This is an all-in-one guide on how to calculate Inventory Turnover Ratio with in-depth interpretation, analysis, and example. You will learn how to utilize this ratio's formula to evaluate a company's efficiency.

Definition - What is The Inventory Turnover Ratio?

In measuring the rate at which a company’s merchandise is sold over a given period of time, the inventory turnover ratio compares average inventory levels against cost of goods sold.

When there’s a relatively low turnover of inventory, it can be an indication that poor planning is involved on the part of the firm’s management, or that the expected level of sales has declined for some reason.

Neither of these scenarios is desirable over the long run, since inventory that’s slow to turn over ties up a company’s working capital in an asset that can be difficult to liquidate.

As an investor, you can use this efficiency ratio to help determine whether the business you’re evaluating is being managed in an effective manner.

Proactive management is one of the key components of a firm’s successful financial performance and, as such, is one of the main factors you should consider as a potential shareholder.

More...

Formula

There are several ways to calculate a company’s inventory turnover over the course of a reporting year, but the following formula is the simplest and most commonly used.

The inventory turnover ratio is calculated as follows:

Inventory Turnover Ratio = Annual Cost of Goods Sold / Average Inventory

The inventory figure generally includes all costs and expenses related to the purchase or manufacture of a firm’s merchandise.

Read also: Accounts Payable Turnover Ratio - Formula, Example & Analysis

Inventory Turnover Calculator

Example

Okay now let's take a look at a quick example so you can see how this ratio is used to assess a company's efficiency.

Perhaps you’ve heard good things about Company CC’s management team, and you’d like to take a closer look at just how efficiently they’re running their business from an inventory point of view.

By studying Company CC’s past financial statements, you compile the following information:

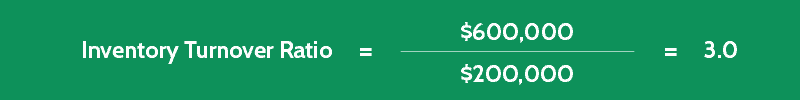

- Annual Cost of Goods Sold = $600,000

- Average Annual Inventory = $200,000

With these figures and the formula given above, you can now calculate Company CC’s inventory turnover, as follows:

From this example, you can see that Company CC turns over the average value of its inventory 3 times every year, or about once every 4 months.

Analysis

So what is a good inventory turnover ratio?

A higher inventory ratio value is usually viewed as a more positive outcome.

When the ratio value is high, it means that a company’s inventory is being bought or manufactured, and sold off, quickly and efficiently.

This indicates that the overall management of the flow of goods through the business is relatively streamlined, and that the company doesn’t have a lot of stagnant and unavailable funds sitting around in the form of unsold merchandise.

But an elevated turnover ratio is not necessarily a good thing in every situation, and you should always investigate your results in combination with other factors, regardless of the outcome.

Is high inventory turnover good?

Sometimes when a company’s inventory ratio is attractively high, for example, it can simply mean that the firm doesn’t have the financial wherewithal to keep its merchandise consistently stocked at a realistic level.

This can often result in lost sales, as customers look elsewhere to have their orders filled in a timelier manner.

When this is the case for the business you’re analyzing, you’ll likely notice a higher level of accompanying debt, and a lower level of cash-on-hand.

Cautions & Further Explanation

Because inventory values can be calculated in a number of different ways, the result of the turnover ratio is open to large variances.

The more expenses a business chooses to allocate to its inventory cost, the higher the inventory value will become, and the lower the resulting turnover ratio will be.

In the case of a manufacturer, for example, inventory costs can include anything from raw materials, to labor, to general overhead.

For this reason, you should always compare companies within the same industry when evaluating the outcome of the inventory turnover ratio, since both merchandise volumes and associated costs vary from one type of business to another.