Have you ever pondered upon how companies determine their financial stability?

One of the crucial metrics that they use is known as the debt to equity ratio.

Despite the complicated term, it's essentially a straightforward concept that can significantly impact a company's financial health.

In this comprehensive guide, we'll delve deep into the realm of the debt to equity ratio and decipher its magic.

We'll examine what it entails, how to calculate the ratio formula, and why it holds importance.

By the end of this article, you'll have a profound understanding of this powerful financial leverage ratio and how it can benefit you.

So, what exactly is the debt to equity ratio?

To put it simply, it's a measure of a company's financial leverage ratio that shows how much debt a company has compared to its equity.

A high debt to equity ratio implies that a company has more debt than equity, while a low ratio indicates the opposite.

However, why does this metric matter?

The debt to equity ratio provides insights into a company's financial risk.

A high ratio suggests that a company is susceptible to financial issues, such as bankruptcy, owing to their reliance on debt.

On the other hand, a low ratio can indicate that a company is financially stable and poses a lower risk of default.

Understanding the debt to equity ratio can also help us make better investment decisions.

By analyzing this metric, we can determine whether a company is a good debt-to-equity investment opportunity.

Additionally, it can aid us in comparing various companies within the same industry and identify the ones that are financially sound.

To calculate the debt-to-equity ratio, one should divide the company's existing debt by its equity.

It can also be measured in terms of the current ratio or the return on equity.

Furthermore, equity financing can be a better alternative to borrowing if a company aims to maintain a low debt-to-equity ratio and a good debt-to-equity ratio.

Understanding the debt to equity ratio is crucial for investors and companies alike.

It enables them to assess their financial well-being and make better-informed decisions.

Hence, it's essential to monitor this ratio consistently to ensure a sound financial position.

So, let's unlock the magic of the debt to equity ratio and use it to our advantage!

Definition - What is Debt to Equity Ratio?

The debt to equity ratio, also referred to as the liability-to-equity ratio, is an essential metric to consider when assessing a company's solvency as a potential investment.

It is a measure of leverage and essentially a gauge of risk, as it examines the relationship between the amount of financing a company receives from debt and shareholder equity.

A good debt-to-equity ratio is vital since the higher the ratio, the greater the level of risk the business assumes, as a higher percentage of its financing is being provided by creditors as opposed to investors.

Debt financing is common in most firms, as it enables them to address cash restrictions and buy back some of their stock to increase the overall return on investment of the remaining shares.

However, when a business becomes too heavily burdened with debt obligations that it can no longer meet, it can spell disaster for the company and its shareholders.

To mitigate this risk, many lending institutions place covenants on their loans that limit a business's allowable ratio of total debt to total equity or restrict how excess cash is used.

As a potential investor, it is essential to examine a company's debt-to-equity ratio to protect your interests.

The ratio of 1.5 is generally considered a good debt-to-equity ratio, indicating that a company has an appropriate balance between debt and equity.

However, the ideal ratio varies depending on the industry and the company's total debt relative to its equity amount.

Therefore, it's crucial to compare the company's debt-to-equity ratio with its peers to get a better perspective.

In summary, the debt-to-equity ratio is a critical measure of solvency and risk that investors should consider when assessing a company's financial health.

By examining the company's debt relative to its equity, investors can determine the level of risk they are willing to undertake.

With this knowledge, investors can make informed decisions that align with their investment goals and risk tolerance.

Formula

How do you calculate debt to equity ratio? The debt-equity ratio formula looks like this:

D/E Ratio = Total Liabilities / Total Stockholders' Equity

You should note that, unlike many other solvency ratios, the debt to total equity ratio includes both short-term and long-term liabilities, as well as any outstanding lease amounts.

You can find all of the figures necessary for calculating this ratio on a company’s balance sheet.

Debt To Equity Ratio (D/E) Calculator

Example

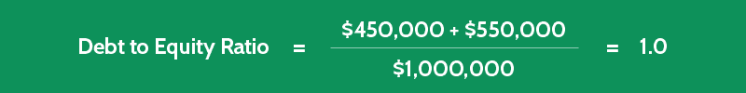

Let’s consider the simplified example of Company J as a potential investment for your portfolio.

By studying Company J’s balance sheet, its total debt to total equity ratio can be calculated as follows:

- Short-Term Liabilities = $450,000

- Long-Term Liabilities = $550,000

- Shareholder Investments (Equity) = $1,000,000

Using these figures and the debt-to-equity ratio formula provided above, you can easily come up with the D/E ratio of this company.

The D/E ratio is calculated as follows:

(With Total Liabilities = Short-term Liabilities + Long-term Liabilities)

Interpretation & Analysis

Understanding a company's solvency requires analyzing its financial statements, including the balance sheet and cash flow.

One important metric for evaluating a company's solvency is the debt to equity (D/E) ratio.

To calculate this ratio, you divide a company's long-term debt by its total assets.

A D/E ratio of 1 indicates that a company's assets are equally financed by both creditors and investors.

However, if a company's total liabilities to equity ratio is over 100%, it could suggest a higher level of financial risk.

In this scenario, creditors may lay claim to a larger portion of every asset dollar, which may impact the company's ability to pay back its debts.

Therefore, it's generally better for a company to have a lower liability to equity ratio, as this indicates that the majority of its operations are being funded by investor equity rather than by debt.

It's important to note that the appropriate D/E ratio benchmark can vary across different industries.

For example, certain sectors may require a higher level of leverage than others, so it's crucial to determine the relevant industry benchmark before analyzing a company's solvency.

Additionally, the numerator of the D/E ratio may not always provide a complete picture of a company's financial situation.

For instance, a company with a high ratio may have a low total debt but may also have several million in shareholder equity.

Therefore, when evaluating a company's solvency, it's crucial to consider multiple financial metrics and to assess whether the business is capable of paying back its debts.

Cautions & Further Explanation

The debt to total shareholders' equity ratio is a financial metric that can help evaluate a company's financial health.

However, it's essential to use debt and equity account figures judiciously, as certain situations can make this ratio misleading.

For instance, this ratio compares the total liabilities to the equity of a company.

The issue with this is that the total liabilities figure used in this ratio doesn't separate out those debts that will have to be repaid in the short term from those that won't become due for many years.

Therefore, a company's debt to equity ratio may appear higher or lower than it actually is.

Furthermore, the ratio relies on debt, and a high debt to equity ratio may indicate that the company may have trouble paying its debt in the future.

If a company's equity is supported by a significant portion of preferred shares, there may be a stock agreement in place that requires the business to pay out a relatively large dividend to its shareholders.

This payment can be substantial enough to affect both a company's cash reserves and its subsequent ability to pay down debt.

In a situation like this, the preferred stock behaves more like a liability than a form of equity.

A ratio of 1 indicates that the company's assets minus its liabilities are equal to its equity.

A low ratio can be a sign of financial trouble, while a high ratio can indicate that the company is relying too much on debt to make its equity.

It's important to note that debt can be useful in some situations, such as when a company needs to invest in growth or expand its operations.

However, a company should be cautious when taking on too much debt, especially if it's in a volatile or cyclical industry.

In such an industry, a company with a debt to equity ratio of 1 million in short-term debt might struggle to meet its financial obligations during a downturn.

Frequently Asked Questions

Q: What is debt to equity ratio?

Debt to equity ratio is a financial ratio that measures the proportion of a company's total debt compared to its total equity. It is calculated by dividing the total debt by the total equity.

Q: How is debt to equity ratio used to evaluate a company's financial health?

The debt to equity ratio is used to determine the level of financial risk a company is exposed to. A high debt to equity ratio indicates that a company is highly leveraged and may have difficulty meeting its financial obligations, while a low ratio indicates that a company has a low level of financial risk.

Q: What is a good debt to equity ratio for a company?

There is no one-size-fits-all answer to this question, as what constitutes a good debt to equity ratio varies by industry and depends on other factors such as a company's growth strategy and financial goals. In general, a ratio of 1 or lower is considered favorable, but some industries may have higher debt to equity ratios.

Q: How can a company improve its debt to equity ratio?

A company can improve its debt to equity ratio by reducing its debt through debt repayment or refinancing, or by increasing its equity through issuing new shares or retaining earnings. However, it is important for a company to carefully consider the potential consequences of these actions before making any changes to its capital structure.

Final Words: Take Advantage of The Debt-to-Equity Ratio

Congratulations on reaching the end of this post on the debt to equity ratio!

By now, you have a solid understanding of how this financial metric can impact your business and personal finances.

Just imagine for a moment, a future where you have achieved financial stability.

You have successfully managed your debts, including short-term and long-term debt, and maintained a healthy balance between your liabilities and equity.

This balance is crucial because it affects your relationship with lenders who want to know if you can pay back the debt.

The debt to equity ratio formula is calculated by dividing your company’s total debt by its total equity.

This ratio tells you how much of your company's assets are financed by debt as compared to equity.

The debt ratio means the amount of debt a company has in relation to its assets, and it is used to determine the risk of lending to a company.

If a company has too much debt, it may be a risk to lenders, and they may not want to lend the company money.

On the other hand, if a company has a healthy balance of debt and equity, it is more attractive to lenders because it demonstrates that the company is financially stable.

Understanding the debt to equity ratio is crucial for achieving financial stability, whether it's for your business or personal finances.

By keeping this ratio in check, you can make informed decisions that will help you achieve your financial goals.

Remember that the calculation of the debt to equity ratio is just one aspect of financial analysis, and continuous learning and practice are essential to reach your financial goals.

So, keep learning about financial ratio analysis, including the debt to equity ratio, and keep implementing the strategies that you have learned today.

With time, effort, and informed decisions, you can achieve financial stability, run a successful business, and live the life you've always dreamed of.