If you are struggling to manage your debt and find it challenging to make payments on time, you may be feeling overwhelmed and worried about your financial future.

However, understanding your debt ratio can be a crucial first step in gaining control of your finances and achieving your financial goals.

Your debt ratio is a measure of how much debt you have in relation to your income, and it is an important indicator of your financial health.

It helps lenders determine your creditworthiness, and if you have a high debt ratio, you may find it challenging to get approved for loans or credit cards, or you may end up paying higher interest rates.

Fortunately, there are several strategies you can use to reduce your debt and increase your income, which can ultimately improve your debt ratio.

For example, you could consider consolidating your debts or negotiating with your creditors for lower interest rates.

You could also find ways to increase your income, such as taking on a part-time job or freelancing.

To calculate your debt-to-income ratio, you need to divide your total amount of monthly debt payments by your gross monthly income.

This ratio may give you an idea of how much of your income is going towards debt repayments.

A comfortable debt-to-income ratio is generally considered to be around 36% or lower, although this may vary depending on your individual circumstances.

In this ultimate guide, we'll dive into everything you need to know about your debt ratio, including how to calculate it, what a healthy debt ratio looks like, and strategies for improving it.

We'll also discuss the potential risks of having a high debt ratio and how it can impact your financial future.

Additionally, we'll provide you with a debt-to-income ratio calculator to help you compare your ratio to industry standards and determine your leverage.

Remember, improving your debt ratio is not an overnight process, and it may take time and effort to achieve your financial goals.

However, with the right strategies and mindset, you can take control of your finances and achieve a more comfortable debt ratio.

So, if you're ready to take the first step towards financial freedom, let's dive into the ultimate guide.

Definition - What is Debt Ratio?

The debt ratio, also known as the total debt to total asset ratio, is a solvency ratio that can provide insight into a company's financial health.

Essentially, it allows you to calculate what portion of a company's assets has been financed by debt.

This information can be very helpful in determining the level of financial leverage a company is utilizing.

One way to lower a company's debt ratio is to reduce the total amount of debt.

This can be done through a variety of means, such as paying off outstanding loans or decreasing the use of credit lines.

Another way is to increase the total assets held by the company, which would decrease the ratio by increasing the denominator.

The debt ratio helps determine if a company is financially stable and capable of meeting its long-term financial obligations.

A ratio value closer to 0% is considered ideal and indicates that the company is stable and economically conservative, with a greater portion of its assets having been purchased with investor equity.

On the other hand, a higher ratio value means the company has a riskier financial structure, with the majority of its assets having been paid for with borrowed funds.

It's important to note that the ideal debt ratio can vary by industry and the industry average should be taken into consideration when analyzing a company's ratio value.

Additionally, taking on debt, such as a mortgage, can be a strategic way for a company to fund growth and increase shareholder value, but it must be managed carefully.

Ultimately, a company's debt ratio and financial leverage should be carefully evaluated in order to ensure it is on solid financial footing.

By utilizing the debt ratio, investors and analysts can gain a better understanding of a company's financial health and make informed decisions regarding potential investments or dividend payouts.

Formula

So how do you calculate debt ratio? To compute this ratio for a business you may wish to invest in, you would use the following formula:

Debt to Assets Ratio = Total Liabilities / Total Assets

Because this ratio is a measure of solvency, it considers all of a company’s liabilities, not just its current amount of debt.

Debt Ratio Calculator

Example

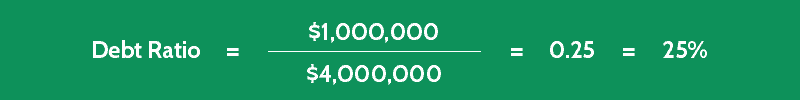

So now you know the formula for debt ratio, let's have a look at the following example to learn how to find this ratio in real life.

Company Q operates in a highly changeable and competitive industry. As a result, its revenues and cash flow have a tendency to fluctuate and are relatively unpredictable.

Because you’re considering buying stock in Company Q, you’d like to get a better picture of its solvency situation.

Company Q’s balance sheet provides the following information:

- Total Assets = $4,000,000

- Total Liabilities = $1,000,000

The debt ratio equation looks like this:

From this result, you can see that Company Q has a relatively low ratio value, where only ¼ of its total assets are funded by debt.

A lower ratio value is far more desirable for a volatile business like Company Q.

Interpretation & Analysis

The debt to total assets ratio is a crucial financial metric that varies widely between companies and industries.

It is important to calculate this ratio as part of your overall assessment of a company's financial health, taking into consideration other factors like credit reports, monthly debt payments, and whether or not they are in good standing with lenders.

A lower debt to asset ratio is generally considered more financially stable, as it is associated with less risk.

However, in some cases, a higher ratio may be acceptable, especially for companies with consistent and reliable income streams or in niche industries with little competition.

By taking on higher levels of debt, a business may be able to increase its return on investment and fund the expansion of its operations.

Additionally, loan interest may be deductible as an expense, providing the company with an important tax advantage.

However, carrying too much debt can be a high-risk strategy, as rising interest rates may have a significant impact on the company's financial stability.

It is important to balance the benefits of debt financing against the potential risks.

When considering a company's debt to asset ratio, it is also essential to look at their overall financial position, including factors like child support and other monthly payments.

Lenders may use this ratio to assess a company's creditworthiness and may be hesitant to lend to companies with a high debt to asset ratio.

Deductions and other tax advantages can be beneficial, but they should be weighed against the potential risks of taking on too much debt.

Ultimately, the debt to asset ratio should be considered alongside other financial factors when assessing a company's financial health.

Cautions & Further Explanation

Understanding the nature of debt is crucial as not all debt is bad.

While it is true that carrying a large amount of debt can be risky, it is equally important to recognize that credit accounts and utility bills are not necessarily negative liabilities.

In fact, many companies require a certain level of debt in order to operate efficiently.

It would be unrealistic to label all debt as bad without taking into account the specific circumstances of each case.

One of the most common ways to evaluate a company's debt situation is by calculating its debt ratio, which is the proportion of a company's total liabilities to its total assets.

However, this ratio has its limitations.

For example, it doesn't distinguish between short-term and long-term liabilities, nor does it take asset depreciation into account.

Asset-heavy businesses, in particular, may display a higher debt ratio due to their larger borrowing base.

Therefore, when evaluating a company's financial health, it is important to use the debt ratio in conjunction with other debt evaluation ratios such as the TIE ratio and the DSCR ratio.

The debt-to-asset ratio, for instance, is another useful metric that calculates the percentage of a company's assets that are financed by debt.

This provides a more accurate picture of a company's debt situation and helps lenders and investors make informed decisions.

In personal finance, it is also important to calculate your debt-to-income ratio, which compares your monthly debt payments to your gross monthly income.

This helps you understand how much of your income is going towards debt payments, including alimony and other financial obligations.

By using a debt-to-income ratio calculator, you can gain a better understanding of your overall debt situation and take steps to improve it.

While carrying too much debt can be risky, it is important to recognize that not all debt is bad.

By using various debt evaluation ratios, lenders and investors can gain a more accurate picture of a company's financial health.

Similarly, calculating your debt-to-income ratio can help you make informed decisions about your personal finances.

Frequently Asked Questions

Q: What is a debt ratio?

A debt ratio is a financial metric that measures the amount of debt a company or an individual has compared to their total assets or income. It helps determine how much of the company's or individual's assets are financed by debt and how much is financed by equity.

Q: Why is the debt ratio important?

The debt ratio is an important metric because it can give insight into the financial health of a company or individual. A high debt ratio may indicate that the company or individual is taking on too much debt and may have difficulty making payments, while a low debt ratio may indicate that the company or individual is financially stable.

Q: How is the debt ratio calculated?

The debt ratio is calculated by dividing the total debt by the total assets or income. For example, if a company has $100,000 in total debt and $200,000 in total assets, the debt ratio would be 0.5, or 50%.

Q: What is a good debt ratio?

A good debt ratio depends on the industry and the individual's financial situation. Generally, a debt ratio of less than 0.5 is considered good for most companies and individuals. However, some industries, such as utilities or real estate, may have higher debt ratios due to the nature of their business. It's important to analyze the debt ratio in conjunction with other financial metrics to get a complete picture of the financial health of a company or individual.

Final Words

Congratulations!

You've successfully made it to the end of our informative blog series on financial ratio analysis.

And by now, we hope you're feeling more confident and equipped to make informed decisions about your finances.

Throughout this series, we have discussed how financial ratios provide valuable insights into a company's performance, and one of the most critical ratios to consider is the debt ratio.

In today's world, where financial stability is crucial, imagine being able to make decisions about your finances with ease and understanding the significance of assessing a company's debt ratio to determine its financial health.

By understanding this crucial ratio, you can avoid potential financial pitfalls and set yourself up for success.

So, what is the debt ratio?

Simply put, it's the ratio of a company's total debt to its total assets.

It is a measure of a company's financial leverage, which indicates how much the company relies on borrowed funds.

A high debt ratio suggests that a company is heavily reliant on borrowing money, which can be a red flag for investors.

On the other hand, a low debt ratio implies that a company is financially stable and able to cover its debts without relying too heavily on borrowing.

It's important to note that the debt ratio is not a one-size-fits-all measure, as it varies by industry and company.

However, by understanding the debt ratio and its implications, you can make more informed decisions about where to invest your money.

For instance, if you're planning to take out a loan, such as an auto loan or a credit card debt, lenders consider your debt-to-income ratio (DTI ratio) before approving your application.

The DTI ratio is a ratio calculated by dividing your monthly payment on debt by your gross monthly income.

It indicates your ability to manage your debt and pay it off.

A higher DTI ratio suggests that you're at a higher risk of defaulting on your loan, whereas a lower DTI ratio indicates that you have a lower risk.

In summary, understanding the significance of the company's debt ratio, as well as your personal DTI ratio, is crucial to maintain financial health.

Learning about financial ratios takes time and practice, but with dedication and perseverance, you'll soon become a pro.

Keep learning, keep practicing, and watch your financial knowledge and success grow.