This is an in-depth guide on how to calculate Gross Profit Margin (GPM) ratio with detailed interpretation, example, and analysis. You will learn how to utilize its formula to assess a firm's profitability.

Definition - What is Gross Profit Margin Ratio?

The gross profit margin ratio, also known as gross profit percentage ratio, is a particularly important calculation to include in your analysis of a potential investment, because it discloses information about a company’s profitability.

More specifically, the gross profit margin ratio measures a firm’s revenues against the variable costs required to produce those revenues, in order to determine the percentage of profits that are being generated.

The ratio value demonstrates a company’s ability to operate cost-effectively, since the money that’s available to fund operations and future growth comes in large part from the profits that are created when goods or services are sold.

Another way to look at the gross profit rate is as a gauge of how efficiently a business is providing a service or product, in relation to the price its customers are willing to pay for it.

The less it costs to get a service or merchandise to market, the more profitable a company will be.

More...

Formula

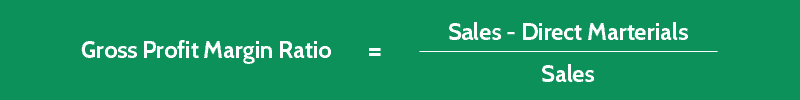

Okay now let's find out how to compute gross margin ratio using the GPM formula below:

Gross Profit Ratio = [Sales - (Overheads + Direct Labor + Direct Materials)] / Sales

Any costs related to turning out a company’s product or service are first combined and subtracted from the resulting revenues.

Because some of these expenses, such as labor and administrative costs, are more fixed than variable, there’s another version of the gross margin ratio that takes this fact into account.

Here's another formula for gross profit rate:

GPM Ratio = (Sales - Direct Materials) / Sales

For a business that simply buys and re-sells merchandise, the direct materials figure would represent only the actual cost of the goods being purchased for resale.

Gross Profit Margin Calculator

Example

Let's have a look at an example so you can understand exactly how to calculate gross profit ratio.

You’d like to evaluate Company DD’s profitability because you think it might make a good addition to your investment portfolio.

When you examine Company DD’s financial statements for the past three years, you discover the following information:

Sales | Cost of Goods Sold | |

|---|---|---|

Year 1 | $1,000,000 | $200,000 |

Year 2 | $1,200,000 | $400,000 |

Year 3 | $1,100,000 | $450,000 |

So how to find gross profit margin of this company?

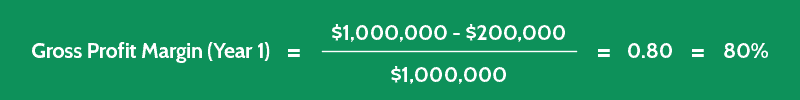

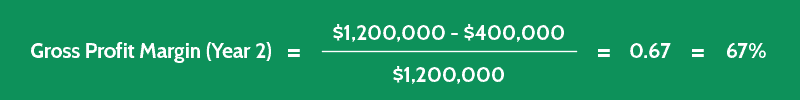

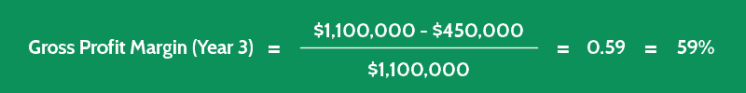

By plugging these figures into the gross margin formula, you’ll end up with the following results:

In this example, you can see that while Company DD’s sales have remained fairly constant from year to year, its gross earnings has dropped off dramatically.

This is most likely due to increased production or overhead costs.

Interpretation & Analysis

The higher a company’s gross profit ratio is, the more money it’s generating in profits through the sale of its goods or services.

There’s an ongoing balancing act that a business must master in order to consistently turn a high enough profit to continue its regular operations, and effectively support any expansion at the same time.

This balance involves either keeping costs low in the pursuit of revenues, or commanding higher customer prices.

While both these scenarios can lead to a greater percentage of gross profit, both present their own set of challenges in terms of qualifying for purchase discounts, and remaining competitive in the marketplace.

Cautions & Further Explanation

Because the value of a company’s gross profit can vary significantly depending on which sales costs you include in your calculations, you should make a point of using the same formula when comparing period to period, or company to company.

You need to decide whether it’s more relevant to include all the costs related to a firm’s revenues within a particular industry, or just the cost of the direct materials involved.

This is an important distinction to make because the fewer expenses you include in the gross profit calculation, the higher the gross profit ratio result will be.