This is a detailed guide on how to calculate Net Profit Margin ratio (NPM) with thorough interpretation, analysis, and example. You will learn how to use its formula to evaluate a firm's profitability.

Definition - What is Net Profit Margin Ratio?

When it comes to evaluating a company’s overall performance for investment purposes, the net profit margin ratio or net profit percentage is one of the most useful financial ratios.

By measuring net income against revenues, the profit margin ratio demonstrates exactly what percentage of each sales dollar remains as profit after a company’s expenses have been paid.

When you use this calculation to measure the results from a range of accounting periods, you can track the trend of a company’s financial accomplishments over a period of time.

You can also use the net profit ratio to contrast and compare the commercial performance of the business you’re interested in, with its closest competitors.

In the end, what this ratio really shows you is just how effective a business is at converting its sales into profits.

This is crucial information, since your investment dividends will rely heavily on those net earnings.

More...

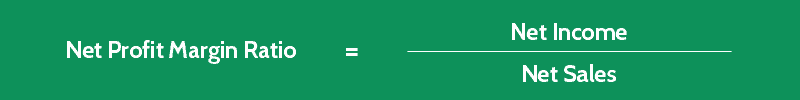

Formula

The formula for determining a company’s net income margin ratio is as follows:

NPM Ratio = Net Income / Net Sales

In this calculation, the net income is equal to the amount of a firm’s total revenues for a given period, less its total expenses.

The net sales figure excludes any sales that were negated through refund or return.

Read also: Operating Profit Margin - Formula, Example & Analysis

Net Profit Margin Calculator

Example

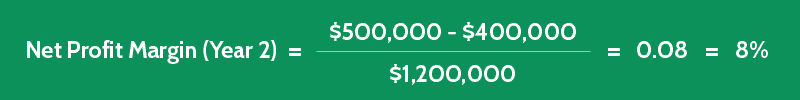

Okay now let's consider this example so you can understand exactly how to find the NPM in real life.

As part of your stock analysis evaluation, you’d like to compare Company DD’s profitability last year with its performance of the previous two years.

When you comb through Company DD’s financial statements, you find the following information:

Total Revenues | Total Expenses | Net Sales | |

|---|---|---|---|

Year 1 | $400,000 | $300,000 | $1,000,000 |

Year 2 | $500,000 | $400,000 | $1,200,000 |

Year 3 | $600,000 | $500,000 | $1,400,000 |

Now you can calculate Company DD’s net profit ratio for the past three years by using the formula given above; the net profit equation looks like this:

In this example, even though Company DD’s net sales have increased attractively year over year, its profitability has actually declined over the same period.

Interpretation & Analysis

The net profit ratio can be viewed as a gauge of both business efficiency and profitability.

When a company’s profit margin ratio is low, it’s usually an indication that a firm’s management has allowed expenses to climb too high.

So what is a good net profit margin?

In general, higher ratios are most often achieved by either cutting costs or increasing revenues.

Since boosting income is by far the more complex of the two goals, most management teams will elect to try and reduce spending in order to reach and maintain the higher net profit ratio that’s so attractive to investors.

Overall, the profit margin ratio is a great way to size up the competence of a company’s past financial performance against its current business operations.

Cautions & Further Explanation

The NPM ratio does tend to lend itself to some creative accounting practices where the formula figures are concerned.

Depending on what amounts a business chooses to include or exclude as part of its net income, it can effectively skew its final profit margin ratio result so that it appears higher, and more impressive, than it actually is.

It’s also important to remember that as useful as the net profit ratio may be, it still only provides you with past and current information about a company’s financial performance and profitability.

Ideally, you’ll also want to get some sense of how the business you’re evaluating plans to preserve or improve that performance over the long haul.

For these reasons, you should always consider the outcome of the net margin ratio alongside the results of other calculations, such as the GPM ratio, that can help to better define a firm’s prospects for continued success in the future.