Investing in the stock market can seem overwhelming, particularly if you're new to the world of investing.

Nevertheless, if you're searching for a reliable income source, investing in dividend-paying stocks might be your best option.

The dividend payout ratio formula is a crucial metric to consider when selecting dividend stocks.

In simpler terms, the dividend payout ratio is the percentage of a company's net income that it distributes to its shareholders in the form of dividends.

The formula to calculate the dividend payout ratio is by dividing the dividends paid per share by the earnings per share.

For instance, if a company pays out $2 in dividends per share and earns $4 per share, its dividend payout ratio would be 50%.

So why is the dividend payout ratio important?

A high dividend payout ratio indicates that the company is distributing a significant portion of its earnings to its shareholders as dividends.

This may imply that the company is mature and steady, and wants to reward its shareholders with a consistent income stream.

Conversely, a low dividend payout ratio may indicate that the company is reinvesting its earnings into the business to achieve growth.

Understanding the dividend payout ratio formula can assist investors in making informed investment decisions.

For example, if you're looking for a stable income, you might want to invest in companies with high dividend payout ratios.

In contrast, if you're searching for growth, you may want to invest in companies with low dividend payout ratios that reinvest their earnings back into the business.

Additionally, investors need to be aware of a company's dividend policy and the difference between common stock and preferred stock.

Dividend yield is another critical metric to consider when choosing dividend stocks.

It is calculated by dividing the annual dividends paid to shareholders by the stock's current price.

Dividend yield provides an investor with the percentage return on their investment from dividends alone.

The dividend payout ratio formula is an essential metric for investors to consider when selecting dividend-paying stocks.

It can help investors make informed decisions based on their investment objectives.

However, investors must also pay attention to other critical metrics, such as dividend yield and a company's dividend policy, to make a well-informed investment decision.

By doing so, investors can potentially enjoy both capital appreciation and a steady income stream.

Definition - What is Dividend Payout Ratio?

The dividend payout ratio is a vital metric for investors as it provides information on the percentage of a company's earnings paid out as dividends.

Knowing the payout ratio can help investors understand the potential cash payouts they can receive from a particular company.

However, this ratio can also reveal additional information about the company's financial health.

One crucial factor to note is that it's highly detrimental for a company to cut or eliminate dividends once they're established.

Hence, companies aim to generate enough income to maintain and increase their dividend payments.

If a business fails to generate sufficient earnings to support its dividend payments, it may need to supplement the payouts from its cash reserves, which is not a sustainable practice over the long term.

Conversely, a company that pays out a small percentage of its earnings as dividends may be reinvesting the remaining portion in its growth and expansion.

Investors who are willing to forego short-term dividend gains for expected future share price increases might find this strategy more attractive.

Therefore, the payout ratio can provide investors with insights into the company's financial health and its strategy for future growth.

Understanding this ratio can also help investors evaluate a company's dividend policies and compare them with its peers.

By keeping an eye on the dividend payout ratio, investors can make informed decisions when buying or selling stocks.

Formula

To find a company’s dividend payout ratio at the individual share level, you would use the following formula:

Payout Ratio = Dividend per Share / Earnings per Share

There is another, more broad-scope formula that is often used to arrive at the same conclusion, and it looks like this:

Payout Ratio = Total Dividend Paid / Net Income

While both versions of this formula will essentially give you the same result, the first version is often the simplest to use, since the figures it requires are generally published and made public on a regular basis.

Dividend Payout Calculator

Example

So now you know the formula, let's have a look at the following example to learn how to calculate this ratio in real life.

You’re considering investing in Company MM that currently has 200,000 million shares outstanding, and would like to examine its most recent dividend payout ratio per share.

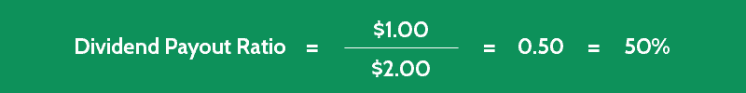

Assume that this company has reported a dividend per share of $1.00 and an earnings per share (EPS) of $2.00.

Using these figures and the formula given above, you can easily calculate the payout ratio of this company, as follows:

The ratio of 50% or 0.5 shows that this company has distributed 50% of its net income to its shareholders in the form of dividends.

Interpretation & Analysis

The dividend payout ratio represents how much a company pays out in dividends compared to its net income.

In other words, it's the proportion of earnings that a company pays out to its shareholders in dividends.

If a company has a higher dividend payout ratio, it means that it's paying out more in dividends than it's actually generating in earnings.

This is not a sustainable practice since it can force a company to use up its cash reserves, sell off assets or resort to debt to meet its shareholder obligations.

To calculate the dividend payout ratio, you need to divide the total amount of dividends paid out by a company by its net income.

So what is a good dividend payout ratio?

Ideally, you should look for companies with a dividend payout ratio of less than 0.6 or 60%.

When a business pays out 60% or less of its net income to investors, it means it will have 40% or more of its earnings left over to fund its own growth and expansion.

However, the dividend payout ratio can be augmented with other factors such as cash flow and dividend growth.

A company that pays out too much in dividends may face some financial difficulties as it may not have enough capital to expand its core business.

In such cases, the company may have to borrow more money, which can eventually make it a high-debt company.

So, what is considered a high dividend payout ratio?

It's important to note that the best way to make use of this ratio is to examine a company's trends over a period of time.

This will provide you with more useful information than a single high or low result will.

It's also important to keep in mind that the dividend payout ratio can vary from industry to industry.

Therefore, you should be cautious when investing in companies with a payout ratio of over 60%.

By analyzing the dividend payout ratio and other related factors, investors can make informed decisions when investing in dividend stocks.

Cautions & Further Explanation

When evaluating a business, one of the key metrics to consider is the dividend payout ratio.

The dividend payout ratio tells us the amount of dividends paid to shareholders in relation to the company's net income.

It's important to be aware that the result of this ratio may be skewed if a company elects to include amounts in its net income that it has yet to receive.

These are known as accrued revenues, and this can sometimes occur in the case of a very long-term client project where a projected percentage of the final revenues are included as income in each reporting period.

To calculate the dividend payout ratio, we simply divide the dividend per share by the company's earnings per share.

The payout ratio based on this calculation can provide valuable insights into a company's financial health and performance.

In fact, the dividend payout ratio is important because it helps investors assess a company's ability to provide a steady stream of income.

It's worth noting that the dividend payout ratio varies from one industry to another.

For example, companies in the technology sector tend to reinvest more of their profits into research and development, while companies in the consumer goods sector tend to pay higher dividends.

In addition to using this ratio as a tool to evaluate the potential value of a business, investors can also use it in conjunction with different financial ratios to gain a better understanding of the company they're considering investing in.

By increasing its dividend, a company can attract more investors and signal to the market that it's confident in its financial position.

Frequently Asked Questions

Q: What is a dividend payout ratio?

The dividend payout ratio is an important valuation ratio that shows the percentage of a company's earnings paid out to shareholders as dividends. It is calculated by dividing the total amount of dividends paid by a company in a year by its net income.

Q: Why is the dividend payout ratio important?

The dividend payout ratio is important because it provides insight into a company's financial health and its willingness to share profits with shareholders. A high dividend payout ratio indicates that a company is paying out a larger percentage of its earnings to shareholders, which can be a sign of a stable and profitable business. On the other hand, a low payout ratio may indicate that a company is reinvesting more of its profits back into the business for growth.

Q: How is the dividend payout ratio calculated?

The dividend payout ratio is calculated by dividing the total amount of dividends paid by a company in a year by its net income. For example, if a company had a net income of $1 million and paid out $200,000 in dividends, the dividend payout ratio would be 20%.

Q: What is a good dividend payout ratio?

A good dividend payout ratio can vary depending on the industry and the specific company. Generally, a payout ratio of 50% or less is considered safe and sustainable, as it leaves enough earnings for the company to reinvest in growth and weather any economic downturns. However, some industries, such as utilities and real estate investment trusts (REITs), may have higher payout ratios due to their stable and predictable cash flows. Ultimately, investors should look at a company's dividend history, financial health, and growth prospects to determine whether a particular payout ratio is appropriate.

Final Words

Are you looking to take your investment game to the next level and generate passive income while you sleep?

Consider investing in companies with a high dividend payout ratio.

This metric calculates the percentage of a company's earnings that are paid out to shareholders as dividends.

By investing in companies with a high dividend payout ratio, you can receive a reliable income stream that grows over time, while also enjoying the potential for capital appreciation.

It's essential to do your research and identify companies with a sustainable payout ratio and a good history of paying dividends.

You should also keep in mind the retention ratio, which is the amount of earnings a company retains to reinvest in the business instead of paying them out as dividends.

A lower dividend payout ratio may indicate that a company is retaining more earnings, which could potentially lead to higher growth and a higher stock price in the future.

Real estate investment trusts (REITs) are another option to consider, as they are required by law to distribute at least 90% of their taxable income to shareholders as dividends.

The dividend payout ratio is calculated by dividing the total dividends paid out by a company by its net income.

Keep in mind that a high dividend payout ratio may not always be sustainable, so it's crucial to analyze a company's financial health thoroughly.

By investing in companies with a high dividend payout ratio and a good history of paying dividends, you can generate a reliable income stream while also enjoying the potential for capital appreciation.

Keep in mind the retention ratio and the sustainability of the payout ratio, and consider diversifying your portfolio with REITs.

Remember that investing is a journey, and continuous learning and practice are essential to achieving financial freedom.

So keep learning, keep practicing, and happy investing!