Are you looking to elevate your investing skills and achieve maximum returns?

The dividend yield ratio could be the key to success!

As a beginner in investing, you might feel intimidated by the various terms and strategies.

But don't worry, we are here to assist you in understanding this valuation ratio and how it works.

The dividend yield ratio is a method of measuring how much money a company pays its shareholders in dividends annually, relative to the stock price.

In other words, it helps to evaluate the dividend payout a company provides.

This ratio is crucial to many investment strategies and is an essential tool for identifying income-producing stocks.

Therefore, it is vital to learn how to calculate dividend yield and recognize what constitutes a good dividend yield.

In this guide, we will provide an in-depth explanation of the dividend yield formula, explore real-world examples, and illustrate how to use this ratio to develop a diversified investment portfolio.

Through our guide, you will learn to evaluate the dividend payout and determine whether a stock's high dividend yield is worth investing in or whether a low dividend yield is a red flag.

With the right knowledge and tools, anyone can succeed in investing.

So why not dive into this guide and unleash the power of the dividend yield ratio to make smarter investment decisions?

With our comprehensive breakdown of dividend yield calculation, definition, and evaluation, you will be on your way to making informed investment choices based on a stock's price and dividend yield.

Definition - What is Dividend Yield Ratio?

The dividend yield ratio is a financial ratio that measures the dividend payment that a company makes to its investors relative to the current share price.

This ratio is expressed as a percentage and is categorized under valuation ratio categories.

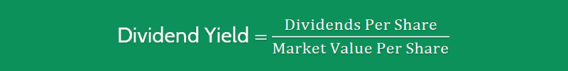

To calculate the dividend yield ratio, we divide the annual dividend per share by the market value per share.

This ratio is often used by investors who are looking for a high yield, continuous dividend income, or a stable source of cash flow.

The dividend yield ratio is a financial measure that allows investors to understand how much every dollar invested in the company's stock is generating in dividend payments.

This ratio is a useful tool for evaluating the company's financial health and dividend policy.

A high dividend yield indicates that the company is distributing a significant portion of its earnings as dividends to shareholders.

On the other hand, a low dividend yield may indicate that the company is retaining more of its earnings to fund growth initiatives or repay debt.

Moreover, the dividend yield ratio is a financial metric that can be used to compare the performance of different companies in the same industry.

It is also helpful for investors to track changes in the company's dividend payout over time, as this can be an indication of the company's financial stability and future growth prospects.

In summary, the dividend yield ratio is a financial measure that tells us the dividend payment a company makes to its investors relative to its share price.

It is expressed as a percentage and is calculated by dividing the annual dividend per share by the market value per share.

The dividend yield ratio is used by investors to evaluate the company's financial health, dividend policy, and potential for future growth.

It is a valuable tool for comparing companies in the same industry and tracking changes in dividend payout over time.

Formula

You can easily calculate the dividend yield ratio by using the following formula:

If there is a high degree of fluctuation in the share price, you should take the average share price for the period.

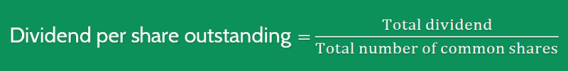

While calculating this ratio, we add all the cash dividends paid out. Also, we need to annualize the dividend.

We multiple the quarterly dividend value by four (monthly dividend figure by 12).

To calculate the value for current year, we either take the previous year’s dividend yield or take the latest quarterly figure and annualize it.

Example

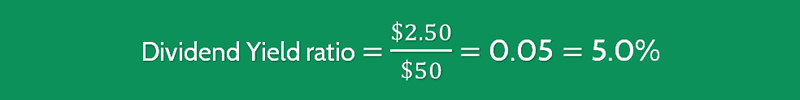

Company A paid $1,000 in dividends in the previous year. The firm has 400 common shares outstanding. The market price of one share of the company is $50.

Interpretation & Analysis

Investors can use the dividend yield as a ratio to evaluate the potential returns from dividend stocks.

The dividend yield is a ratio that shows the total dividend paid out by a company in a year divided by the stock's price per share.

This ratio is particularly important for investors who seek a constant stream of dividend income from their shares.

A company's dividend yield may change over time due to various reasons, such as market fluctuations in its share price or changes in the firm's dividend policy.

Generally, a company with a higher dividend yield pays out more in the form of dividends compared to a firm with a lower yield.

The insights that investors can draw from this value depend on the industry in which the firm is operating.

For instance, high-growth firms like technology companies rarely give dividends as they usually reinvest their profits back into the business to fuel growth.

Conversely, firms operating in the telecom industry generally pay high dividends as they often have limited growth opportunities.

Therefore, understanding a company's dividend yield is critical for investors who want to make informed decisions about their investments.

By analyzing the company's dividend yield, investors can determine whether the stock's dividend yield is worth the investment, and they can weigh the potential return on investment from dividends against the potential stock appreciation.

Cautions & Further Explanation

Investors usually aim for higher returns, and therefore, a higher dividend yield ratio is often desirable.

However, a high dividend yield ratio is not always a good sign as it could indicate financial troubles.

One possible reason for an increase in the dividend yield ratio could be a sudden decrease in the market value of the stock.

In such a scenario, investors may be getting a larger dividend payout for the same investment, resulting in a higher yield.

To determine if an increase in the dividend yield ratio is a positive or negative sign, it is crucial to investigate the reason behind it.

If the increase is due to financial troubles, the company may have to reduce the dividend amount in the future, making the dividend yield ratio appear to be artificially inflated.

Therefore, it is essential to analyze dividend data carefully and find out the exact reason for the increase in the dividend yield ratio.

Furthermore, investors must ensure that the firm can sustain the higher dividend payments in the long run.

If a company is paying out too much of its profits to shareholders, it may not have enough funds to invest in its business or pursue growth opportunities.

On the other hand, if a company is not paying dividends, it could be reinvesting that money into the business to support its growth.

Thus, not paying dividends is not necessarily a bad thing if it is being done for the right reasons and the money is being put to good use.

When assessing a company's dividend distribution, it is also essential to consider the average dividend yield and the trailing dividend.

The average dividend yield provides a better understanding of the company's dividend-paying history and how it compares to its peers.

The trailing dividend, on the other hand, helps investors evaluate the company's recent dividend performance.

In summary, while a higher dividend yield may seem attractive to investors, it is not always a positive sign.

Investors must analyze the reasons behind any increase in the dividend yield ratio to determine if it is sustainable.

Additionally, investors must evaluate the company's ability to sustain dividend payments in the long run and ensure that the firm is not paying out too much of its profits to shareholders.

By taking these factors into account, investors can make informed decisions when investing in companies with large dividends.

Frequently Asked Questions

Q: What is dividend yield ratio and how is it calculated?

Dividend yield ratio is a financial ratio that measures the amount of dividends a company pays out to its shareholders relative to its stock price. It is calculated by dividing the annual dividend per share by the current stock price.

Q: Why is dividend yield ratio important for investors?

Dividend yield ratio is important for investors because it helps them understand how much income they can expect to receive from their investment in a particular company. A higher dividend yield ratio may indicate that a company is more financially stable and has a history of consistently paying dividends to its shareholders.

Q: What are the factors that affect dividend yield ratio?

There are several factors that can affect a company's dividend yield ratio, including changes in the company's dividend policy, fluctuations in the stock price, and changes in the number of shares outstanding.

Q: How can investors use dividend yield ratio to make investment decisions?

Investors can use dividend yield ratio to compare the dividend income they can expect to receive from different companies and make informed investment decisions. However, it's important to consider other factors such as the company's financial health, growth potential, and industry trends before making an investment decision based solely on dividend yield ratio.

Final Words

Success is an aspiration shared by many, both in their personal and professional lives.

It is a product of hard work and dedication, as we strive to reach our goals and envision the kind of life we want to lead.

Investors are no exception, as they seek to achieve high returns on their investments.

One financial ratio that plays a critical role in this pursuit is the dividend yield ratio.

The dividend yield ratio is a formula used to determine the return on investment in a particular company.

It is calculated by dividing the annual dividend per share by the current market price per share.

The resulting ratio provides insight into how much income investors can expect from their investment in the form of dividends.

The higher the ratio, the more income investors can expect.

However, the dividend yield ratio is not just a number.

It is highly informative and can help investors make informed investment decisions to achieve their financial goals.

By focusing on companies with a high dividend yield ratio, investors can potentially earn a steady stream of income while also benefiting from potential stock price appreciation.

In contrast, companies with a low yield may not be the best choice for investors seeking high returns.

Furthermore, the dividend yield has been steadily increasing in recent years, making it an increasingly important metric to consider in financial ratio analysis.

It is closely related to other financial ratios, such as the dividend payout ratio, which measures the percentage of earnings paid out to shareholders in the form of dividends.

By using the dividend yield ratio and other related financial ratios, investors can gain valuable insights into the financial health of a company and make informed investment decisions.

In conclusion, the dividend yield ratio is a powerful tool for investors to assess the return on their investments in a particular company.

It provides valuable information on the potential income investors can expect from their investment in the form of dividends.

By using this ratio and other financial ratios, investors can make informed decisions and achieve their desired level of success.

So, keep learning and practicing, and happy investing!