This is an in-depth guide on how to calculate Cash to Current Assets Ratio with detailed interpretation, analysis, and example. You will learn how to use its formula to evaluate a firm’s liquidity.

Definition - What is Cash to Current Assets Ratio?

The cash to current assets ratio tells us what portion of total current assets is constituted by the most liquid assets of the company – cash and cash equivalents and marketable securities.

To understand the relevance of this ratio, we must first look at current assets of a firm.

A current asset is any asset that can easily be sold or consumed in less than twelve months. They are used to pay for day-to-day operations of a business.

Although it may vary depending on the type of business, current assets usually consist of the following:

- Cash and cash equivalents – Available for immediate use

- Short-term investments – Includes marketable securities, debt securities, and other liquid investments

- Accounts receivables – Money that a firm is yet to receive on selling goods and services to customers on credit

- Inventories – Includes raw material, work-in-process and finished goods which will eventually be sold to customers

- Prepaid expenses – Includes payments made for goods and services which are yet to be received

More...

Formula

Now that we know the various components of current assets of a firm, let us look at the formula to calculate cash to current assets ratio.

Cash to Current Assets Ratio = (Cash & Cash Equivalents + Marketable Securities) / Total Current Assets

The numerator of the formula represents the value of the most liquid assets of a company.

Cash and cash equivalents include instruments that can be converted into cash in three months or less.

Marketable securities are those short-term investments which can be converted into cash quickly (under three months or less).You should be careful while deciding which short-term investments should be included under marketable securities.

A majority of short-term investments usually take more than three months to liquidate and hence should not be included.

The denominator will include all current assets of the company. This value will always be greater than the numerator as current assets include everything that we have taken in the numerator plus other things (as elaborated in the introduction).

Example

Okay now let’s have a look at an example so you can understand clearly how to compute this ratio.

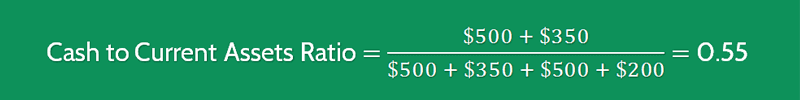

For instance, you would like to invest in a company has $500 in cash, $350 in marketable securities, $500 in inventory, $200 in accounts receivables and nothing in prepaid expenses.

In order to compare the company’s cash on hand with its current assets, you would calculate the cash to current assets ratio as follows:

This ratio tells us that a little over 50% of the firm's total current assets are in the form of cash and other highly liquid instruments.

We will look at how to draw insights from this value in the following section.

Interpretation & Analysis

Generally speaking, a high cash to current assets ratio is a good sign.

It shows that a higher portion of the firm's current assets is in the form of cash and other highly liquid assets.

Depending upon the sector in which the firm operates, it could also indicate a firm’s effectiveness in converting its non-liquid assets such as inventory into cash.

At the same time, too high a ratio might indicate that the firm is not allocating sufficient resources to grow its business.

You should also look at various other factors and ratios to meaningfully draw some insights from this ratio.

The ideal value of this ratio would depend on the industry in which the firm is operating. In all practical cases, this value will be less than 1.In extreme scenarios, it can be equal to 1 when a company only has cash and short-term highly liquid investments as current assets (that would mean no inventory and receivables, which is very unusual for a smooth functioning of any firm).

Cautions & Further Explanation

There are many other ratios that are used to look at liquidity of a business such as cash asset ratio, acid-test ratio, and current ratio.

These ratios include or exclude different components depending upon how stringent the requirement is.

The closest one is cash asset ratio which represents the value of cash and marketable securities divided by the company’s total current liabilities.

We have to be careful while using these ratios, and be clear about the specific aspects that each ratio provides insights about.