If you're seeking to improve your company's financial health and put an end to the constant state of financial worry, then it's important to understand the current cash debt coverage ratio.

This financial metric is an essential tool for businesses of all sizes as it measures a company's ability to pay off its short-term debts using its available cash.

By calculating and interpreting this ratio, you can evaluate your cash flow and overall financial health.

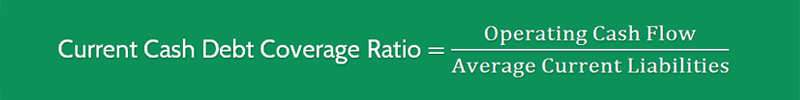

To calculate the current cash debt coverage ratio, you need to divide the company's cash flow from operations by its total current liabilities.

The resulting figure will tell you how many times the company can cover its current debt obligations with its available cash flow.

An example is provided to show how to use the formula, and a video demonstrates how to calculate the ratio using an online calculator.

A high ratio indicates that a company is in a strong position to pay off its short-term debts, while a low ratio suggests that the company may struggle to do so.

Therefore, keeping a close eye on this ratio is crucial for avoiding financial distress and making informed decisions about your business's financial health.

It's also worth noting that the current cash debt coverage ratio is closely related to the company's cash flow from operations.

By improving your cash from operations, you can increase your company's available cash and, in turn, improve your current cash debt coverage ratio.

Understanding this solvency ratio is an essential aspect of financial ratio analysis.

By using this ratio to evaluate your company's financial health and cash flow, you can make informed decisions that can lead to long-term financial stability and success.

Definition - What is Current Cash Debt Coverage Ratio?

If you want to invest in a stock, then it's critical to assess its state of solvency and determine the company's ability to pay off its debt.

One of the essential measures in evaluating this is the current cash debt coverage ratio.

By calculating the current cash debt coverage ratio or the current cash flow to debt ratio, you can gain valuable insights into the company's financial health and its ability to meet its financial obligations.

This measure provides a clear picture of a company's financial strength by analyzing its current operating cash flow (OCF) in relation to its current debt obligations.

In simpler terms, it indicates the firm's capability of paying its short-term debt in the upcoming years from its cash from operations.

By examining this ratio, investors and creditors can gauge whether a company has enough cash flow to cover its debt and assess its ability to honor its financial commitments.

As an investor, analyzing these numbers becomes even more crucial as they directly impact your investment decisions.

It is through these calculations that you can gauge a company's ability to pay its debts, providing you with a better understanding of its financial position.

The current cash flow to debt ratio serves as a valuable tool for investors, offering insights into the financial health of a company and its ability to manage its debt.

Another important measure to consider is the current ratio, which calculates the cash and other current assets a company has in relation to its current liabilities.

This ratio further assesses a company's ability to pay off its debts as they come due.

By comparing the current assets to the current liabilities, investors and creditors can evaluate whether a company has sufficient resources to meet its short-term obligations.

To calculate this ratio, you need to determine the cash provided by operating activities, which represents the cash generated from a company's core operations.

This information, combined with the company's total debt, helps you assess its ability to pay off its financial obligations.

In summary, evaluating a company's ability to pay its debts is crucial for both investors and creditors.

The cash debt coverage ratio and current ratio are essential tools that measure a company's ability to pay its short-term obligations and provide valuable insights into its financial health.

By analyzing these ratios and calculating the cash provided by operating activities, investors can make informed decisions and assess the financial strength of a company before making an investment.

Formula

This ratio formula is similar to that of the cash flow to debt ratio; the only difference is that it takes the company’s current liabilities into account, instead of the total debt.

You can arrive at this ratio by dividing the net cash derived from operating activities by the average current liabilities.

Current Cash Debt Coverage Ratio = Operating Cash Flow / Average Current Liabilities

You can easily find the cash flow from operating activities on the company’s cash flow statement, and the current liabilities on its balance sheet.

Example

Now that you know the exact formula for finding this ratio, let’s dive into a quick example.

For example, you are looking to evaluate a debt-repayment capacity of Company U.

Looking into its financial statements, you find the following information:

- Cash Flow from Operating Activities = $1,000,000

- Current Liabilities at Beginning of Year = $200,000

- Current Liabilities at End of Year = $300,000

So how do you calculate this company’s current cash debt coverage ratio?

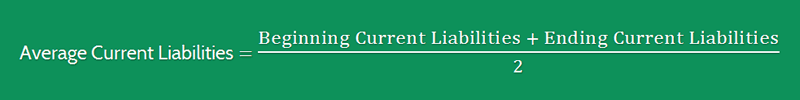

First, we’ll calculate the average current liabilities, like so:

Next, we simply plug the average current liabilities and the operating cash flow into the given formula, as follows:

The ratio of 4.00 tells us that Company U could easily cover its short-term debt by using one-fourth of its operating cash flow.

In other words, the company is generating enough cashflow to pay off its short-term debt.

Interpretation & Analysis

The current OCF to debt ratio is a liquidity ratio that measures a company's capability of maintaining its short-term debt levels on track.

It focuses on the relationship between the company's operating cash flow (OCF) and its debt obligations.

This ratio is an important financial indicator as it helps determine whether a company can pay its current liabilities with cash generated from its operations.

Ideally, a high OCF to debt ratio is preferred over a low one.

A high ratio highlights that there is sufficient income available to cover debt servicing without resorting to extreme measures such as selling off assets, using savings, or borrowing additional money.

It signifies a company's ability to meet its financial obligations without jeopardizing its stability.

So, what exactly constitutes a good current cash debt coverage ratio?

Well, a ratio of 2.0 or higher is generally regarded as an excellent indicator of a company's financial stability.

This means that the company has twice the amount of cash needed to repay its current liabilities.

With such a ratio, the company possesses a strong liquidity position, ensuring it can readily meet its obligations and sustain its operations effectively.

On the other hand, a ratio of less than 1.0 could be a cause for concern.

It indicates that the company may not have sufficient cash flow to cover its current liabilities.

Even a slight reduction in earnings could potentially overwhelm the company and lead to financial difficulties.

Such a situation could result in complications, including an inability to meet payment deadlines, damaging the company's creditworthiness and reputation.

To calculate the ratio, one compares the company's cash available to pay current liabilities with cash generated from operations.

By evaluating this ratio, investors, lenders, and other stakeholders can assess a company's ability to manage its debts and maintain its financial health.

A strong debt coverage ratio or cash liquidity ratio provides reassurance that the company has the necessary resources to fulfill its financial obligations promptly and avoid potential disruptions in its operations.

The current OCF to debt ratio is a crucial financial metric that gauges a company's liquidity and its capacity to pay off its short-term debts.

A higher ratio signifies a healthier financial position, indicating that the company has sufficient cash flow to meet its obligations.

In contrast, a lower ratio raises concerns about the company's ability to cover its liabilities adequately.

Therefore, it is vital for businesses to monitor and manage their cash debt coverage to ensure long-term stability and mitigate potential liquidity risks.

Cautions & Further Explanation

The cash flow to debt ratio is an essential metric that can provide useful insights into a company's financial health.

However, it is crucial to keep in mind that this ratio only tells one side of the story.

In other words, it provides a snapshot of a company's performance in a given timeframe, usually in the past.

Thus, it is not entirely dependable for indicating a company's stability and potential future.

For instance, suppose a company has long-term liabilities due within the next five years.

In that case, the cash flow to debt ratio might not be a reliable indicator of its ability to pay back its debts.

Furthermore, the ratio only considers cash flows recorded in the income statement, which means that it may not reflect a company's ability to pay back its debts accurately.

To get a broader view of a company's debt settlement capacity, you should use this ratio with other debt ratios like the asset coverage ratio, interest coverage ratio, or fixed charge coverage ratio.

For instance, suppose a company's cash flow to debt ratio is 1 means it is able to pay back its debts using its cash flow.

In that case, you should also look at its asset coverage ratio, which indicates whether the company has enough assets to cover its debts if it were to become unable to make payments.

In conclusion, while the cash flow to debt ratio is a valuable metric, it should not be the only factor considered when assessing a company's financial health.

By using it in conjunction with other ratios, you can get a more comprehensive view of a company's ability to pay back its debts over the long term.

Frequently Asked Questions

Q: What is the current cash debt coverage ratio, and why is it important?

The current cash debt coverage ratio is a financial metric used to determine a company's ability to repay its debts using its available cash flow. It's an important indicator of a company's financial health and can provide valuable insight into its ability to meet its financial obligations.

Q: How is the current cash debt coverage ratio calculated?

To calculate this ratio, you need to divide the company's cash flow from operations by its total debt. The resulting ratio indicates how many times over the company can cover its debts with its available cash flow.

Q: What is a good ratio?

A good cash debt coverage ratio depends on the industry and the company's specific circumstances. Generally, a ratio of 1 or higher is considered good, as it indicates that the company can cover its debts with its cash flow. However, it's important to compare a company's ratio to that of its peers to determine its relative financial health.

Q: How can a company improve its cash debt coverage?

A company can improve its cash debt coverage by increasing its cash flow from operations or by reducing its total debt. This can be achieved through a variety of means, such as increasing sales, reducing expenses, or refinancing debt at a lower interest rate.

Final Words

Imagine a life where you're in control of your finances, where the weight of debt is a distant memory and the road to prosperity stretches out before you.

Picture yourself confidently making financial decisions, knowing that you have the power to cover your debts and build a solid foundation for your dreams.

That's the kind of future you deserve, and it's within your grasp.

When it comes to achieving financial stability, one key metric you need to keep in mind is the cash debt coverage ratio.

This ratio helps you gauge your ability to cover your debts using your available cash flow.

By calculating it, you gain insights into your financial health and can make informed decisions to strengthen your position.

But here's the exciting part: it's not just about numbers and ratios.

It's about the possibilities that lie ahead.

When you understand and optimize your company's cash debt coverage, you unlock a world of opportunities.

You gain the freedom to pursue your passions, invest in your future, and achieve your goals.

Remember, success doesn't happen overnight.

It takes learning, practice, and a commitment to your financial well-being.

So keep exploring, keep educating yourself, and keep implementing the strategies that align with your goals.

With each step forward, you're one step closer to financial freedom.

So, dear reader, embrace the power of financial stability.

Imagine the life you desire, harness the potential of your cash debt coverage ratio, and set your sights on a future of abundance.

You've got this!

Keep learning, keep practicing, and watch as your dreams become a reality.

Your journey to financial success starts now.