This is a complete guide on how to calculate Debt Service Coverage (DSCR) ratio with thorough interpretation, analysis, and example. You will learn how to use its formula to examine a business debt settlement capacity.

Definition - What is Debt Service Coverage Ratio?

When you want to investigate the solvency of a company you’re considering as an investment, that company’s ability to support its debt payments becomes a crucial consideration.

The debt service coverage ratio is one of the calculations you can use to measure a firm’s debt-paying ability, by comparing its net earnings with the amount of its loan and interest payments.

So what is the meaning of debt service ratio?

In short, this financial ratio allows you to determine whether the business you’re considering is generating enough income to cover its debts.

If a company’s DSCR is less than 1, there’s a strong likelihood that the firm will be unable to meet all of its loan obligations.

But when the ratio value is greater than 1, it tells you that cash flow from the company’s net income is more than sufficient to service the firm’s current debt load.

Because the debt service ratio looks at all of the costs associated with a firm’s outstanding debt, rather than just at the outstanding amount of the debt itself, it provides you with information about a company’s debt-servicing ability that’s much more precise than what you could glean from its debt ratio alone.

More...

DSCR Formula

The formula to calculate the debt service coverage ratio looks like this:

DSCR = Net Operating Income / Total Debt Service Costs

You can usually find the information you need for this formula by studying a company’s income statement and balance sheet, as well as any notes that accompany its financial statements.

A firm’s net operating income is the amount of cash that’s left over after all of its regular operating expenses have been paid, excluding any taxes and interest expenses.

The total debt service costs amount includes any loan payments that are due within the upcoming year, including all interest and principal amounts, and any lease payments.

If you want to fine-tune your debt coverage ratio calculations even further, you can use the following formula instead:

This version of the ratio gives you a higher level of accuracy, since it accounts for the fact that interest payments on loans are tax deductible, while principal payments are not.

Read also: Debt to Asset - Formula, Example & Analysis

Debt Service Coverage Ratio Calculator

Example

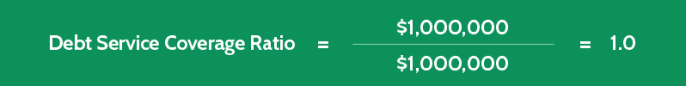

Perhaps you’re considering buying stock in Company R, and would like to examine its debt-paying ability as part of your investment analysis.

After studying Company R’s financial statements, you come up with the following figures for your calculations:

- Net Operating Income = $1,000,000

- Loan Interest Expenses = $550,000

- Loan Principal Payments = $350,000

- Lease Payments = $100,000

With this information and the DSCR formula, you can figure out Company R’s debt service coverage ratio, as follows:

(With Total Debt Service = Interest Expenses + Principal Payments + Lease Payments)

In this example, Company R generates just enough in earnings to cover the costs associated with its current debt load.

Interpretation & Analysis

When net income is equal to the cost of carrying loans, meaning the DSC ratio is 1, it tells you that a business is making just enough money to cover 100% of its current debts, without having to dip into its savings, sell off assets, or borrow more money.

So what is a good debt service coverage ratio (DSCR)?

Any ratio value at, or just above, 1 should therefore be viewed with caution, since the slightest reduction in earnings could cause a business to become financially overextended.

When a company’s debt service ratio is below 1, it’s best regarded as an all-out sign of looming financial difficulty.

Some lending institutions will even go so far as to stipulate that a business must maintain a minimum coverage ratio, in an attempt to keep it from defaulting on its loan payments.

Because the debt service ratio measures a company’s ability to sustain its current level of debt, the higher the ratio value is, the better its debt servicing position.

A higher coverage ratio not only indicates a more positive cash flow, it also means a business is more likely to pay down its debts in a timely fashion, since more of its profits from income are available to put toward loan payments.

Cautions & Further Explanation

The biggest drawback of using the debt service ratio to measure a company’s ability to service its current debt load is the fact that it only takes historical earnings into account.

A business that’s growing quickly can reasonably be expected to increase its income level over the short term, and so improve its debt-paying ability at the same time.

As a potential investor, you may want to consider additional calculations, such as the debt to income ratio, that make use of a company’s expected earnings over upcoming reporting periods, in order to arrive at a more realistic debt servicing picture for that firm.

Regardless of which of the varied approaches you take in your debt coverage analysis of a promising investment, just be sure that they’re consistent from period to period, and from company to company.