This is an in-depth guide on how to calculate Return on Research Capital Ratio (RORC) with detailed analysis, interpretation, and example. You will learn how to use its formula to assess a firm's profitability.

Definition - What is Return on Research Capital Ratio?

The return on research capital ratio (RORC) assesses the return a company earns as a result of expenditure on research and development activities.

As research and development are a key technique for companies to create new products, this is an important metric to understand a company’s productivity and capabilities.

Pharmaceutical and tech companies who typically spend heavily on R&D would be the most common users of this metric.

As a general rule, the higher the RORC ratio, the better as it would suggest that the company is achieving a good return on its R&D investment and this is what any investor wants to see.

A low return on research capital would, on the other hand, suggest that the company is not achieving a good return per $1 and subsequently, would potentially need to review future expenditure on R&D.

More...

Formula

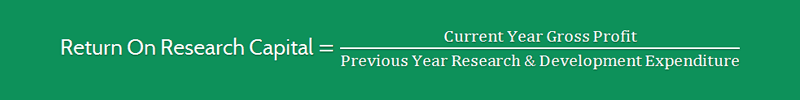

The formula to measure the return on research capital is as follows:

Return On Research Capital = Current Year Gross Profit / Previous Year Research and Development Expenditure

So divide the gross profit that the company has achieved in the current year by the amount spent on research and development from the previous year.

You can find these numbers on a company’s financial statements.

Example

Okay now let’s dive into a quick example so you can understand clearly how to compute the return on research capital ratio.

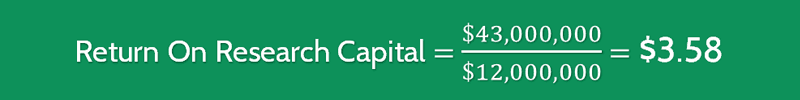

HQS Company has a gross profit for the year 2015 of $43,000,000. In the fiscal year 2014, HQS spent $12,000,000 on research and development.

To determine the return they achieved on their research capital we need to substitute into the formula:

This suggests that for every $1 HQS Company spent on Research and Development, they achieved a return of $3.58 in gross profit.

Interpretation & Analysis

The higher the return on research capital, the higher the benefit we assume that the company is reaping from its R&D activities.

It enables investors to make informed decisions on the current state of R&D expenditure, its impact and contribution to financial performance and subsequently, future considerations for further research and development activities.

The expenditure of a business can sometimes be a trade-off between investing in tangible assets or R&D, and any company will face an opportunity cost to this decision.

Any investment made in research and development might take several years before a tangible return is seen.

This is why the decision is so important and strict analysis needs to be followed through year on year.

Cautions & Further Explanation

One key caution when using the RORC ratio is that it assumes that an investment in year 1 is guaranteed to start reaping profits in year 2 which is, of course, not always the case.

A large research and development project that might take longer to make a return would be assessed negatively and potentially incorrectly, based on this analysis.

The ability to provide context to the result by looking at other companies is also diminished as growth strategies.

The research and development are undertaken to meet these can vary greatly between industries and even between similar business within the same industry.