This is an all-in-one guide on how to calculate Operating Profit Margin (OPM) ratio with detailed interpretation, example, and analysis. You will learn how to use its formula to examine a business operating performance.

Definition - What is Operating Profit Margin Ratio?

Like the net profit ratio, the operating profit margin ratio, also known as net operating profit percentage, allows you to examine a company’s profitability and efficiency in more detail, where generating profits from revenues is concerned.

But while both calculations measure profits against costs, the operating margin ratio scrutinizes a narrower scope of operational and overhead expenses, excluding such costs as interest payments and taxes.

This ratio will give you a middle-of-the-road view of how effective a company is at managing and controlling its expenditures as a whole.

While less refined than including a company’s total expenses, the operating margin ratio does better reflect a firm’s ability to control overall operational costs than calculations that consider only those expenses directly related to the creation or sale of goods or services.

As a percentage measurement, the operating margin ratio shows you how much of each dollar in sales translates into profits from a firm’s regular business operations, as opposed to from other income sources, such as the sale of an asset.

More...

Formula

So what is the operating margin formula? You can easily find a company’s OPM by using the following formula:

A firm’s operating income is usually stated on its income statement.

This figure represents the amount of a company’s net sales, less its operational, overhead and administrative expenses, as well as its cost of goods sold (COGS).

Operating Profit Margin Calculator

Example

Okay now let's consider this profit margin example so you can understand how to calculate operating margin in real life.

In your investigation of Company EE as a potential investment, you’d like to figure out its operating profit ratio for the past year.

After examining Company EE’s income statement and other financial reports, you compile the following information:

- Net Sales = $1,000,000

- Cost of Goods Sold (COGS) = $300,000

- Wages = $250,000

- Building Lease = $75,000

- Annual Insurance = $25,000

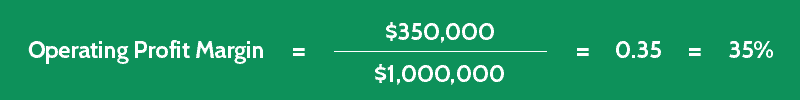

With these figures and the operating profit margin formula given above, you can now calculate Company EE’s operating profit ratio, as follows:

(With the Net Operating Income = Net Sales - COGS - Wages - Building Lease - Insurance)

Interpretation & Analysis

The operating margin ratio shows you how capable a company is of supporting itself through its regular business operations.

The higher the ratio value, the more revenues are available to fund a company’s non-operational costs, such as the interest payments on any debts it may be carrying.

If a firm’s operating margin ratio is 35%, as in the example of Company EE, it means that 35 cents out of every dollar Company EE earns through the sale of its goods or services is available to pay for other expenses.

In general, a business can be considered more stable, and its continued operation more sustainable over the long-term, if it’s making enough money to cover both its variable and its fixed costs.

A higher operating profit ratio also means there’s more cash available to be paid out as dividends to investors.

Cautions & Further Explanation

As an investor, you should be aware that there are many ways for a business to artificially enhance the outcome of its operating margin ratio.

Accounting practices that boost apparent revenue figures, or that reduce the appearance of overhead costs, are widespread among companies looking to portray a better overall picture of financial health.

The numbers reported on a firm’s financial statements rely heavily on timing, and if this timing can be tweaked just a little, by pushing or pulling sales or expenses into former or future accounting periods, it can produce a more favorable margin ratio to present to both creditors and investors.

A large part of your role in investigating any business as a potential investment is to remain vigilant where its financial reports are concerned.

Always thoroughly research any information that’s available to you, and back up your findings with as many financial calculations as possible.