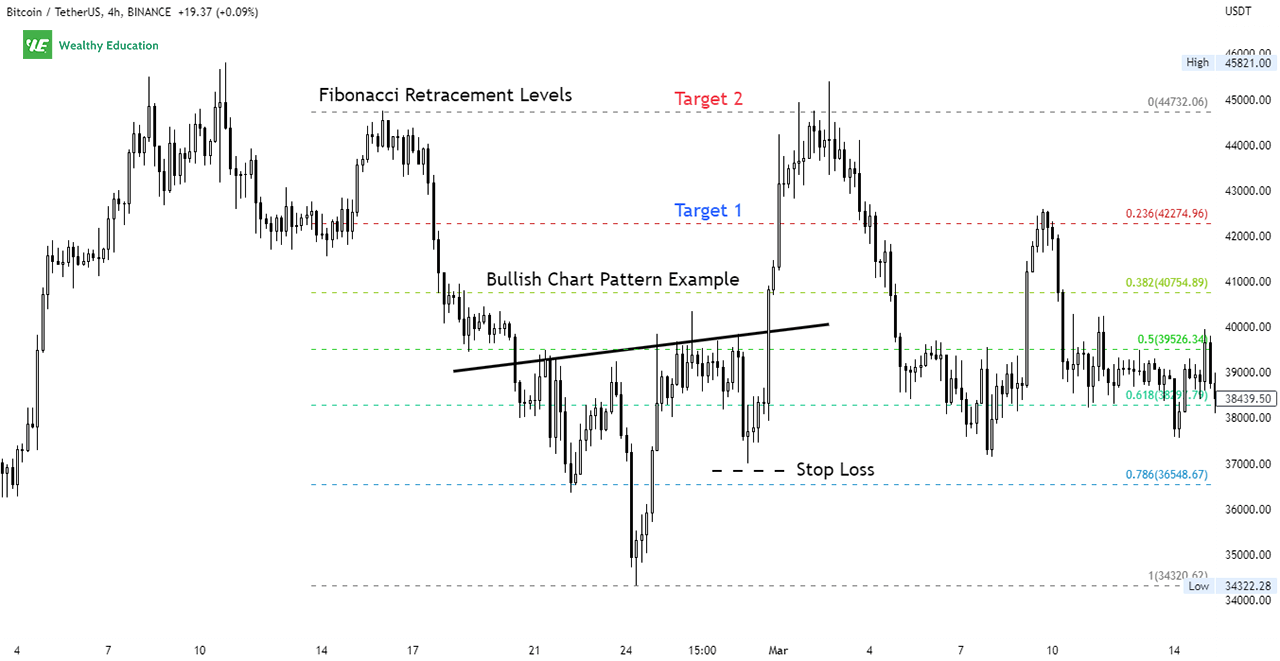

You can set your profit target using the Fibonacci retracement levels or based on the height of the formation.

A stop loss can be placed below the recent low or the low of the formation, depending on your risk appetite.

You can also trail your stop loss higher as the market moves in your favor to lock in more profits and reduce your risk exposure at the same time.

However, you need to make sure that you don't get greedy easily and increase your position size beyond your risk tolerance.

Otherwise, your winning trade will become a losing one quickly when the market goes against you.

Bull Market Trading Tips

If you're looking to make a fortune in the market, bull runs could be your opportunity of a lifetime.

But if you want to get out alive, you need to know how to ride the wave and position yourself for massive gains.

I've been trading for over 10 years now and I've witnessed how traders enter the game thinking they can beat the odds and end up losing their shirts in the process.

Over the years, I've learned that the number one mistake that traders make is chasing the market.

That's what happens when you get sucked into the hype surrounding the latest hot stock tips, or whatever trading opportunity everyone is talking about on social media.

And you ignore your own analysis and research to follow the crowd in hopes of making a quick buck or two.

Of course, it doesn't work out that way most of the time, and you end up getting burned more often than not.

By the time you realize what's going on, it's too late and you're left with nothing but regrets.

Don't let that happen to you. Please equip yourself with the right knowledge before risking your money in the market.

If you want to trade bullish price patterns successfully, you'll need to know the patterns inside and out.

You'll need to understand the psychology behind these formations and how they form so you can anticipate upcoming price movements with high accuracy.

You'll also need to understand the trading strategies that work best with these patterns and how to incorporate them into your trading strategy.

That's why you need to focus on improving your trading skills by practicing as much as you can with a demo account until you master the patterns inside out.

Keep in mind that this takes time but it's necessary if you want to become a successful trader in the long run.

If you're tired of falling behind in the market every time it moves up, then it's time to take action and learn how to trade like a pro.

Bullish vs Bearish Patterns

If you ask me, which type of chart patterns I prefer to trade, I'd have to say BOTH. Do you know why?

That's because both are profitable and it's just a matter of finding the right ones to trade at the right time.

Bullish and bearish chart patterns come with their own set of pros and cons and provide different opportunities to make money in the market.

You may have heard that bearish patterns are more profitable than bullish ones, but that's not entirely true.

It's not the pattern itself, but the way you trade it that matters the most, along with proper risk management and proper position sizing.

A well-timed entry and tight stop loss are the keys to making profitable trades regardless of the pattern type you trade.

If you're too late to the party, you miss out on huge profits while risking your account in the process.

So make sure that you learn the best entry and exit strategies for every pattern before you jump in and trade them live.

Summary

Bullish stock chart patterns are often followed by strong rallies, so catching them early can help you generate profit quickly.

Being able to read price action and market psychology will help you tremendously when it comes to making big money in any type of pattern.

After all, that's how successful traders make their fortune, not through luck or gut feelings, but by relying on their chart analysis skills and intuitions.

The best bullish pattern is the one that forms near the market bottom at an important support level and then rebounds strongly afterward.

They usually trigger a volume surge that supports the breakout and leads to explosive upside moves in the stock price.

If you trade these uptrend patterns correctly, you can increase your winning rate while minimizing your risk exposure at the same time.

But if you don't know how, you'll most likely end up getting stopped out before you can make any meaningful profit in the market.

That's why you must learn how to identify these uptrend chart patterns and incorporate them into your trading strategy properly.

As long as you know how to spot them and confirm their validity, you'll increase your odds of making money in the stock market.

I hope this article is helpful and gives you a better understanding of bullish market patterns and how to use them to your advantage.

Good luck and happy trading!