If you are a business owner or a finance student, you must have come across the term "capitalization ratio" while analyzing a company's financial position.

In simple terms, the capitalization ratio is a measure of a company's financial leverage, which reflects the proportion of debt and equity in a company's capital structure.

By calculating this ratio, you can determine a company's ability to meet its financial obligations and evaluate its potential for growth.

It's important to note that the capitalization ratio is not a single number, and it can be calculated in different ways, such as the debt-to-equity ratio, the debt-to-capital ratio, or the equity-to-capital ratio.

Each of these methods provides a unique perspective on a company's capitalization structure, and understanding them is crucial in making informed financial decisions.

For instance, the debt-to-capitalization ratio measures a company's debt relative to its total capitalization, which includes both debt and equity.

The lower the ratio, the better it is for the company, as it indicates that it has a smaller amount of debt in proportion to its capitalization.

In contrast, the total debt to capitalization ratio measures a company's total amount of debt in proportion to its total capitalization.

This ratio helps determine whether a company has an acceptable capitalization structure, as excessively high ratios may signify a higher level of financial risk.

Moreover, capitalization ratios are indicators of a company's debt coverage ratio, which measures the company's ability to cover its interest and principal payments with its operating income.

A higher coverage ratio indicates that the company can comfortably meet its financial obligations.

Although calculating the capitalization ratio might seem complicated, understanding the different methods of calculation and their pros and cons is essential.

By doing so, you'll be able to evaluate a company's financial health using the capitalization ratio along with practical examples.

So, what are you waiting for?

Dive into our comprehensive guide to calculate capitalization ratio and become an expert in evaluating a company's financial position!

Definition - What is Capitalization Ratio?

The capitalization ratio is a solvency ratio that can be used to determine a company's ability to financially support their growth and operations.

This ratio is considered one of the more meaningful debt ratios, as it provides insight into how the company manages its leverage.

Essentially, leverage is when a company can earn more on their borrowed funds than they pay in interest and fee expense on loans.

The capitalization ratio formula is relatively simple.

It equates to the sum of shareholder equity plus long-term debt.

This ratio is often used when considering whether to invest in a company.

It is also known as the "financial leverage" ratio and it determines the influence of each financial component to the company's total capital.

Total capitalization refers to the sum of:

- Debt

- Common stock

- Preferred stock

On the other hand, shareholders equity is the difference between total assets and total liabilities.

Having a higher capitalization ratio implies a greater level of debt for a company, which results in greater risk for an investor.

However, it also means a greater chance for potentially larger returns.

Remember the phrase: "no risk, no return."

It's important to note that lower capitalization ratio calculations don't always guarantee good outcomes.

With less leverage, a company may not have the funds needed to grow.

This is where the company needs to find their sweet spot, where they have optimal availability to build, with a reasonable amount of debt.

There are different types of capitalization ratios, but the debt-to-equity ratio is a popular one.

The cap ratio is one of the important ratios for a company that can help determine the level of debt a company has and how it manages its leverage.

It provides insights into a company's ability to financially support their growth and operations.

Finding the right balance is important, as having too much or too little leverage can have its downsides.

Formula

Okay now you understand exactly what this ratio is about, let’s have a look at its formula.

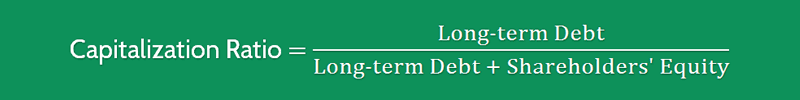

We arrive at the capitalization ratio by dividing long-term debt by the sum of long-term debt and shareholders' equity.

Capitalization Ratio = Long-term Debt / (Long-term Debt + Shareholders’ Equity)

You can easily find the long-term debt and shareholders’ equity reported on a company’s balance sheet.

Example

Now that you know the capitalization ratio formula, let’s consider a quick example so you can clearly understand how to calculate this ratio.

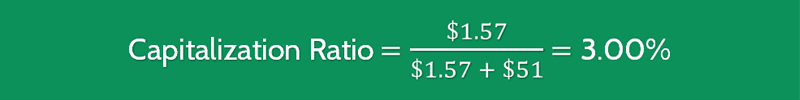

Assume that you are looking to measure the capital structure of Company A as well as how it uses leverage to expand its core operations.

For instance, this company has $1.57 million in long-term debt and $51 million in shareholders’ equity.

By using the above formula, we’ll arrive at the capitalization ratio as follows:

As you can see that Company A’s capitalization ratio is too low, which tells us that while their long-term debt is also low, investing in this organization is risky because the management might fail to use leverage to grow their business.

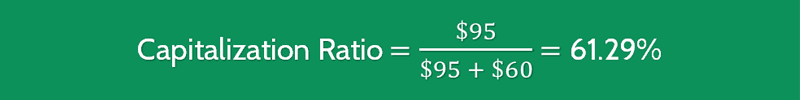

Now let’s look at another example. Assume that Company B has $95 million in total long-term liabilities and $60 million in shareholders’ capital.

By using the given formula, we’ll have the capitalization ratio of about 61.29%

This higher ratio means that the company is a higher risk investment because the management abused debt financing techniques to fund the company’s operations.

And obviously, as a value investor, you will not want to put your money in a high-debt business.

Interpretation & Analysis

There isn't a definitive answer when it comes to determining the ideal amount of debt for a company.

The optimal level of debt varies depending on factors such as the industry, the nature of the business, its products, and its stage in the life cycle, whether it's a start-up or a mature business.

However, one simple and straightforward way to evaluate the financial health of a company is by assessing its equity and debt.

If a company has a high level of equity and low debt, it is generally considered a quality investment option, indicating that it is financially sound.

This implies that the company has a strong foundation and is capable of managing its financial obligations effectively.

One commonly used metric to gauge the capital structure of a company is the capitalization ratio.

This ratio measures the proportion of a company's long-term debt to its total equity.

In general, a capitalization ratio of around 40% is considered standard for larger organizations operating under normal conditions.

This ratio provides a benchmark for comparing capitalization ratios across companies within the same industry.

A high capitalization ratio, indicating a greater reliance on debt, can be a cause for concern.

It suggests that the company is over-leveraged and carries a significant amount of long-term debt.

This situation can hinder the company's growth prospects since it becomes increasingly challenging for them to obtain further credit.

Furthermore, investing in such a highly leveraged company involves a higher level of risk.

Such a weakened state can provide an opportunity for competitors to capitalize on the situation.

Competing firms may take advantage of the company's vulnerability to improve their own market share and gain a competitive edge.

Therefore, maintaining an appropriate capitalization ratio is crucial to ensuring the company's long-term viability and competitiveness in the market.

On the other hand, having a capitalization ratio that is too low can also raise concerns.

A low ratio suggests that the company is underutilizing its available equity and may not be making the most efficient use of its financial resources.

This conservative approach to debt management may be less risky, but it can also hinder the company's potential for growth and profitability.

It may result in reduced earnings and lower dividend potential for shareholders, as the company may not be taking full advantage of its available capital to expand and pursue new opportunities.

To calculate the capitalization ratio, one must subtract the total liabilities from the total assets of a company, yielding the total equity.

This ratio provides valuable insights into the financial structure of a company by comparing the total debt to the total equity.

By carefully evaluating this ratio, investors and analysts can gain a better understanding of a company's financial position and make informed investment decisions.

The ideal level of debt for a company depends on various factors, and there is no one-size-fits-all answer.

However, assessing a company's equity, capitalization ratio, and debt-to-equity ratio can provide valuable insights into its financial health and investment potential.

It is crucial to strike a balance between leveraging debt to fuel growth and ensuring that the company can manage its financial obligations effectively.

Cautions & Further Explanation

Having a solid ratio is a great indication of the amount of risk associated with investing in the organization.

One important aspect to consider when evaluating a company's risk profile is its total debt.

Alongside the total debt, it is essential to consider the balance between equity and debt.

This balance can provide valuable insights into the financial structure and stability of the organization.

To gain a deeper understanding of the company's debt situation, it is necessary to compare the level of debt to other relevant factors.

Calculating the total debt as a percentage of the company's assets, for instance, can help determine the debt capacity and the extent to which the company relies on borrowed funds.

This financial ratio, known as the debt-to-assets ratio, measures the proportion of a company's assets that are financed through debt.

The ratio is calculated by dividing the long-term debt by the total assets.

A higher debt-to-assets ratio indicates that a larger portion of the company's assets is financed through debt, which can be seen as a higher risk factor for potential investors.

In such cases, the company's ability to meet its financial obligations may be closely tied to its ongoing success and profitability.

However, it's important to note that not all high debt situations are necessarily problematic.

Some industries, such as capital-intensive sectors like manufacturing or infrastructure, may naturally have higher debt on the books due to the significant upfront investments required.

Therefore, it becomes crucial to assess the company's debt in relation to industry standards and benchmarks to gain a more accurate perspective.

Additionally, evaluating the company's history of compliance with loan agreements is crucial.

Even if the company has a substantial amount of debt compared to its assets, maintaining a strong record of compliance demonstrates financial discipline and reliability.

Adhering to the terms of loan agreements showcases the company's commitment to fulfilling its financial obligations, mitigating the risk for investors.

In summary, the total debt and its relationship to equity, as well as the company's ability to meet loan agreement terms, are essential factors to consider when assessing the risk associated with investing in an organization.

Calculating the debt-to-assets ratio provides a valuable financial metric that measures the company's reliance on debt financing.

However, it is equally important to consider industry-specific factors and the company's compliance history to form a comprehensive understanding of its financial risk profile.

Frequently Asked Questions

Q: What is a capitalization ratio?

A capitalization ratio is a financial metric used to measure the proportion of debt and equity that a company uses to finance its operations. It represents the total amount of long-term debt and equity capital used by a company to generate earnings and can be used to evaluate a company's financial leverage.

Q: How is capitalization ratio calculated?

The capitalization ratio is calculated by dividing a company's long-term debt by its total capital, which includes long-term debt plus equity. The formula is: Capitalization Ratio = Long-term Debt / (Long-term Debt + Equity)

Q: What does a high capitalization ratio mean?

A high capitalization ratio means that a company relies more heavily on debt to finance its operations than equity. This could indicate that the company is taking on a significant amount of financial risk, as too much debt can be difficult to service if the company experiences financial difficulties.

Q: How does the capitalization ratio affect investors?

Investors may use the capitalization ratio as an indicator of a company's financial health and potential risk. A higher capitalization ratio may signal higher financial risk, while a lower ratio may indicate a lower level of risk. It can be used in conjunction with other solvency ratios to assess a company's overall financial performance and prospects for growth.

Wrap Up

Congratulations on making it to the end of this article!

I hope you've gained a clear understanding of how to achieve success in financial ratio analysis.

However, success doesn't come easy.

It requires a comprehensive understanding of critical financial metrics such as the capitalization ratio, capital structure, equity, long-term debt, leverage, and the proportion of debt.

The capitalization ratio (cap ratio) is a critical metric used by investors to determine the value of a property.

The cap ratio is the ratio between the net operating income and the property's value.

In simple terms, the higher the cap ratio, the more profitable the investment.

It is an essential metric that helps investors determine the potential return on investment and make informed decisions.

Understanding the cap ratio is essential for investors who want to build a profitable portfolio.

When analyzing properties, it's crucial to calculate the capitalization ratio along with practical metrics like debt and equity.

Debt increases financial leverage, which is the proportion of debt a company has relative to its total equity or a section.

A low capitalization ratio indicates that the property's debt is high in comparison to its equity, making it a risky investment.

To become a savvy investor, you need to research and analyze various properties to find the best deals.

Keep practicing and learning more about cap ratio and other essential metrics to identify properties that align with your investment goals.

Remember, success in investing requires knowledge, strategy, and a lot of hard work.

With the right mindset and tools, you can achieve your goals and build a profitable investment portfolio.

So, what are you waiting for?

Keep learning, practicing, and investing in your future.