This is a complete guide on how to calculate Days Cash on Hand Ratio with thorough analysis, interpretation, and example. You will learn how to use its formula to evaluate a business efficiency.

Definition - What is Days Cash on Hand?

The days cash on hand represents the number of days a company can continue to pay its operating expenses with the current cash it has available.

Essentially it is the number of days a company can stay in business if it makes no sales and doesn’t collect any money from customers.

This is important to know especially if the company is at a early stage of its lifetime e.g. a start up when they are not making any cash sales or even due to seasonal cycles where there may be a slump in sales made.

Knowing how much money you have on hand allows you to adjust your expenditure if necessary and, if your days cash available figure starts to get too low, drastically cut back spending.

Typically, a company would look to achieve a days cash on hand figure of around 45 as this would provide enough time to look at adjusting expenditure and planning ways to improve sales and collect money from customers.

More...

Formula

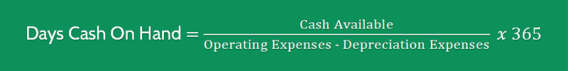

The formula to measure the days cash on hand is as follows:

Days Cash On Hand = Cash Available / ((Operating Expenses - Depreciation Expense) / 365)

So divide the cash that the company has available by any operating expenses less depreciation and divided by 365 days.

You can find these numbers on a company’s financial statements.

Example

Okay now let’s consider an example so you can see how to find the days cash available of a company.

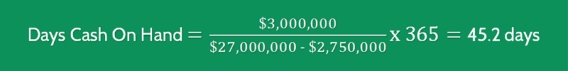

GBY Company has cash and cash equivalents of $3,000,000. Operating expenses of $27,000,000 and depreciation expense of $2,750,000.

To determine the days cash on hand the company has available we need to substitute into the formula:

This suggests that for every GBY Company has 45 days in which it can continue using the cash it has available to fund its operating expenses before it essentially runs out.

Interpretation & Analysis

Typically, a company would ideally have a days cash on hand of 45 or more as this would suggest a good period of time within which to try and improve sales or collect money from customers.

If you are looking at a days cash on hand of between 0-15 days then this would be a major cause of concern, suggesting the company is at a point of financial distress.

Cautions & Further Explanation

Days cash on hand is a flawed measurement for a number of reasons.

Firstly it assumes that there will be a daily average cash outflow which is unlikely to be the case.

Typically, expenditure of a business flows unevenly due to larger outgoings at certain times of the month for example, rent or salaries which can shorten days available.

It also does not take into account that once a declining cash reserve becomes of concern to a business, steps will be taken instantly to cut expenditure and this will lengthen the days of operation a company has.