Are you interested in measuring a company's profitability using a powerful tool?

Then, the earnings per share (EPS) ratio is something you should consider.

EPS is one of the most widely used financial ratios due to its simplicity and effectiveness in providing a clear picture of a company's profitability.

This ratio calculates a company's net earnings per share of outstanding stock by dividing its net earnings by the number of outstanding shares.

The resulting number represents the earnings that each shareholder would receive if the company distributed all of its earnings for that period.

One of the primary reasons why the EPS ratio is crucial is that it can provide insights into a company's profitability over time.

If a company's EPS is increasing, it can be an indicator of the company generating more profits.

Conversely, a decreasing EPS may suggest that the company is struggling to generate profits.

This ratio can also assist investors in comparing the profitability of different companies within the same industry.

For example, if two companies have similar earnings, but one has a higher EPS, it could indicate that the company is more efficient at generating profits per share.

It is worth noting that the EPS ratio is just one of many financial ratios used to measure a company's financial health.

However, it is one of the most commonly used ratios and provides valuable insight into a company's profitability.

There are two types of EPS calculations: basic EPS and diluted EPS.

Basic EPS considers only the number of outstanding shares, while diluted EPS takes into account the potential dilution of outstanding shares.

The diluted EPS formula is more complex and considers the potential dilution of outstanding shares by including the impact of stock options, warrants, convertible bonds, and preferred stock.

The diluted EPS formula uses the numerator and denominator of basic EPS and then adds the effects of any potentially dilutive securities.

The denominator of the diluted EPS formula includes the weighted average shares outstanding, which takes into account the potential dilution of outstanding shares.

However, there are limitations to the EPS ratio, and investors should exercise caution when using it as the sole metric for investment decisions.

For instance, the EPS ratio does not consider a company's debt or the impact of its financing activities.

Additionally, the EPS ratio can be manipulated by share buybacks or other financial strategies, which can artificially inflate earnings per share.

In summary, the EPS ratio is a powerful tool that can help investors make informed decisions about their investments.

It provides insights into a company's profitability over time and can assist in comparing the profitability of different companies within the same industry.

However, investors should exercise caution and use EPS in conjunction with other financial metrics to make sound investment decisions.

If you want to learn more about the EPS ratio, including its calculation and benefits, keep reading this comprehensive guide.

Definition - What is Earnings Per Share Ratio?

Earnings per share (EPS), also known as income per share, is a widely used valuation ratio that calculates the net income of a company for a particular period allocated to each outstanding share.

A company's earnings per share declaration is a great indication of how profitable it is.

This financial ratio is calculated by dividing the earnings available to common shareholders by the number of outstanding shares.

In other words, it represents the portion of a company's profit that is allocated to each outstanding share of common stock.

It's a simple way to measure the performance of a company in terms of how much profit it generates for each share outstanding.

EPS is calculated by subtracting preferred dividends from net income and then dividing it by the weighted average of outstanding shares.

This ratio is essential in financial ratio analysis because it shows how much profit a company brings on a shareholder basis.

Basic EPS, which only takes into account common shares, and diluted EPS, which takes into account all potential dilution from options and convertible securities, are two types of EPS.

Basic EPS is considered a more conservative measure than diluted EPS since it does not consider any potential dilution.

A good EPS can make a significant difference in a company's market share.

EPS provides a basis for comparing the profitability of two different companies, regardless of size.

However, it is crucial to keep in mind that EPS is greatly influenced by the number of outstanding shares.

Larger companies may have to split their profits among different shares, which can lower their EPS.

Therefore, when comparing two companies, it's important to consider their size and number of outstanding shares.

In summary, earnings per share is a crucial financial ratio that provides insights into a company's profitability and is essential for any investor or analyst conducting financial ratio analysis.

Formula

Earnings per share ratio is calculated as you subtract the preferred stock dividends from net income, and then divide it by the combination of common stock equivalents and all outstanding common shares.

The formula will, therefore, look something like this:

Earnings per Share = Net Income - Preferred Dividends / Average Number of Shares Outstanding

The EPS generally measures the income that is available to the common stockholders. It’s normally declared and reported by a company on a quarterly and yearly basis.

The preferred dividends, therefore, are shifted towards the preferred shareholders – and thus, they can’t mix.

Besides, you can come up with a more precise result if you use a weighted average number of shares outstanding when calculating the EPS.

That’s because the company’s capital structure can change from time to time, and that also leads to a change in outstanding shares number.

If a firm employs a more complicated capital structure, it’s required to report two EPS figures: basic EPS and diluted EPS.

Diluted EPS expands on basic EPS by adding the shares of warrants and convertibles outstanding to the number of shares outstanding if these convertible securities were exercised.

The formula for calculating diluted earnings per share looks like this:

Diluted EPS = (Net Income - Preferred Dividends) / (Shares Outstanding + Diluted Shares)

You can easily find all of these figures on a company’s financial statements.

Example

Okay now let’s consider a quick example so you understand clearly what this ratio is about and how it can help you in making your investment decision.

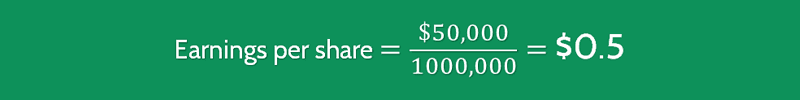

Let’s say that we have Company C that has a net income that is around $50,000 per year.

Considering that the firm is small, we don’t have any preferred shares outstanding.

The shares of common stock during the year will be 100,000. Therefore, the formula is calculated this way:

You can see that Company C’s net income per share is $0.5. This means that if we divide the entire income to all shareholders, each of them would get $0.5.

Or in other words, the shareholders will receive $0.50 per every $1.00 they invested into this company.

Interpretation & Analysis

The earnings per share (EPS) concept is crucial in determining a company's profitability ratio or market prospect.

Investors generally prefer a higher EPS ratio because it signifies that the company is generating more profits, which could result in greater value distribution to the shareholders in the future.

Despite the significance of EPS, only a few investors give it enough attention.

However, a higher EPS ratio can have a positive impact on a company's share price.

Therefore, it is essential to understand what makes a good EPS ratio.

In general, a higher EPS ratio is preferable.

A steady growth in EPS is an indication that the management is doing an excellent job of generating more value for shareholders.

The EPS value is calculated by dividing a company's net income by its weighted average shares outstanding.

Moreover, EPS is a useful metric when comparing a company's performance with its competitors and industry averages.

Comparing EPS enables investors to determine which company is creating more value for shareholders.

It's worth noting that EPS can be either fully diluted or basic.

Fully diluted EPS formula considers the potential dilution that could result from convertible securities, stock options, or warrants, while basic EPS formula doesn't.

A higher EPS indicates that a company is generating more profits with less shareholder capital.

As an investor, it is always wise to put money into a company that creates more value for shareholders in the long run.

Therefore, it is essential to pay attention to a company's EPS when evaluating its prospects.

Cautions & Further Explanation

When analyzing a company's financial health, it's crucial to take into account its net income as it's a vital aspect of the ratio.

However, it's essential to note that the net income can be significantly affected by non-operating credits or charges, which can conceal the actual cash position of the firm.

Therefore, it's imperative to mix the analysis of net income with an assessment of the operating results and a careful study of the cash inflow and outflow.

Moreover, it's important to keep in mind that the number of stock equivalents can sometimes be overstated, artificially reducing the basic earnings per share (EPS) amount.

The type of EPS calculation can also affect the EPS amount.

To calculate EPS, the total number of common shares issued by the company is divided by the income.

Although EPS is an essential metric, there are several factors that can manipulate the ratio, so it should not be the sole factor influencing investment decisions.

In addition to the EPS, the company's earnings are also critical in determining the dividend payment.

Dividends are paid out of the company's earnings, and the board of directors decides the amount of dividend to be distributed to the shareholders.

Therefore, it's crucial to examine the company's earnings to determine the dividend payment.

When analyzing a company's financial health, it's crucial to take into account multiple factors such as net income, EPS, and the number of common shares issued by the company.

However, one should not make the mistake of solely relying on EPS as there are several factors that can manipulate the ratio.

Frequently Asked Questions

Q: What is earnings per share (EPS) ratio?

The earnings per share (EPS) ratio is a financial metric that indicates how much profit a company has earned for each outstanding share of its common stock. It is calculated by dividing the net income of a company by its total number of outstanding shares of common stock.

Q: Why is earnings per share ratio important?

The earnings per share (EPS) ratio is important because it helps investors and analysts evaluate the profitability of a company on a per-share basis. It can also be used to compare the performance of a company against other companies in the same industry.

Q: How is earnings per share ratio calculated?

To calculate earnings per share (EPS) ratio, divide the net income of a company by its total number of outstanding shares of common stock. The formula for EPS is:

EPS = (Net Income - Preferred Dividends) / Average Outstanding Shares

Q: What is a good earnings per share ratio?

A good earnings per share (EPS) ratio varies depending on the industry and the company's size, growth rate, and stage of development. Generally, a higher EPS ratio indicates that a company is more profitable, but it's important to look at other financial metrics as well to get a complete picture of a company's financial health.

Conclusion: Boost Your Investment Decisions with EPS Ratio Insights

As a savvy investor, it's essential to make informed decisions before investing your hard-earned money.

For instance, let's say you've heard about a company with a promising future.

But how do you know if it's worth investing in?

To evaluate a company's profitability, you can use the earnings per share (EPS) ratio, which is a crucial metric that can give you valuable insights.

The EPS ratio calculates how much profit a company generates for each share of its stock.

It's an essential tool for evaluating a company's financial health and potential for growth, and it's easy to calculate, even for beginners.

To calculate the EPS ratio, you need to divide the company's net income by the shares outstanding at the end of the period.

The resulting number represents the earnings generated per share of the company.

EPS is an important metric because it can help you identify companies that are consistently profitable and generating strong returns for investors.

A low EPS may indicate a company that is not generating as much profit as it should.

On the other hand, an increase in the EPS may mean that a company is growing and expanding its profitability.

It's worth noting that preferred dividends are subtracted from the net income when calculating EPS.

Moreover, companies may also report EPS figures that exclude certain one-time expenses or gains.

In such cases, it's crucial to understand the methodology behind the calculation by using the number reported and taking into account the context of the financial report.

To sum up, EPS is an example of a crucial metric that can provide valuable insights into a company's financial health and growth potential.

It's an easy calculation to understand and execute, making it an accessible tool for investors of all levels of expertise.

By regularly evaluating EPS figures and keeping up-to-date with financial reports, investors can make informed decisions about when to buy or sell shares and achieve their financial goals.