Welcome to the world of cash management, where financial decisions are critical to the success of your business.

If you're here, it means you're ready to take your financial ratio analysis skills to the next level and understand the power of cash.

As a business owner or manager, you know that cash is king.

Cash is the fuel that powers your operations, and without it, your business will struggle to survive.

But, do you know how to manage your cash effectively?

That's where the cash reinvestment ratio comes in.

The cash reinvestment ratio is a financial metric that measures how much of your business's cash flow is being used to reinvest in the company.

It takes into account capital expenditures, interest payments, working capital changes, and other factors.

In other words, it shows how much of your cash is being put back into the business to fuel growth and innovation.

This ratio is crucial because it helps you understand how effectively your business is using its cash to generate future profits.

To calculate the cash reinvestment ratio, you need to divide your after-tax operating income, adjusted for dividends, by the total cash outflow for the period.

You can then compare your ratio with your peer group to see how your company is performing.

By understanding the cash reinvestment ratio, you can make informed decisions about how to allocate your cash resources.

You'll be able to identify areas where you can cut costs or increase investment, allowing you to optimize your cash flow for maximum growth and profitability.

Understanding the cash reinvestment ratio is crucial for any business owner or manager.

It can help you make informed decisions about how to reinvest cash and optimize your cash flow for maximum growth and profitability.

So, don't miss out on the opportunity to unleash the power of your cash and take your business to new heights.

Definition - What is Cash Reinvestment Ratio?

The cash reinvestment ratio, also referred to as the cash flow reinvestment ratio, is a valuation ratio that helps investors gauge the percentage of a company's annual cash flow that is being used to reinvest back into the business.

By calculating the reinvestment rate, investors can better understand a company's long-term goals and strategies.

Essentially, the cash reinvestment ratio measures the amount of cash that management reinvests back into the company after deducting capital expenditures, taxes, and other expenses.

A high cash reinvestment ratio is typically indicative of a company that is anticipating significant growth, such as young tech companies that reinvest large amounts of their cash flow back into their business.

On the other hand, a low cash flow reinvestment rate usually indicates a mature, stable company that does not anticipate rapid growth or expansion, such as large manufacturing companies that do not require significant capital investments.

Calculating the cash reinvestment ratio is relatively straightforward.

To determine this ratio, you need to divide the amount of cash that management reinvests back into the business by the total cash flow generated during the year, expressed as a percentage.

Additionally, a strong likelihood of future growth can be indicated by a higher cash reinvestment ratio.

However, it's important to note that a high reinvestment rate does not always mean that the company is undervalued or a good investment opportunity.

Overall, understanding a company's cash reinvestment ratio is a crucial aspect of evaluating its valuation and potential for future growth.

By analyzing this metric, investors can make more informed investment decisions and assess the overall health and financial stability of a company.

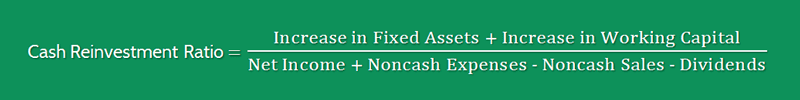

Formula

The equation for the cash reinvestment ratio is as follows:

Cash Reinvestment Ratio = (Increase in Fixed Assets + Increase in Working Capital) / (Net Income + Noncash Expenses - Noncash Sales - Dividends)

To compute the ratio, you add the incremental increase in fixed assets to the increase in working capital, and divide the result by the net income, plus noncash expense, minus non-cash Sales and dividends.

You can easily this information on a company’s balance sheet and income statement.

Example

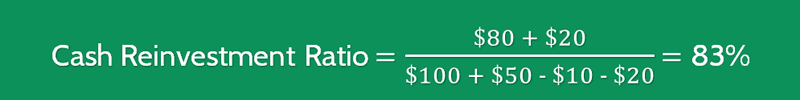

Okay now let’s consider an example so you can see how easy it is to calculate this ratio.

Suppose between 2016 and 2017, a company increased its fixed assets and working capital $80 million and 20$, respectively.

Additionally, in that time span, the company reported net income of $100 million, non-cash expenses of $50 million, non-cash sales of $10 million and $20 million in dividends.

By plugging the numbers into the equation, cash reinvestment ratio is calculated to be 83%.

Meaning that 83% of the company’s available cash flow is being reinvested into the company’s operations.

Interpretation & Analysis

The reinvestment rate or cash flow reinvestment ratio is a financial metric that measures the percentage of cash generated from operations that a company reinvests back into its business.

In the example above, the company has an 83% reinvestment rate, which means that it reinvests a significant majority of its available cash into its operations rather than paying out dividends or earning interest income from other sources.

This is a positive sign for investors because it suggests that the company is focused on building its business and positioning itself for growth in the future.

It's important to note that the reinvestment rate doesn't take into account how much cash a company generates in total, or how much cash it needs to cover its expenses.

Therefore, investors should not rely solely on this metric when evaluating whether to purchase shares of stock.

Instead, they should look at a range of financial metrics before making a decision, including the company's revenue growth, profitability, and return on investment.

One potential downside to a high reinvestment rate is that it may subtract from the amount of cash available for other purposes, such as paying down debt or issuing dividends.

Additionally, if a company is focused solely on new fixed asset additions and not on maintaining existing assets or improving operational efficiency, it may not see the returns on investment that investors are hoping for.

Therefore, investors should pay attention to how a company is allocating its cash and not focus solely on new fixed asset additions.

Cautions & Further Explanation

When analyzing a company's financial health, the cash flow reinvestment ratio is one of the factors investors consider.

A high cash flow reinvestment ratio may indicate that a company is using its profits to fund its growth and expand its operations, which can be attractive to investors.

However, it is important to note that this ratio has its limitations.

It is true that young, high-growth potential companies often have a high cash flow reinvestment ratio, sometimes close to 100%.

But it is important to evaluate the reasons behind this ratio before making any investment decisions.

Poorly managed companies can also have high reinvestment ratios, even if they are not primed for high growth.

For instance, a company may spend 90% of its cash flow on its assets and working capital, but if the management properly updated its machinery and negotiated better contracts with suppliers, they could reduce the ratio to 60%.

It is crucial to calculate other ratios and peruse the company's financial statements to better understand its financial health and long-term goals.

One way to do this is by using a calculator to determine the present value of a company's cash flows over a certain period, factoring in the rate of return and depreciation.

Another consideration is the holding period of the investment, as a company's reinvestment strategy may not be sustainable over the long term.

Ultimately, the key is to evaluate how effectively the management reinvests in the business.

A company with a high cash flow reinvestment ratio may seem attractive, but if the reinvested funds are not used wisely and do not generate sufficient returns, it can be detrimental to the company's success in the long term.

Therefore, investors should carefully analyze a company's reinvestment strategy and determine whether it aligns with their investment objectives before making any investment decisions.

Additionally, considering the risk-free rate of return on treasury bills and other investments can help assess whether the company's reinvestment is worth the risk.

Frequently Asked Questions

Q: What is the cash reinvestment ratio, and what does it measure?

The cash reinvestment ratio is a financial ratio that measures the amount of cash a company has available to reinvest in its business operations after covering its current liabilities. This ratio indicates the company's ability to finance future growth or invest in capital expenditures.

Q: How is the cash reinvestment ratio calculated?

The cash reinvestment ratio is calculated by dividing the company's cash flows from operations by its current liabilities. The resulting ratio indicates how much cash the company has available to reinvest in the business.

Q: What does a high cash reinvestment ratio indicate?

A high cash reinvestment ratio indicates that the company has a large amount of cash available to reinvest in its business operations. This may be a positive sign for investors, as it suggests that the company is well-positioned for future growth and expansion.

Q: How can a low cash reinvestment ratio impact a company?

A low cash reinvestment ratio indicates that the company has limited cash available to invest in its business operations. This may be a negative sign for investors, as it suggests that the company may struggle to finance future growth or capital expenditures. A low cash reinvestment ratio may also indicate that the company has a high level of debt or is facing financial difficulties.

Final Words

Congratulations! You have successfully made it to the end of the road, but this is not the end of your journey.

Let's take a moment to imagine that you are a successful business owner who has managed to generate profits and is ready to take the next step towards future growth.

However, the question that arises is, where do you start with reinvesting your cash?

The answer lies in the cash reinvestment ratio, which is a powerful tool that requires your attention solely on new fixed asset additions for future growth.

It helps business owners make smart decisions about how to allocate their funds.

This ratio is calculated using the annualized cash flow and comparing it to the capital expenditures, adjusted for dividends.

This variation on the formula helps you reinvest your working capital in the most effective way.

However, it's not just about the numbers.

To take calculated risks and make informed decisions, you need to have the right mindset.

By embracing challenges and opportunities, you can turn your business into a thriving success.

Remember, you are the driving force behind your business, and with the right mindset, you can achieve your goals.

Using the cash reinvestment ratio as a guide, you can determine the best course of action for your company's growth.

Reinvesting your working capital can also mean that there is a strong likelihood of future success.

So, keep learning, keep practicing, and keep pushing forward.

The ratio will help you stay on track with your financial goals and investments.