This is an all-in-one guide on how to calculate Cash Coverage ratio with detailed interpretation, analysis, and example. You will learn how to use its formula to evaluate a company's liquidity.

Definition - What is Cash Coverage Ratio?

As one of the most extreme measures of a company’s liquidity, or its ability to pay out its current debts, the cash coverage ratio, or cash ratio, examines only an organization’s available cash or cash equivalents.

This ratio measures the actual dollar amounts found in a company’s bank accounts, and held in such investments as marketable securities that can be immediately converted into cash.

The ratio then compares these amounts against the company’s current liabilities.

Unlike other coverage ratio calculations, like the quick ratio or the current ratio, this liquidity ratio offers you a much more conservative assessment of how capable a business currently is of servicing its short-term debt load, because it doesn’t take assets like customer receivables or inventory into account.

Since receivables may take weeks or months to collect, and inventory may take years to sell, this ratio may well give you the truest picture of a company’s liquidity position.

More...

Formula

The cash ratio formula divides a company’s total cash-on-hand, and any assets that can be immediately converted into cash, by its current liabilities, as follows:

Cash Coverage Ratio = Cash & Cash Equivalents / Current Liabilities

This ratio is also known as the cash to current liabilities ratio.

You can find the amounts of cash and cash equivalents held by an organization on its balance sheet.

Sometimes these assets are listed as separate items, and sometimes they are grouped together as one amount.

In either case, the cash equivalents will include any short-term investments that can be converted into cash within three months or less.

You’ll also find that a company’s balance sheet generally reports its current or short-term liabilities separately from its long-term liabilities, making them easy to identify.

Cash Coverage Ratio Calculator

Example

Let’s look at an example of how this powerful ratio can provide you with some useful information when evaluating a potential investment.

In this example, we’ll examine the balance sheet of Company C, which may look like this:

- Cash & Cash Equivalents = $100,000

- Marketable Securities = $25,000

- Accounts Receivable = $50,000

- Inventory = $100,000

- Prepaid Taxes = $10,000

- Current Liabilities = $167,000

- Long-Term Liabilities = $215,000

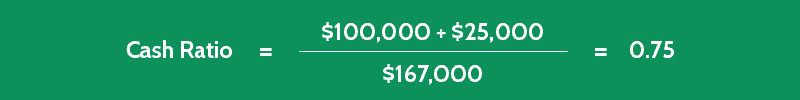

Using the figures provided, you can plug the relevant information into the given formula as follows:

As you can see from the results of this calculation, Company C’s current cash reserve is about 0.75, or 75% of its current liabilities.

In other words, it has enough money to pay off 75% of its current debts.

While a ratio value of 1:1, or 100% coverage, is seen as a reasonable measure of immediate liquidity, 75% is still a decent score when you consider that the company is able to maintain such a high level of cash on hand.

Read also: Cash to Working Capital - Formula, Example & Analysis

Interpretation & Analysis

Okay now we're done with the cash ratio calculation. Let's dive into how the cash coverage ratio is used to evaluate the company's liquidity.

While this ratio shows you how easily a company could pay off its current liabilities with cash and equivalents only, it’s best analyzed in conjunction with other debt coverage ratios, and with other liquidity ratios in particular.

So what is a good cash ratio?

In general, a cash ratio of 1 or higher represents a positive scenario, and tells you that the business you’re assessing can cover its current debts by using cash alone.

A ratio of less than 1 means the business would need to use other short-term assets, such as its receivables, to fully pay out its current liabilities.

Cautions & Further Explanation

If you choose to use this ratio in your investment analyses, you should always make sure that its value is valid.

There are some situations where a company’s use of its cash may be restricted by certain loan agreements, minimum bank balance requirements, or mandates imposed upon the use of funds by the firm’s board of directors.