This is a detailed guide on how to calculate Long Term Debt to Capitalization Ratio with thorough interpretation, example, and analysis. You will learn how to use its formula to determine a business debt repayment capacity.

Definition - What is Long Term Debt to Capitalization Ratio?

The long term debt to capitalization ratio is another solvency ratio that you can use to evaluate how well a company is using financial leverage to finance its core operations.

This ratio is one of the variations of the regular debt to equity ratio; the only difference is that it takes only the company’s available capital into account instead of the total shareholders’ equity.

You can use this ratio to determine how efficiently a company utilizes its financial leverage, and then compare that with other companies in the same industry to find out who is doing the best job.

In general, companies with a higher long-term debt to capitalization ratio are riskier to invest in because they have a higher debt capital structure.

Conversely, companies that come up with a lower ratio tend to focus more on financing their business by using equity or their shareholders’ capital.

The company’s management always has a choice between using debt and equity to finance their business.

They can use equity, debt, or both, to raise funds, but it should be noted that the end goal of using these approaches is to achieve a balanced capital structure.

With an optimal capital structure, the business can take full advantage of low-cost debt financing, while also preventing the risk of a potential debt default.

More...

Formula

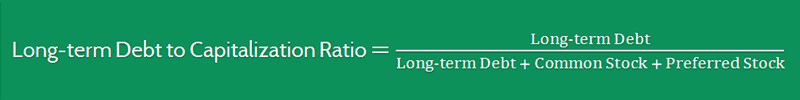

In order to calculate a company's long term debt to capitalization ratio, you can use the following equation:

LT Debt to Capitalization Ratio = Long-term Debt / Total Available Capital

This ratio is calculated by dividing the firm’s total long-term debt by its total available capital.

The total available capital is the sum of the firm’s long-term debt, and its common and preferred stock, as follows:

Available Capital = Long-term Debt + Common Stock + Preferred Stock

Putting everything together, you can come up with a more complicated formula that looks like this:

LT Debt to Capitalization Ratio = Long-term Debt / (Long-term Debt + Common Stock + Preferred Stock)

You can easily find all of these numbers reported on a firm’s statement of financial position.

Example

Okay now let’s take a look at an example so you can understand exactly how to find this ratio.

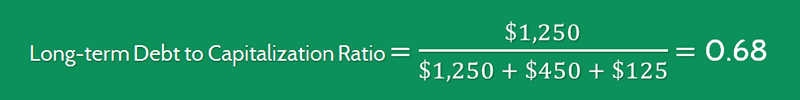

For example, you are looking to evaluate Company A’s capital structure to find out how well the management is utilizing debt and their stockholders’ capital to create value for the business.

You went through its financial statements and found the following information:

- Long-term Debt = $1,250M

- Common Stock = $450M

- Preferred Stock = $125M

By using the given formula, you can easily find this company’s total long term debt total capitalization ratio, as follows:

The ratio value of 0.68 indicates that the company’s total available capital is made up of 68% of its long-term debt.

Interpretation & Analysis

As mentioned earlier, the long-term debt to capitalization ratio is a variant of the traditional debt to equity ratio.

The ratio result of greater than 1.0 shows that the business long-term debt is outweighing its total available capital.

This generally means that the business is taking too much on debt, and there’s a sure sign that the management is abusing debt to finance their business.

A lower ratio value may be what you are looking for in a company, as it indicates that the management is doing a great job to keep their debt under control.

However, you should keep in mind that a decreasing ratio value is a sign that there’s an increase in the company’s capital.

Having a higher equity capital structure means there will be less control and benefits for existing investors (like yourself, especially if you are already the company’s shareholder).

That’s to say, the overall shareholders’ benefits will be diluted as many new external investors come in.

Whether a particular value of this ratio is high or not depends upon the industry in which the company is operating.

For industries which operate on higher leverage such as manufacturing, a higher value might not be a cause for concern.

In order to use this ratio effectively, you can compare the ratio result of a company with that of its industry peers.

Companies with a higher ratio value often have a larger portion of their capital coming from debt, and that eventually makes them much riskier to invest in.

So what is a good long term debt to capitalization ratio?

Generally speaking, a good ratio should be of course less than 1.0, and should be somewhere between 0.4 to 0.6.Or in other words, the company’s long-term debt should account for 40% to 60% of the company’s total capitalization.

Cautions & Further Explanation

As with other financial leverage ratios, you will have to be careful while drawing insights from this ratio.

Although a higher value suggests that the company has higher leverage, it does not necessarily mean that the company is going through financial troubles.

Long-term debts can prove to be beneficial if the firm can convert it into strong growth and comfortably pay the interest.

As lenders do not take a share of the company’s profit, debt financing is often preferred.

But if things don’t go as planned, long term debts may lead the company into a situation where it is not able to repay its debt, and this will potentially lead the business to bankruptcy.