This is a complete guide on how to calculate Working Capital Turnover Ratio with detailed interpretation, example, and analysis. You will learn how to utilize this ratio formula to examine a company's operating efficiency.

Definition - What is Working Capital Turnover Ratio?

The Working Capital Turnover Ratio is used to measure how much revenue is generated per dollar of working capital investment which is, in basic terms, also referred to as the net sales to working capital ratio (WC).

As a general rule, a high working capital turnover ratio is seen to be more positive as it indicates that the company is converting its working capital into sales which implies efficiency and can give the company a competitive edge over others in the same industry.

On the other hand, a low working capital turnover can suggest that the business is not producing a sufficient return on its assets which could eventually result in financial issues due to the lack of efficiency.

More...

Formula

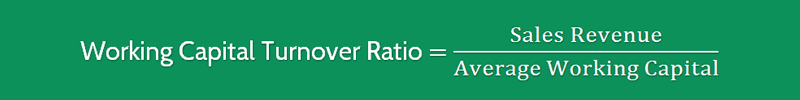

The formula to measure the working capital turnover ratio is as follows:

WC Turnover Ratio = Revenue / Average Working Capital

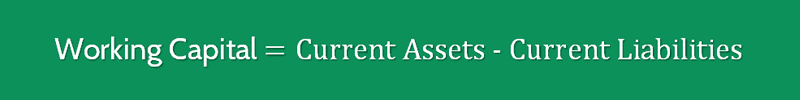

Working capital can be calculated by subtracting the current assets from the current liabilities, like so:

Working Capital = Current Assets - Current Liabilities

To arrive at the average working capital, you can sum the opening and closing balance of working capital, and then divide the result by 2, like this:

Average Working Capital = (Opening Working Capital + Closing Working Capital) / 2

Average Working Capital is the ideal figure to use for a more accurate result; however, where the average is not given for example, in financial statements that only show closing balances, then these figures may be used.

You can find all of these numbers on a company's income statement and balance sheet.

Example

Okay now let’s consider an example so you can see exactly how the WC turnover ratio works.

DFG Company has the following information on its financial statements:

- Revenue: $350,000

- Current Assets on January 1st, 2015: $220,000

- Current Assets on December 31st, 2015: $270,000

- Current Liabilities on January 1st, 2015: $160,000

- Current Liabilities on December 31st, 2015: $150,000

To determine the WC turnover ratio of this company, we need to substitute into the formula:

This suggests that for every $1 that the company has invested in working capital, this has generated $3.89 towards sales revenue.

Interpretation & Analysis

As a standalone figure, this is without context, and you would need to compare it to previous year figures.

If the previous year ratio was higher than 3.89, this would suggest that utilization of the working capital during the period has become inefficient or rather, less efficient than before.

However, if the ratio was much lower in the previous year, this could signal that the company is possibly taking on very large orders that it cannot fulfill and is therefore overtrading.

So what is a good working capital turnover ratio?

In short, the higher the working capital turnover ratio, the better. Notwithstanding, this also varies from industry to industry, and there's no standard ratio for all companies.

In order to use this ratio effectively to evaluate a firm's efficiency, you should compare the ratio results in the last 3 to 5 years to draw a picture of how the company utilizes its working capital to generate more revenues.

Cautions & Further Explanation

As with most profitability and performance, the context of the result is better understood when you compare it to other companies that are within the same industry or sector.

A WC turnover ratio is generally confirmed as being higher or low when compared to similar businesses running in the same industry.

For example, if two of your close competitors have their WC turnover ratios of 3.2 and 3.8 and yours is 6, then yours would be deemed as high within your industry.