This is an advanced guide on how to calculate Inventory to Working Capital ratio with thorough interpretation, example, and analysis. You will learn how to utilize its formula to assess an organization's liquidity.

Definition - What is Inventory to Working Capital Ratio?

The amount of current assets that a company has on hand at any given time, in excess of its current liabilities, is known as its net working capital (NWC).

These funds are what allow a business to run its daily operations.

One of the short-term assets held by many companies is the cash invested in its inventory.

But if this inventory amount is relatively large compared to other assets, it can skew the perception of just how readily available a firm’s cash truly is for paying off short-term debts.

Sometimes a company’s inventory can suffer from extremely low turn-over, or simply becomes outdated and difficult to sell.

The inventory to net working capital ratio allows you to calculate exactly what proportion of a business’s working capital is tied up in its inventory, giving you a more accurate picture of its liquidity position.

More...

Formula

If you want to figure out what component of an organization’s working capital is represented by its inventory, you can use the following formula:

Inventory to WC Ratio = Inventory / (Accounts Receivable + Inventory - Accounts Payable)

In the inventory to working capital ratio, a company’s working capital (current assets – current liabilities) is represented by the amount of its receivables and inventory, less its payables.

Read also: Quick Ratio - Formula, Example & Analysis

Inventory to Working Capital Calculator

Example

Perhaps you’re considering including Company G in your investment portfolio.

Company G has recently been trying to maintain its competitive edge by steadily increasing the range and quantity of inventory it carries, regardless of how infrequently a product is requested by customers.

When you study the company’s financial statements for the past three years, this is what you find:

| Year 2013 | Year 2014 | Year 2015 |

|---|---|---|---|

Inventory | $500,000 | $750,000 | $1,250,000 |

Accounts Receivable | $1,200,000 | $1,300,000 | $1,400,000 |

Accounts Payable | $250,000 | $300,000 | $600,000 |

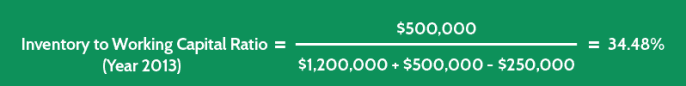

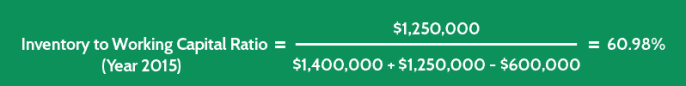

If you plug these figures into the given formula, you end up with results like this:

You can see that Company G has indeed been successful in carrying a larger volume of stock, and there has been a slight increase in sales, as reflected in the rising receivables.

But it’s also evident from the inventory to WC ratio values that Company G has significantly decreased the availability of its working capital, by increasing the amount of cash it’s invested in inventory; much of which is likely to be quite slow in turning over.

This situation could make it more difficult for Company G to service its short-term debt load.

Interpretation & Analysis

In general, the lower a company’s inventory to working capital ratio is, the higher its liquidity.

This will be particularly true for those businesses that hold large quantities of inventory and that require certain levels of cash to fund their operations.

While some analysts consider ratio values of less than 100% to be sufficient proof of a company’s liquidity, this value often proves to be too generic for every situation.

Inventory to WC ratios vary widely between industries and companies, and you’ll glean more meaningful information by using industry averages as a benchmark in your analyses.

Cautions & Further Explanation

Analyzing a company’s inventory to net working capital ratio is best done over a number of periods to accurately identify trends in the use of a firm’s working capital.

Such trends can help to reveal any problems in a company’s regular operations, including the rising ratio values associated with heavy quantities of outdated stock, inferior purchasing control, and inefficient sales forecasts.

Ideally, you should use the inventory to NWC ratio at the same time as you examine a company’s inventory turnover rate, since stock that consistently turns over quickly will contribute far more positively to an organization’s level of liquidity.