This is an advanced guide on how to calculate Sales to Working Capital ratio with thorough interpretation, example, and analysis. You will learn how to use its formula to evaluate a firm's liquidity.

Definition - What is Sales to Working Capital Ratio?

The sales to working capital ratio is another useful liquidity ratio that defines the relationship between a company’s revenues, and the amount of cash it holds in the form of inventory and receivables.

Because it will show you the amount of invested cash a company requires to maintain a certain level of sales, as an investor you can use this liquidity ratio to analyze any changes in an organization’s use of its cash over a period of time.

In general, the amount of working capital available to a business for its daily operations is reduced when its sales to net working capital ratio is lower, since it means that more of the company’s money is tied up in receivables and inventory.

In an ideal world, a company’s sales to WC ratio should remain fairly constant regardless of its sales levels.

More...

Formula

You can use the following formula to calculate a company’s sales to working capital ratio for various accounting periods:

Sales to WC Ratio = Annualized Net Sales / (Accounts Receivable + Inventory - Accounts Payable)

For accuracy purposes, this ratio always uses a company’s net sales amount rather than its gross sales, and receivables and inventory are always offset by any accounts payable amounts.

Read also: Net Working Capital - Formula, Example & Analysis

Sales to Working Capital Calculator

Example

To better understand the information provided by this liquidity ratio, let’s look at a simplified example of a company you may be considering as an investment.

After the 1st quarter of its current year, Company F decided to free up some much-needed cash, and avoid taking out a loan, by returning some of its inventory to suppliers, and maintaining a lower level of stock.

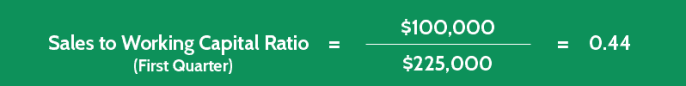

At the end of the current year, Company F’s financial situation looked like this:

First Quarter | Second Quarter | Third Quarter | Fourth Quarter | |

|---|---|---|---|---|

Revenue | $100,000 | $90,000 | $79,000 | $75,000 |

Accounts Receivable | $50,000 | $45,000 | $35,000 | $25,000 |

Inventory | $200,000 | $100,000 | $100,000 | $100,000 |

Accounts Payable | $25,000 | $23,000 | $18,000 | $16,000 |

(With Working Capital = Accounts Receivable + Inventory - Accounts Payable)

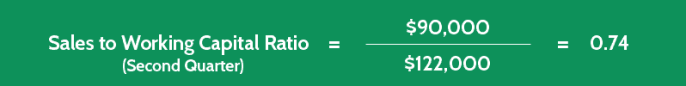

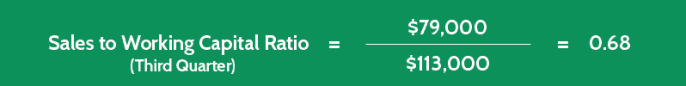

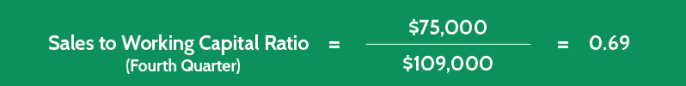

As you can see, management’s decision to carry less stock resulted in a major change in Company F’s sales to NWC ratio value.

While the company did manage to free up some working capital, its sales suffered as a result, most likely because its customers began to look elsewhere for the timely fulfillment of their sales orders.

Interpretation & Analysis

The lower a company’s available working capital, the higher its need for undesirable financing may become.

When a company faces a shortage of working capital, its management may decide to tighten up customer credit or decrease on-hand inventory levels to free up cash.

Decisions like these will be reflected in the sales to working capital ratio.

While tighter credit and lower stock levels will reduce the amount of cash invested in receivables and inventory, they can also result in reduced sales when the company’s payment terms become unattractive to clients, or when customers turn to better-stocked competitors to fulfill their orders more quickly.

Cautions & Further Explanation

When analyzing a business as a potential investment, the sales to net working capital ratio is best used as a trending signal to alert you to investigate various management decisions.

A steadily increasing ratio value where there’s been no change in sales, for example, may simply mean that a company has reduced the cash it has invested in receivables and inventory.

But it might also mean that the firm has elected to extend its accounts payable turnaround time, effectively increasing its accounts payable amount, in order to free up some working capital.

This decision could affect business operations by leading to unhappy suppliers, higher supply prices, and the subsequent loss and replacement of reliable suppliers with less dependable ones.