This is an ultimate guide on how to calculate Return on Average Assets (ROAA) Ratio with in-depth interpretation, analysis, and example. You will learn how to use its formula to evaluate a company's profitability.

Definition - What is Return on Average Assets Ratio?

The return on average assets (ROAA) ratio is a simple calculation that shows you the connection between a company’s net income and its average total assets.

This figure, expressed in percentage, gives a picture of the company’s efficiency in utilizing its average total assets to generate profits.

Or in other words, it measures how much the firm can make from its existing capital expenditure resources.

In case you are a business owner, the return on average assets is a useful ratio that will help you determine whether or not your company’s assets are being optimized or used to their fullest extent.

Buying assets is inevitable when running a business, unless you are employing an asset-light type of business model.

In any case, you would want to know how much money is being made from each asset working to push production.

Unoptimized assets lead to a lot of unnecessary costs that would have gone to more productive measures.

This ratio is important for you if you are looking at optimization and cost-cutting measures.

In case you are an investor, using this ratio will help you evaluate a company’s management performance by looking at how well they are utilizing their business assets to produce revenue.

This ratio will tell you how capable the firm is of funding its own expansion and growth, thereby you can make a better investment decision.

More...

Formula

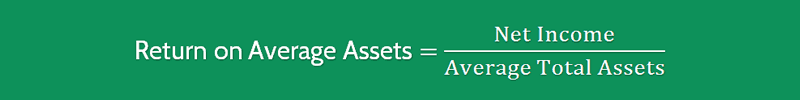

In order to calculate the return on average assets ratio for a company you would like to evaluate, you can use the following formula:

Return on Average Assets = Net Income / Average Total Assets

Net income can be found at the bottom line of a company’s income statement.

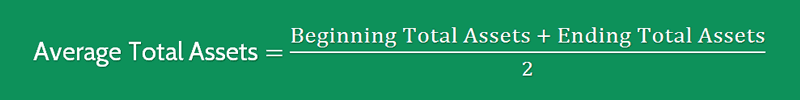

So how can we find the average total assets of a company?

Simple - You just need to sum its beginning and ending total assets, and then divide the result by 2, as follows:

You can easily find the total assets figures reported on a firm’s statement of financial position.

Example

Okay now let’s have a look at a quick example so you can see how easy it is to calculate this ratio.

Company A would like to find out its return on average assets, especially since they had just invested in new machines last year.

They made the investment decision on the fact that they were promised more productivity if they purchased and employed these new machines.

Now that another year has come and gone, they wanted to make sure that their investment has paid off.

To start off, they knew that their return on average assets of the previous year was 3.10%.

This means that for every dollar that had spent on their capital, they were earning $1.31 more. This did not impress them, and they wanted to take action as soon as possible.

They bought their additional machines because of this. The past year had experienced a boost in their net income, which excited the owners very much.

Year 1 | Year 2 | |

|---|---|---|

Net Income | $15,500 | $18,000 |

Average Total Assets | $5,000 | $6,000 |

Return on Average Assets | 3.10% | 3.00% |

By calculating their return on average assets for the past 2 years, the company’s management found out that while their income was substantially boosted, they were getting lower returns that the previous year.

So what if you are an investor and you’d like to use this ratio to evaluate a company’s profitability?

Okay now let’s dive into another example.

Assume that you are considering Company E and you want to discover how efficient its management team is at generating earnings by using their company’s asset.

By using the given formula, you can easily find Company E’s return on assets, as follows:

Year 1 | Year 2 | Year 3 | |

|---|---|---|---|

Net Income | $100,000 | $112,000 | $125,000 |

Average Total Assets | $375,000 | $378,000 | $400,000 |

Return on Average Assets | 26.67% | 29.62% | 31.25% |

The results indicate that there has an increase in the company’s return on average assets for the past couple of years.

This means that the management team has been doing a great job to generate more and more profits for their business in the past 3 years.

Interpretation & Analysis

Getting additional capacity in your production line is important if you want to expand your business.

But you should keep in mind that there is an inflection point that will reflect a point wherein the right amount of assets will reflect as positive income.

Some businesses make the mistake of believing increased production will amplify their sales when the demand is not enough for their product.

A high return on average assets is always desirable. It means that the company has optimized the cost of acquiring the asset and its usage in the firm is not wasted.

So what is a good return on average asset ratio?

In short, the higher the return, the better. However, it should be noted that this ratio is more useful when you look at multiple year figures.

That’s to say, considering the return on assets of a company in a single year doesn’t give you any insight about how efficiently it’s operating.

But comparing the returns that the company has been achieving over the past 3 to 5 years will tell you exactly how the management is handling their business resources more effectively in the production of income.

Additionally, this ratio should also be used to compare companies within a particular industry.

By doing so, you can easily find out who are the top players in that industry, thereby you can choose the best one to include in your investment portfolio.

Cautions & Further Explanation

There is no standard value for the return on average assets, and this ratio result varies from industry to industry.

For example, companies in an asset-intensive industry, including manufacturing, mining, or transportation, often come up with a lower return on average assets as they rely heavily on their critical assets to generate revenue.

Companies in other industries like financial services often come up with a higher ratio value since they don’t have a lot of assets, but they are still generating decent income by leveraging and using their shareholders’ capital.

To use this ratio effectively, you should find out a list of companies in the same industry, and then compare their ratio results.