This is an advanced guide on how to calculate Fixed Asset Turnover Ratio with detailed analysis, example, and interpretation. You will learn how to use its formula to assess a company's operating efficiency.

Definition - What is Fixed Asset Turnover Ratio?

The fixed asset turnover ratio measures how efficiently a company can generate sales with its fixed asset investments (typically property, plant, and equipment).

Generally, a greater fixed-asset turnover ratio is more desireable as it suggests the company is much more efficient in turning its investment in fixed assets into revenue.

Investors and creditors typically favor this ratio as it shows how well a company is utilizing its assets to generate sales, and can therefore assist with measuring the return on investment that can be achieved.

This ratio is also important in industries such as manufacturing where a company can typically spend a lot of money on the purchase of equipment.

More...

Formula

The formula to measure the fixed asset turnover ratio is as follows:

Fixed Asset Turnover Ratio = Net Sales / (Fixed Assets - Accumulated Depreciation)

So take all Fixed Assets less any accumulated depreciation they may have generated and then divide the result into net sales.

You can find these figures reported on a firm’s balance sheet and income statement.

Example

Okay now let’s take a look at a quick example so you can understand clearly how to compute this ratio in real life.

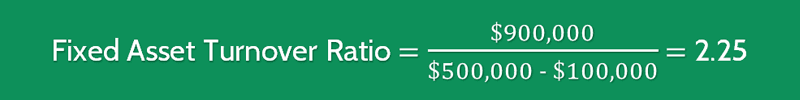

BNR Company builds small airplanes and has net sales of $900,000 for the year using equipment that cost $500,000. The accumulated depreciation on the equipment is $100,000.

To determine the fixed-asset turnover, we need to substitute into the formula:

BNR Company has a fixed asset turnover of 2.25 meaning that it generates just over two times more sales than the net book value of the assets it has purchased.

Interpretation & Analysis

To provide further context to the fixed assets turnover ratio, we need to determine if it is increasing or declining in comparison to previous years.

A ratio that is declining can indicate that the company is potentially over-investing in property, plant or equipment or simply producing a product that isn’t selling.

Any manufacturing issues that affect sales might also produce a misleading result.

A bottleneck that is stifling sales will lead to a much lower ratio but will right itself and become more accurate once the bottleneck is removed.

An increase in the ratio over previous periods can, on the other hand, suggest the company is successfully turning its investment in its fixed assets into revenue.

It could also mean the company has sold some of its fixed assets yet maintained its sales due to outsourcing for example.

Cautions & Further Explanation

The fixed asset turnover ratio holds significance especially in certain industries such as those where companies spend a high proportion investing in fixed assets.

However, some caution must be taken to ensure the reliability of the results, especially when making comparisons.

One issue is how the depreciation is calculated. Some methods of depreciation can produce a book value that is false, and thus the performance will look much better than reality.

It is also wise to compare the fixed assets turnover to companies in the same industry on the basis that they are also the same age.

A new company with brand new equipment and low sales will have a vastly different turnover to a competitor who has old equipment with high sales and so shouldn’t be compared even though they are in the same industry.