This is an advanced guide on how to calculate Days Sales Outstanding with in-depth interpretation, analysis, and example. You will learn how to utilize its formula to evaluate a firm's efficiency.

Definition - What is Days Sales Outstanding?

The days sales outstanding (DSO), also known as the average collection period, is a measure that helps determine if the business can efficiently collect cash made from its sales.

In short, it measures how long it would take, in days, for a company to get the payments from the sales that have been credited to their account.

This ratio can help determine if a company needs to find a solution to improve their collection strategy.

A high revenue may seem like an indicator of success, but unless a company can successfully turn these credits into actual cash, they don't have any actual returns to use for their operations and investments.

It’s worth noting that investing in a company with no cash, and has a high amount of accounts receivable could be big trouble.

More...

Formula

In order to calculate days sales outstanding for a company you would like to evaluate, you should use the following formula

Days Sales Outstanding = (Average Accounts Receivable / Total Sales) x Days in a Period

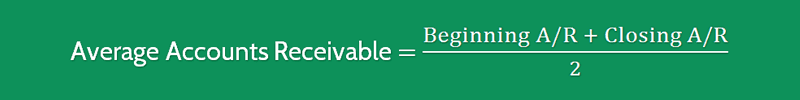

In order to calculate the average accounts receivable, you just need to sum the ending and beginning accounts receivable, and then divide the result by 2, as follows:

Average Accounts Receivable = Beginning Accounts Receivable + Closing Accounts Receivable) / 2

You can easily find the total sales and accounts receivable figures reported on a company’s income statement and balance sheet.

Example

Now that you know the exact formula for calculating the average receivables in days, let’s consider an example.

Company A is struggling to repay the initial loans made to come up with capital for the start of the business.

To be able to determine improvements that can be made to free up their cash flow, the company's manager calculates the days accounts receivable as follows:

Company A | |

|---|---|

Average Accounts Receivables | $92,000 |

Total Sales | $95,000 |

Inventory | $200,000 |

Days in the Period (Month) | 30 days |

Day’s Sales Outstanding | 29 days |

Company A discovered that they were taking nearly a month to collect payments made on sales.

While the number is relatively short, they are only a small business that had to take on a large loan.

To give a solution to the problem, Company A focused on efforts to shorten the cash collection time, so that they may be able to receive the cash promptly and pay their loans on time.

For investors, the DSO can give you an overall picture of how efficient a business is in terms of collecting money from its customers.

Now let’s take a look at another example.

For example, you are looking to examine a firm’s ability to collect payments from its customers.

You looked into the business financials statements and found the following information:

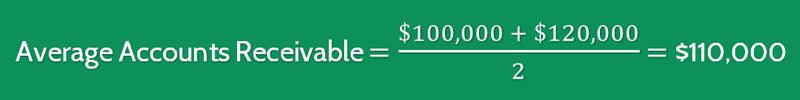

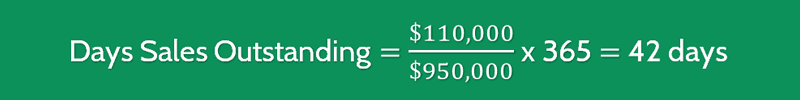

- Beginning Accounts Receivable = $100,000

- Ending Accounts Receivable = $120,000

- Total Sales Revenues = $950,000

- Days in the Period = 365 days

By using the given formula, you would calculate the day’s sales outstanding of this company, as follows:

So the result of 42 days tells us that it takes the company 42 days to collect money from its customers after a sale is made.

Interpretation & Analysis

Generally speaking, a low days sales outstanding value shows that it takes a firm fewer days to collect money owed by its customers.

And vice versa, a high days sales outstanding means that it takes a firm longer time to collect its accounts receivable.

So what is a good day's sales outstanding result?

As this ratio value varies from industry to industry, there is no general rule on the best number for this indicator.

In order to use this calculation effectively, you should find several companies that are operating in the same industry, and then calculate their DSO values.

A lower DSO result indicates that a company takes less time to collect payments from its customers in comparison with other companies, and vice versa.

Cautions & Further Explanation

Problems with cash can pose big troubles for a business. The source of this inefficiency can come from a lot of factors.

From the administrative set-up to the logistical planning, there are a lot of ways to approach the system that can satisfy the needs of the company.

The other reasons the collection could be performing poorly is an inferior credit checking system that allows customers who are likely to default on payments to transact with them.

Collecting payments from these customers can be difficult, putting stress on the company’s cash flow. Putting some effort into mitigating these lists can be a solution to the problem as well.

It should be noted that this ratio is more useful if you use it to compare the receivable collection period of companies within an industry.

You cannot know the acceptable days’ sales in average receivable for a particular company if you don’t consider the industry average value, as well as other industry peers.