If you're struggling to keep your business afloat, juggling numerous loans, and bills with little success, you're not alone.

However, with the right financial strategy, you can put these worries behind you and set your business on a path to success.

One powerful metric that can help you analyze your business's financial health and take steps to improve it is the cash flow to debt ratio.

This ratio is a measure of how much cash is generated from your business operations compared to your outstanding debts.

By optimizing this ratio, you can ensure that your business has enough cash flow to cover its debts and maintain healthy financial stability.

The cash flow to debt ratio is an essential metric to evaluate a company's ability to repay its debt.

It is calculated by dividing the cash generated from operating activities by the total outstanding debt.

The ratio means that a higher cash flow to debt ratio indicates that your business is generating enough cash flow to cover its debts and obligations, providing financial stability and room to grow.

In contrast, a lower ratio means that your business is struggling to keep up with its debts, which can lead to financial distress, missed payments, and ultimately, bankruptcy.

Optimizing your cash flow to debt ratio can help you improve your business's financial health and long-term sustainability.

By reducing your debts or increasing your cash flow, you can improve this ratio and enjoy the benefits of a healthier financial outlook.

This could include increased investor confidence, improved credit ratings, and easier access to funding or loans.

A high cash flow to debt ratio is a coverage that can give you peace of mind that your business has enough cash flow to cover its debt obligations.

To calculate your cash flow to debt ratio, you need to have your cash flow statement and balance sheet in order.

It's better to use a cash flow statement to calculate this ratio because it assumes that a company's ability to repay its debt is dependent on its cash flow from operating activities.

You should also be aware of negative amortization, which occurs when the interest expense exceeds the cash payment.

In this case, the debt may increase instead of decreasing, and it can negatively impact your cash flow to debt ratio.

In conclusion, understanding your cash flow to debt ratio is crucial for your business's financial health and success.

By optimizing this ratio, you can ensure that your business has enough cash flow to cover its debts and maintain financial stability.

So, dive into our comprehensive guide on the cash flow to debt ratio and discover how this powerful financial strategy can transform your business's future.

Let's get started!

Definition - What is Cash Flow to Debt Ratio?

When it comes to analyzing investments, one important factor to consider is a company's ability to meet its debt obligations.

A solvency ratio that can be used for this purpose is the cash flow to debt ratio (CF/D) or cash flow to total liabilities ratio.

This ratio shows how much cash is available to pay off a company's debt commitments, including both principal payments and interest expenses.

By using free cash flow generated by the business, this ratio analysis can help investors understand the company's ability to pay off its debt in a timely manner.

The higher the cash flow to debt ratio, the more cash is available to pay off the company's outstanding debt.

Therefore, a higher ratio indicates that the business is better equipped to support its short-term and long-term debt obligations.

In addition to showing how much cash is available to pay off existing debt, the CF/D ratio also provides an indication of whether a company is in a position to take on more debt if needed.

By examining the ratio alongside other financial metrics, such as lease numbers and capital structure, investors can get a better idea of the company's overall financial health.

The cash flow to debt ratio shows how much operational cash a company has available to pay off its debt.

This financial ratio analysis is an important tool for investors who want to determine a company's ability to meet its debt obligations, pay off its debt, and take on more debt in the future.

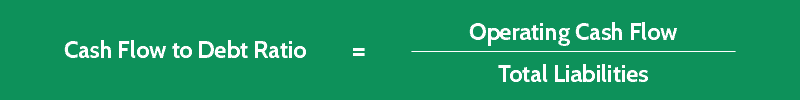

Formula

The formula for calculating a firm’s cash flow to debt ratio looks like this:

CF/D Ratio = Operating Cash Flow / Total Liabilities

As you can see in the formula above, the ratio is calculated by taking a company's operating cash flow and dividing it by the total liabilities.

For this reason, the cash flow to total debt ratio is also known as the cash flow from operations to total liabilities ratio.

You’ll notice that this calculation doesn’t take a company’s full earnings into account, but considers only the amount of those earnings that are available in cash to service its debt load.

Non-cash expenses and sales would include any amounts related to asset amortization and depreciation.

Cash Flow to Debt Ratio Calculator

Example

Now let's consider this example so you can understand clearly how to work out the cash to debt ratio.

Company X has been operating for many years, and has all the appearances of a successful and growing business.

You’re considering buying stock in Company X, and would like to evaluate its debt coverage ability.

A thorough study of the firm’s financial statements reveals the following information:

- Operating Cash Flow (OCF) = $1,000,000

- Debt Payments = $1,150,000

- Lease Payments = $2,500

You can now use these figures and the formula given above to calculate Company X’s cash to total debt ratio, as follows:

From this result, you can see that Company X has debt payments in excess of its cash from operations, since its cash flow only covers 87% of its total debt.

Interpretation & Analysis

The cash flow to total debt ratio is a financial metric that can be used to evaluate a company's solvency.

This ratio compares a company's cash flow to its total debt, providing insight into the company's ability to make debt repayments if necessary, as well as to pay the interest and retire its debt using its debt capital.

While a cash flow to total debt ratio well above 1 or 100% indicates that a company has ample cash available to service its debts, a value of less than 1 does not necessarily mean that it should be avoided as a potential investment.

Instead, it is important to consider the results of the cash to total liabilities ratio in light of a firm's historical performance.

A low ratio may indicate too much debt or a lack of financial strength, but it is essential to find out why before dismissing it as unacceptable.

One way to confirm the viability of a low ratio is to study the past cash flow to total liabilities ratio results.

This can help pinpoint negative trends or warning signs and provide insight into whether a low ratio is warranted in a particular case.

It is worth noting that many large and successful corporations operate with cash to debt ratio values of less than 1.

This suggests that a low cash flow to total debt ratio may not necessarily be a bad sign, and that it is essential to evaluate a company's solvency in the context of its specific financial situation.

Thus, using a cash flow to debt ratio calculator can be a helpful tool when considering whether a company's ratio is a good investment.

Cautions & Further Explanation

Calculating a company's financial health can be a complicated process, but one important ratio to consider is the cash flow to total liabilities ratio.

This ratio provides a snapshot of a company's financial health at a given point in time.

However, it's essential to keep in mind that the final value of this ratio can fluctuate from one measurement period to another because the total debt figure used in the calculation includes both short-term and long-term debts, as well as any current portion of any longer-term obligations.

To get the most accurate picture of a company's financial health, it's essential to estimate any debt obligations over the period being measured.

This can account for any short-term borrowings being acquired or paid off, as well as any recognized debt acquisitions that may be looming in the future.

It's crucial to note that different companies in the same industry may have different debt structures, so comparing their ratios may not be entirely accurate.

Another important ratio to consider is the coverage ratio, which is calculated by dividing a company's earnings before interest and taxes (EBIT) by its interest expenses.

This ratio formula indicates how many times a company's earnings can cover its interest expenses.

A ratio greater than 1.

5 is generally considered good, while a ratio below 1 may indicate that a company may have difficulty paying its interest expenses.

It's also essential to calculate the free cash flow, which is the cash a company generates after accounting for capital expenditures.

This calculation can help determine how much cash a company has available to pay off its debts or make other investments.

Calculating the cash flow to debt ratio indicates the amount of time it would take a company to pay off its debts based on its current cash flow.

This ratio can be particularly useful in determining whether a company can meet its financial obligations, including any bullet payments that may be due in the short term.

Additionally, calculating the years to pay ratio can provide insight into how long it will take a company to pay off its debts based on its current cash flow.

Overall, by calculating these ratios and taking into account any debt obligations, investors can make more informed decisions about a company's financial health.

Frequently Asked Questions

Q: What is cash flow to debt ratio, and how is it calculated?

The cash flow to debt ratio is a financial metric that compares a company's cash flow to its total debt. It's calculated by dividing the cash flow by the total debt amount. This ratio helps investors and analysts determine a company's ability to repay its debt obligations.

Q: How is cash flow to debt ratio different from other financial ratios

Cash flow to debt ratio focuses specifically on a company's cash flow and debt, while other ratios may take into account additional financial metrics such as profitability, liquidity, and efficiency. The cash flow to debt ratio provides insight into a company's ability to generate cash flow to pay off its debt obligations.

Q: Why is the cash flow to debt ratio important?

The cash flow to debt ratio is important because it provides a measure of a company's financial health and ability to pay off its debts. A higher ratio indicates that a company has more cash flow available to service its debt, which is a positive sign for investors and lenders.

Q: What is a good cash flow to debt ratio?

There is no one-size-fits-all answer to this question, as what is considered a good cash flow to debt ratio can vary depending on the industry and the company's specific circumstances. However, generally speaking, a ratio of 1 or higher is considered to be healthy, as it indicates that a company is generating enough cash flow to cover its debt obligations.

Wrap Up

Congratulations on reaching the end of our blog, but remember that the journey towards financial success is ongoing.

Throughout this blog, we have aimed to inspire you to envision what financial freedom means to you.

Is it owning your dream home, starting a business, or traveling the world?

Whatever it may be, there are essential tools to help you achieve it, and one of them is the cash flow to debt ratio.

At its core, the cash flow to debt ratio is a powerful concept that measures your ability to pay off debts.

It compares your cash flow, which is the money you have coming in, to your debt, which is the money you owe.

By doing so, you can determine your financial position and whether you have the means to achieve your goals.

For example, a company can use this ratio to assume whether it can repay its debt, as it reflects the ability to generate cash flow.

The cash flow to debt ratio is expressed as a percentage and tells you how many times over your cash flow can pay off your debt.

A higher ratio means you have more money available to pay off your debts and invest in your future.

The ratio includes cash flow from operations, which is the money you generate from your business or employment, and cash flow from financing, which is the money you receive from loans or investments.

But understanding the ratio is only the beginning.

To master your finances, you need to keep learning and practicing.

It would be best if you made it a habit to track your cash flow and debts regularly so you can make informed decisions about your money.

Set realistic financial goals and create a plan to achieve them.

Remember that financial success takes time, but with the right mindset and tools, you can achieve it.

In conclusion, taking control of your finances and using the cash flow to debt ratio as your guide is crucial in achieving financial freedom.

We believe in you and cannot wait to see the great things you'll accomplish.

Remember to keep learning and practicing, and success will follow.