This is an advanced guide on how to calculate Accounts Payable Turnover (A/P) ratio with detailed interpretation, analysis, and example. You will learn how to use its formula to evaluate a company's efficiency.

Definition - What is Accounts Payable Turnover Ratio?

When you’re considering buying stock in a particular company, it can be helpful to know how efficient that company is at meeting its supplier debt obligations.

The accounts payable turnover ratio, which is also known as the creditors turnover ratio, provides you with just such an efficiency measurement.

This financial ratio allows you to compare a firm’s credit purchases against its average accounts payable (AP) amount, in order to determine how frequently it pays its suppliers.

So what does accounts payable turnover mean?

If you discover that a business has a payable turnover ratio of 6, for example, it means the company you’re evaluating pays off its average supplier balance owing 6 times a year, or about every 60 days.

This information can be particularly useful when you’re analyzing ratio results over a period of time, because it lets you gauge any change in an organization’s payment habits.

A slowing trend in supplier payments often serves as a warning signal that a firm’s financial health may be declining.

More...

Formula

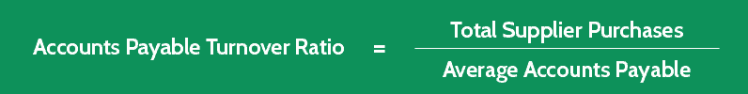

The payable turnover ratio is most commonly calculated on an annual basis, using the following formula:

A/P Turnover Ratio = Total Supplier Purchases / Average Accounts Payable

Only supplier purchases on account are included in this ratio, since cash purchases don’t contribute to a company’s payables.

Because the accounts payable figure will fluctuate throughout the year as supplier payments are made, the average annual amount can be calculated like this:

Average Accounts Payable = (AP at Beginning of Year + AP at Year-End) / 2

Read also: Accounts Receivable Turnover Ratio - Formula, Example & Analysis

Accounts Payable Turnover Calculator

Example

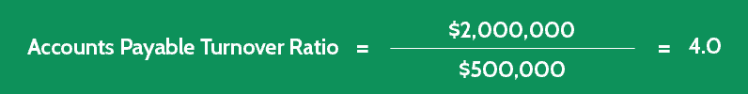

Now let's have a look at an AP turnover example so you can see exactly how to find this ratio in real life.

Company H is showing promise as a potential investment for your portfolio, and you’d like to evaluate how quickly it turned over its supplier payments last year.

After studying Company H’s financial statements, you end up with the following figures:

- Supplier Credit Purchases = $2,000,000

- Opening Accounts Payable (AP) = $750,000

- Year-End Accounts Payable (AP) = $250,000

Using these figures and the above formula, you can now calculate Company H’s AP turnover ratio, as follows:

From this example, you can see that Company H turns over its average accounts payable balance 4 times each year, or about once every 90 days.

Interpretation & Analysis

Now let's find out how the payables turnover ratio is used to evaluate a company's efficiency.

So what does the payables turnover ratio measure?

The higher the payables turnover ratio, the more adept a business is at paying its suppliers frequently and consistently.

Not only is a higher ratio result a sign of financial strength, it also shows creditors that the business has an established track record of paying its bills in a timely manner.

This inspires a greater level of confidence on the part of both lender and investor.

You should be aware, however, that an acceptable result for the payable turnover ratio varies from industry to industry.

Because the turnover of payables is unique to each business type, you’ll gain the most valuable information for your investment analysis by comparing companies within the same industry.

At the same time, when you track the payable turnover ratios of one or more firms over a specific period, you’ll get a much better sense of where each is headed in terms of its financial performance.

Cautions & Further Explanation

It may be challenging for you to accurately measure the amount representing a company’s annual supplier purchases, since this figure isn’t always readily available in a firm’s financial statements.

This can be especially problematic if the organization you’re evaluating experiences irregular or unpredictable business operations throughout the year.

One of the most common ways to accommodate for this lack of information is to add the cost of goods sold in a given year to a company’s year-end inventory figure.

When this sum is subtracted from the firm’s opening inventory amount for the same year, it will give you a workable supplier purchases figure to plug into the AP payable turnover ratio.