This is a detailed guide on how to calculate Days Inventory Outstanding with in-depth interpretation, example and analysis. You will learn how to use its formula to assess a company's operating efficiency.

Definition - What is Days Inventory Outstanding?

The days inventory outstanding, also referred to as the day sales of inventory (DSI) or the average inventory period, is a calculation that helps determine if the business efficiently turns its inventory into purchased products, or in other words, into cash.

In short, it measures how long it would take, in days, for a company to sell its inventory.

Holding onto too much inventory can negatively affect a company’s operating performance, and it’s even worse when it takes long time for the business to liquidate its inventory.

Evaluating how long it takes for inventory to be sold can give you an overall picture of how well the business is operating.

For managers, knowing your company’s day sales of inventory (DSI) can help you figure out what issues to address.

You can decide to optimize your procurement and storage process to make your products become more liquid and sell even faster.

For investors, this ratio is particularly useful if you use it to compare different companies in the same industry.

You can easily find out which business is doing better in its operations, and this information will be useful for making your investment decision.

More...

Formula

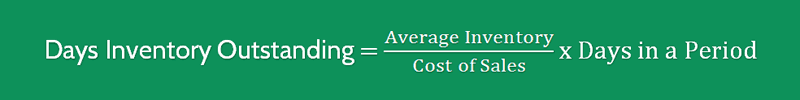

In order to calculate day sales of inventory for a company you would like to evaluate, you can use the following formula:

Days Inventory Outstanding = (Average Inventory / Cost of Sales) x Days in a Period

So how can you calculate the average inventory of a company?

That’s simple: You only need to find the beginning and ending inventory figures, and then average them, like this:

The inventory and cost of sales can be easily found on a company’s financial statements.

Example

Okay now let’s dive into a quick example so you can understand clearly how to calculate the average inventory days of a firm.

A store sells several kinds of snack foods. The manager wants to figure out which lines are doing well in terms of inventory turnover. He is comparing amongst 3 similar lines.

By using the given formula, we will arrive at the average inventory processing days of Brand A, Brand B, and Brand as follows:

Brand A | Brand B | Brand C | |

|---|---|---|---|

Average Annual Inventory | $1,200 | $800 | $1,050 |

Cost of Sales | $24,000 | $28,000 | $26,250 |

Days in The Period | 365 | 365 | 365 |

Day Sales of Inventory (DSI) | 18 days | 10 days | 15 days |

As you can see that even though they are similar products, Brand A is lagging behind B and C.

The manager will consult with his sales and marketing team to figure out how to push Brand A to sell a little faster, or to study if they should continue to host Brand A in their store.

And if you are an investor, this ratio will be very useful when you use it to compare the average inventory processing days of several companies in the same industry.

Now let’s consider another example.

For example, you want to assess Company A’s inventory performance and you want to know its average inventory days.

You will need to find at least 2 more competitors, for example, Company B and C.

After looking into the financial statements of these companies, and with the formula provided above, you could calculate the average inventory days of these companies as follows:

Company A | Company B | Company C | |

|---|---|---|---|

Average Annual Inventory | $8M | $9M | $17M |

Cost of Sales | $85M | $140M | $120M |

Days in The Period | 365 | 365 | 365 |

Day Sales of Inventory (DSI) | 34 days | 23 days | 52 days |

As you can see that it takes much longer for Company C (52 days) to sell their inventory than Company A (34 days) and B (23 days).

The result tells us that Company B is better than Company A and C in terms of converting its inventory into cash. That’s to say, Company B is more efficient in its operations.

Interpretation & Analysis

The result of the days inventory outstanding is not a ratio but rather a measurement of time.

These number of days indicate how long inventory is being held in storage before it’s sold.

So what is a good days inventory outstanding value?

While this number varies from industry to industry, a lower days inventory outstanding is generally seen as better. The lower it is, the less time the inventory sits in the storage.

A low average inventory processing period indicates that the company is able to keep its inventory liquid so there will be no significant impact on its cash flow and operations.

On the other hand, a high days inventory outstanding result indicates that the company is struggling to liquidate its inventory which will potentially impact the overall operating performance of the business.

Consider the fact that many kinds of inventory can easily become obsolete or damaged; if a business fails to liquidate its inventory on time, there will be a lot of troubles.

Cautions & Further Explanation

This metric will be useless if you don’t use it to compare a company with other companies in the same industry.

There’s no magic value of the days inventory outstanding, and the result of this measure varies from industry to industry.

A company in the food industry will obviously come up with a much lower inventory processing period than that of a company that sells industrial products.

If you want to effectively use this measure to assess a firm’s operating efficiency, you should find at least 2 to 3 other companies that are operating in the same industry.

Compare your company’s average inventory days with that of other companies, and if possible, try to compare with the industry average value.

By doing so, you can easily know which company is doing the best job at managing their inventory, as well as selling their products.