This is an in-depth guide on how to calculate Debt to Net Worth Ratio with detailed analysis, example, and interpretation. You will learn how to use its formula to assess an organization's solvency.

Definition - What is Debt to Net Worth Ratio?

The debt to net worth ratio, also referred to as the total debt to total net worth ratio, is a simple calculation that can help you in evaluating the financial health of a given company by comparing the level of debt it has with its total net worth.

A firm’s net worth can be calculated by subtracting its total assets by its total long-term and short-term debt.

In a nutshell, if the business has more assets than its liabilities, its net worth will be positive.

And vice versa, if the business liabilities exceed its total assets, it will have a negative net worth.

This ratio is very useful when it’s used to determine how financially healthy a company is.

A high ratio tells you that the company that you’re considering investing in has already financed by a high level of debt, and it’s a riskier investment compared with other companies.

On the other hand, the low ratio indicates that the business has a low debt burden, which means it can easily cover or meet its debt obligation without having to sell a lot of assets.

More...

Formula

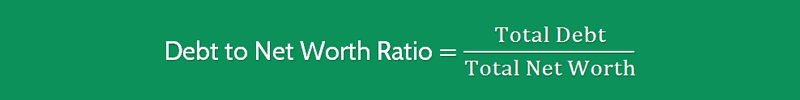

In order to calculate the total debt to net worth ratio of a business, you can use the following formula:

Debt to Net Worth Ratio = Total Debt / Total Net Worth

To calculate this ratio, you will need to find the company's total debt by summing all of its long term and short term debts.

Then, you can calculate the business net worth by subtracting its liabilities from the total assets, like so:

Net Worth = Total Assets – Total Liabilities

Net worth basically represents the value that will remain if the firm decides to wind up operations and pay off all of its liabilities.

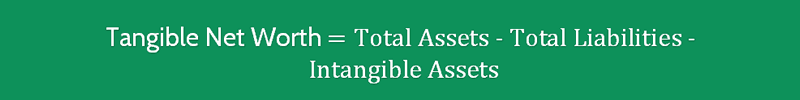

When it comes to valuation, if a business that you are looking to invest in has a lot of intellectual properties, such as copyrights, goodwill, and patents, you will need to go one step further to exclude its intangible assets from the total assets.

The key to assessing a company’s solvency is to determine whether it can cover or pay off debts using its assets.

Intangible assets are still assets, but keep in mind that they are not physical in nature.

Even if these assets provide a lot of value for a company, it cannot be touched or seen, and that’s to say, it’s not easy to convert these assets into cash.

So a better formula for calculating a company’s net worth looks like this:

Tangible Net Worth = Total Assets - Total Liabilities - Intangible Assets

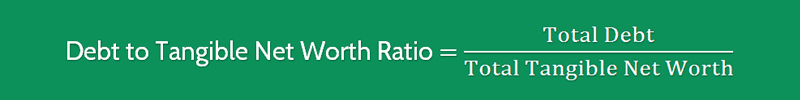

And the revised formula for the debt-to-net worth ratio is as follows:

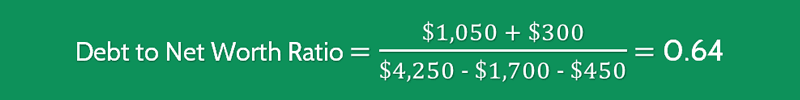

Debt to Tangible Net Worth Ratio = Total Debt / Total Tangible Net Worth

Because this ratio takes the intangible assets out of the company’s total assets, it’s often known as the debt to tangible net worth ratio.

You can easily find all of these figures reported on a firm’s balance sheet.

Example

Okay now let’s dive into a quick example so you can understand clearly how to compute this ratio.

For example, you are investing in Firm XYZ to evaluate its overall financial health.

After looking into its balance sheet, you found the following information:

- Total Assets = $4,250

- Intangible Assets = $450

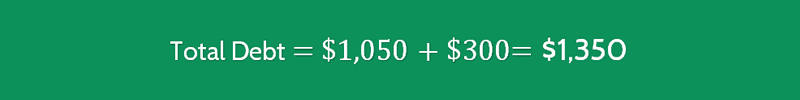

- Long-term Debt = $1,050

- Short-term Debt = $300

- Total Liabilities = $1,700

By using the given formula, we’ll calculate this company’s debt-to-net worth as follows:

The ratio of 0.64 suggests that 64% of the company’s net worth is being financed by its lenders.

Interpretation & Analysis

A lower total debt to total tangible net worth ratio indicates that the business is mostly being financed by its investors or retained earnings.

This indicates that the firm has a strong financial standing, which makes it easier to raise money in the future. Therefore, the lower this ratio is, the better.

On the other hand, a higher value suggests that a substantial part of the business is being financed by lenders.

It makes getting future loans more difficult as higher leverage means higher risk for the lenders.

So what is a good debt to net worth ratio?

A ratio of 1.0 suggests that the company has the capability to pay off its debts using all of its tangible net worth.

So in most cases, you want this ratio to be lower than 1.0, and a good ratio should be lower than 0.4.

That’s to say, the company should have an ability to pay off its debt obligations using less than 40% of its current tangible net worth.

Cautions & Further Explanation

As with other financial ratios, you will need to look at many things before coming to a conclusion.

A firm having a low debt to net worth ratio may not necessarily be better than a firm with a higher value.

A firm having a higher ratio might have had legitimate reasons to borrow money in the short term which might have pushed the ratio up.

By going through your company’s financial statements, you will be in a better position to correctly interpret this ratio.

It’s also worth spending some time comparing the debt-to-net worth ratio of a company with that of its competitors and the industry averages.

By doing so, you can easily determine if a particular company has a high or low ratio, thereby you can make a better investment decision.