This is a complete guide on how to calculate Return on Invested Capital Ratio (ROIC) with detailed analysis, interpretation, and example. You will learn how to use its formula to assess a company's profitability.

Definition - What is Return on Invested Capital?

The return on invested capital ratio (ROIC) is a simple calculation that helps you figure out how well a company is using the money stockholders have invested into it.

The higher the ROIC ratio, the smarter the company is about spending its money to increase profits.

This ratio is particularly useful when it’s used to compare with a company’s weighted average cost of capital (WACC).

More...

Formula

The formula to calculate a company’s return on invested capital ratio looks like this:

Return on Invested Capital = (Net Income - Dividends) / Invested Capital

So how can you calculate the invested capital?

You can use the following formula to calculate a company’s total invested capital:

Investing Capital = Long-term Debt + Total Shareholders’ Equity

You can easily find all of these figures reported on a company’s income statement and balance sheet.

Example

To better understand how that formula works, let’s take a look at an example.

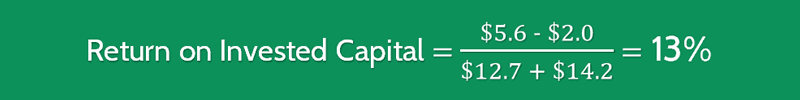

For example, you are trying to calculate the return on capital invested for Company XYZ; you look into its financial statements and find the following:

- Net income: $5.6 Million

- Dividends paid: $2 Million

- Total debt: $12.7 Million

- Total shareholder equity: $14.2 Million

So the first step is to subtract the dividends paid out from the company’s net income in order to get our numerator.

Next, we add the total debt with the shareholder equity, and finally we divide the top number by the bottom to get the ROIC ratio, as follows:

The ratio of 13% suggests that, for each dollar invested, Company XYZ is generating about 13 cents in profit.

Interpretation & Analysis

So is a total return on invested capital ratio of 13% good or bad?

The answer, as with most things, is that it depends. In general, anything above 8% will mean a trend toward growth.

However, the closer to that low end of the spectrum, the slower the growth will be and the higher the risk that the growth will stagnate or even backslide.

But to really make sense of that percentage, you have to compare it to the company’s cost of capital.

This is a separate formula to tell you how much a company’s sources of capital cost.

That is, how much of their money they have to give back in the form of interest in debt, dividends, or return on a stockholder’s investment.

In a healthy company, the cost of capital is somewhere between 8% and 12%.In order for the ROIC to be considered strong, then, it has to be higher than the cost.

So, in this case, an ROIC of 13% could indicate decent (but not amazing) growth assuming the cost of capital is somewhere in that healthy range.

So what is a good ROIC ratio?

Generally speaking, no matter how high the ROIC is, then, it has to be higher than the cost of capital in order to be taken as a good sign.

Cautions & Further Explanation

As with any ratio or measurement, you don’t want to base your whole decision on the return on invested capital ratio of a company even if it is strong.

First of all, it’s an accounting measurement. So depending on how a company handles its accounting, it isn’t always easy to get the most accurate numbers to input into the formula.

This means you really just getting a ballpark estimate more than a hard number.

This doesn’t tell you which investments are actually generating the return. Just a measure of all investments taken together.

That means the number could be hiding the fact that the company isn’t dividing its investments up as well as it could be.

For example, a high ROIC could be based entirely on a single investment that the company won’t be making again in the following year.

So you can use a company’s ROIC ratio to give you a general sense of how much profit a company will generate out of each dollar you invest into it.

The ratio is not 100% precise and doesn’t tell you very much about exactly how your dollars will be spent.

However, as a general rule, a higher ROIC is a good sign and a good reason to look into a company for more promising signs that it would be a good investment.