This is a complete guide on how to calculate Net Working Capital (NWC) ratio with detailed interpretation, analysis, and example. You will learn how to use its formula to evaluate an organization's liquidity.

Definition - What is Net Working Capital (NWC)?

The amount of money, or assets, that a company has on hand at any given time to run its daily operations is called its working capital.

Also known as its net working capital, this money is only considered to be available when it’s in excess of what the company currently owes in terms of debt.

So what is included in working capital?

You can determine the working capital (WC) for any business by using the following formula:

In essence, when you’re studying a company’s financial standing as a potential investment, the amount of its NWC can help to give you a current picture of both its level of operational efficiency, and its short-term financial health.

Without maintaining a positive level of working capital on an ongoing basis, a business could run into problems funding its current debts.

Ideally, you’ll want to compare the net working capital from period to period, in order to develop an idea of how proficiently a business is being run.

More...

What is Net Working Capital Ratio?

A simple calculation known as the net working capital ratio is the best way for you to measure a company’s short-term capital against its short-term debts.

Sometimes called the current ratio, the working capital ratio effectively measures an organization’s liquidity, or its ability to service its current debt load with any assets that can reasonably be expected to convert to cash within a year.

By providing you with a simple and easily evaluated number, the working capital ratio lets you conveniently compare an organization’s working capital between operating periods, and against that of other companies.

As a measure of liquidity, the working capital ratio doesn’t take into account any assets that can’t be relatively quickly converted into cash.

By this definition, current assets would include cash and any cash equivalents, such as marketable securities, as well as accounts receivable and inventory.

NWC Formula

So what is the formula for measuring a firm's working capital? The NWC ratio is calculated by dividing all of a firm’s current assets by all of its current liabilities, as follows:

Net Working Capital Ratio = Current Assets / Current Liabilities

The figure you end up with will tell you what percentage of the firm’s current debt load is covered by its short-term assets.

Both the current assets and the current liabilities for any company can be found on its balance sheet, where they’re generally separated out from any long-term assets and liabilities.

Working Capital Ratio Calculator

Example

Now you know the NWC formula, let's dive into a quick example so you can understand clearly how to find net working capital.

Let’s consider a hypothetical example to give you a better idea of how the working capital ratio can provide meaningful information in your investment analyses.

If, in the third year of its operations, Company D has $125,000 in current assets, and $100,000 in current liabilities, you would calculate its NWC ratio as follows:

At first glance, a result of 1.25 (or 125%) seems encouraging, since Company D obviously has more than enough money in current assets to cover its current liabilities.

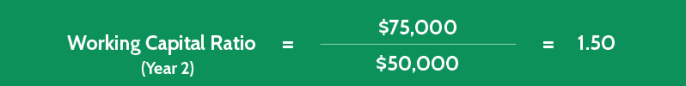

If we look deeper however, and compare this ratio value with earlier accounting periods, we may find results that look like this:

Year 1: Current Assets = $50,000 / Current Liabilities = $25,000

Year 2: Current Assets = $75,000 / Current Liabilities = $50,000

Year 3: Current Assets = $125,000 / Current Liabilities = $100,000

As you can see, while both Company D’s assets and liabilities have been increasing year over year, its NWC ratio, or the amount of money it has available to conduct its regular operations, has been decreasing steadily.

This gives you an entirely different picture of Company D’s efficiency level, and its ongoing financial performance.

Interpretation & Analysis

Now that we're done with the net working capital calculation, let's learn how to use this ratio to evaluate a company's financial performance.

It should be clear that a higher net working capital ratio result is a more desirable outcome. In general, any result of less than 1 will tell you that a company is operating in a negative working capital capacity.

This isn’t good news on the investment front since it means that, even if the company sold all of its current assets, it still wouldn’t have enough money to pay off all of its current debts.

So what is a good working capital ratio?

While a ratio of 1 is considered to be middle ground, and a ratio of 2 is often viewed as good short-term liquidity, the outcome of the working capital ratio should always be weighed against other financial and performance factors.

Remember that the working capital ratio is only one piece of a much bigger puzzle.

Cautions & Further Explanation

Because this ratio defines all of a company’s current assets as liquid, this can be somewhat misleading if those assets are predominantly in the form of hard-to-liquidate inventory, or difficult-to-collect receivables.

This could lead to an unreasonably high working capital ratio value that doesn’t give a true picture of the actual availability of company assets to pay off short-term debts.