This is a complete guide on how to calculate Sales to Administrative Expenses Ratio with thorough analysis, interpretation, and example. You will learn how to use its formula to evaluate a firm's operating performance.

Definition - What is Sales to Administrative Expenses Ratio?

The sales to administrative expenses ratio is a measure that provides really important context for an amount of sales that a company is reporting.

The ratio will essentially tell you how much the company is spending in order to maintain that level of sales volume.

Using the formula, you are figuring out exactly how much the company spends in order to get each sale.

More...

Formula

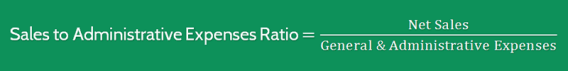

This is really simple to figure out. You simply divide the net sales for the year by the total amount of general and administrative expenses.

Sales to Administrative Expenses Ratio = Net Sales / General and Administrative Expenses

Net sales are the total amount of sales the company has generated over the past year after subtracting any discounts, damages, returns, or other losses taken.

General and administrative expenses are the overhead costs involved in executing the sales.

This includes everything from rent, utilities, and insurance to salaries, supplies, and equipment.

You can easily find all of these figures on a firm’s statement of income.

Example

Now that you know the exact formula for calculating the sales to administrative expenses ratios, let’s dive into a quick example.

ABC Company has reported a sudden increase in sales volume. The company’s net sales for the year were $642M (up from $580M the previous year).

At the same time, general and administrative expenses increased from $85 to $150M.

So, using the formula above, you can see that this year’s ratio is 1:0.17. But in the previous year, the ratio was 1:0.10.

Previous Year | This Year | |

|---|---|---|

Net Sales | $580 | $642 |

Administrative Expenses | $85 | $150 |

Sales to Administrative Expenses Ratio | 1 : 0.15 | or 1 : 0.23 |

The results above suggest that, for earning every dollar of sales revenue, the company has to spend about 23 cents on administrative expenses, whereas they only had to spend about 15 cents in the previous year.

This tells us that even though the company is producing more revenue this year, it’s not efficient in managing its administrative expenses.

Interpretation & Analysis

As you can see, looking at the 10.6% revenue increase (from $580M to $680M) alone would tell you a simple story of exciting growth. That is still definitely a nice amount of growth.

But it’s important to realize that at the same time, each dollar of sales has become more expensive.

So the real growth is less impressive than it could be if they had managed to hold their expenses at the same level as the previous year.

What you'll often see, however, is that the ratio goes up when the sales go down.

That's because they have likely kept their general and administrative expenses where they are, but they aren't bringing in as much revenue as they once were.

In either case, a higher ratio is a sign that it's time to make some changes.

A company will usually take a close look at their expenses and find out where their money is going and how it can be spent more efficiently.

Cautions & Further Explanation

While this is a good estimate of about how much a company’s sales cost, you need to take it with a grain of salt.

For example, in some cases, achieving higher sales revenue really does justify increasing your expenses.

The company in the example above may have just gone through a natural growth spurt.

And if that’s the case, trying to cut the expenses down again could lead to a loss in sales revenue.

And maintaining the expenses where they are could lead to continued growth in sales.

So a company can use the ratio as a sign that it’s time to take a closer look at the expenses. But that doesn’t always mean it’s time to make steep cuts.