This is an in-depth guide on how to calculate Average Payment Period with detailed interpretation, analysis, and example. You will learn how to use its formula to assess a company's operating efficiency.

Definition - What is Average Payment Period?

The average time (in months and days) it takes a business to make payments to its creditors is known as the average payment period, or days payable outstanding (DPO).

It is crucial for you to be aware of the average payable period in order for you to be prepared to take necessary action when the time comes to pay creditors.

Typically, it is much more advantageous to try and keep the average payable days as low as possible as this can keep suppliers happy and might also allow you to take advantage of any trade discounts.

However, you have to try and strike a balance as taking as long as possible to pay creditors can result in the company having more money which is good for working capital and available cash flows.

More...

Formula

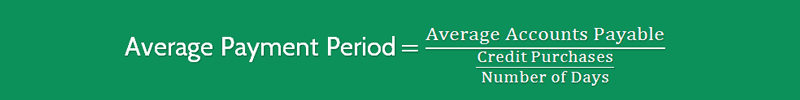

The formula to measure the average payment period is as follows:

Average Payment Period = Accounts Payable / (Credit Purchases / Number Of Days)

The average payment period is arrived at by dividing Credit Purchases by 365 days, and then dividing the result into Average Accounts Payable.

So how can you calculate average accounts payable?

That’s simple: you just need to average the beginning and closing accounts payable, like so:

Average Accounts Payable = (Beginning AP + Closing AP) / 2

You can get all of these numbers on a firm’s balance sheet and income statement.

Example

Now that you know the exact formula for calculating the average payment period, let’s consider a quick example.

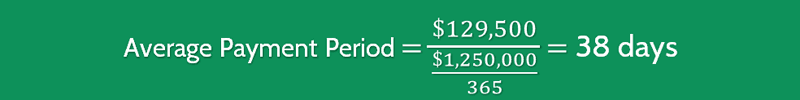

Company XYZ has beginning accounts payable of $123,000 and ending accounts payable of $136,000.

Its credit purchases total $1,250,000. To determine the average payables in days, we need to substitute into the formula:

So Company XYZ’s average payable period is 38 days.

Interpretation & Analysis

To understand the implications of the payment period and its consequences, we need to look at the payment terms which could deem the result of 38 days as positive or negative.

So what is a good average payment period?

If the payment terms are set at 30 days, then 38 days is probably too long to settle payment and may potentially be causing some consternation to your suppliers.

However, if the payment terms are set at 50 days, then 38 days to pay on average may suggest that the company is not taking advantage of its credit terms.

You do need to take some care when analyzing the firm’s average payable period as the balance needs to be right.

This can be somewhat tough to achieve when the company does not only need to keep on good terms with suppliers but also needs to consider its internal working capital and available cash flows.

Cautions & Further Explanation

One flaw of this ratio is that as a standalone metric, it lacks practical use.

The average payment period needs to be compared to other companies in the same industry as typically, there will be a standard average.

If for example, the standard payment period amongst similar businesses in your industry is 30 days and you are paying your suppliers in 15 days, it might be wise to extend the time between payment in the future providing this doesn't go against any vendor agreements and cause damage to the relationship.

However, on the flip side, if the standard is 30 days within the industry and you are paying your suppliers in 45 days, it might be wise to consider how you can tighten the gap and this could potentially allow for trade discounts and other favorable terms.