This is a detailed guide on how to calculate Cash to Current Liabilities Ratio with in-depth analysis, interpretation, and example. You will learn how to use this ratio formula to assess a company’s liquidity.

Definition - What is Cash to Current Liabilities Ratio?

The cash to current liabilities ratio (also known as the cash ratio) tells us about the ability of a company to settle its current liabilities using only its cash and highly liquid investments.

Highly liquid investments are referred to as investments that can be liquidated within 3 months.

To understand how this ratio works, we must first look at current liabilities of a firm.

Current liabilities are the obligations of a firm that are due within one year.

Although it may vary depending on the type of business, current liabilities usually consist of the following:

- Accounts payable – Amounts due to be paid for goods and services received

- Short term debt and/or current portion of long-term debt – Portion of a company’s debt which is due within one year

- Deferred Revenues – Advance payments received by the firm for goods and services it has not yet delivered to customers

- Accrued expenses – Amounts that a firm owes but are not included in accounts payable, such as accrued interest on a bank loan.

More...

Formula

Now that we know the various components of current liabilities of a firm, let’s look at the formula to calculate cash to current liabilities ratio.

We divide the value of the most liquid assets of a firm by its total current liabilities.

Cash to Current Liabilities Ratio = (Cash & Cash Equivalents + Marketable Securities) / Total Current Liabilities

You can easily find the cash & cash equivalents, marketable securities, and the current liabilities figures reported on a company’s balance sheet.

It’s worth noting that we include only those short-term investments under marketable securities which can be converted into cash quickly.

Most short-term investments usually take more than three months to liquidate and hence they should not be included.

Example

Now let’s consider a quick example so you can see exactly how to compute this ratio.

For example, you are looking to invest in a company, and you would like to evaluate its liquidity.

After reading this company’s balance sheet, you find the following information:

- Cash & Cash Equivalents = $500

- Marketable Securities = $350

- Accounts Payable = $550

- Deferred Revenues = $150

- Accrued Expenses = $300

- Interest Expenses incurred but not yet paid.

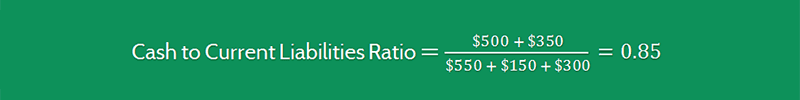

By plugging these figures into the given formula, we’ll arrive at the cash to current liabilities ratio, as follows:

This ratio tells us that the company can easily pay off 81% of its current liabilities using its current cash and cash equivalents balance.

Interpretation & Analysis

Generally speaking, a high cash to current liabilities ratio is good for the firm.

This indicates a better liquidity position and shows us that a greater portion of the firm's current liabilities can be covered using its cash and cash equivalents.

At the same time, too high a ratio might indicate that the firm is not making the best use of its cash.

Excess cash could be reinvested to generate higher returns or returned to shareholders.

You should consider these factors to meaningfully draw insights from this ratio.

Cautions & Further Explanation

Creditors prefer a high cash to current liabilities ratio as it signifies that the firm has a comfortable cash position and can cover its current liabilities.

But we have to be careful. A firm which is very efficient in managing its excess cash might have a lower ratio, but it doesn't necessarily mean that it is less creditworthy as compared to a firm having a higher ratio.

There are other ratios to look at liquidity of a business such as acid-test ratio and current ratio.

These ratios consider different components depending upon how stringent the requirement is. We should be clear about these differences while interpreting these ratios.