The world of finance can be intimidating, especially when it comes to understanding terms like the price-to-earnings ratio (P/E ratio).

However, this metric is crucial for investors who want to evaluate the value of a company's stock.

In a nutshell, the P/E ratio is calculated by dividing the current stock price by the earnings per share (EPS).

But what does this ratio mean?

Essentially, it tells you how much investors are willing to pay for each dollar of earnings.

A high P/E ratio suggests that investors have high expectations for future earnings growth, while a low P/E ratio may indicate that the stock is undervalued or that investors are pessimistic about future earnings growth.

The P/E ratio is just one of many metrics that investors use to evaluate a stock.

Other metrics, such as the price/earnings-to-growth ratio (PEG ratio), earnings yield, and earnings growth, can provide additional insights into a company's financial health and growth potential.

It's worth noting that the P/E ratio is not a perfect indicator of a stock's value.

It's important to consider other factors, such as the company's financial statements, market trends, and competition.

In addition, the P/E ratio may not be as useful for evaluating growth stocks, which may have high P/E ratios due to their potential for future earnings growth.

Despite these limitations, the P/E ratio can be a valuable tool for investors who want to make informed decisions about their investments.

By understanding how this ratio is calculated and what it signifies, you can identify potential investment opportunities and make informed decisions about buying or selling stocks.

So, whether you're a seasoned investor or a beginner, the P/E ratio is a metric that you should understand.

And with a bit of creativity, humor, and real-life examples, learning about this ratio can be an enjoyable and exciting process.

So dive into our article and let's get started on cracking the code of the price-to-earnings ratio!

Who knows, by the end of it, you might just become the next investment guru.

Definition - What is PE Ratio and How It is Used?

The price earnings ratio, commonly known as the P/E ratio, is one of the fundamental tools used by investors to determine the market's willingness to pay for shares of a particular company's stock.

This ratio measures the relationship between the price of the stock and its annual earnings.

Specifically, it describes a stock's market value concerning the amount of earnings it's generating.

The ratio is calculated by dividing the price of the stock by the earnings per share (EPS).

The P/E ratio can tell you what a stock is worth currently and what it could be worth based on future earnings.

It is a valuable metric for evaluating a firm's current earnings per share in comparison to its current market price per share.

If a business is expected to experience future earnings growth, it is considered a positive attribute as more cash will be available to fund higher investor dividends.

Additionally, the price-to-earnings ratio can also indicate whether a stock is currently undervalued in the marketplace.

When the ratio shows that a stock is selling at a price well below its intrinsic worth, it may mean that share prices are set to increase as investor demand eventually brings the stock back in line with its true value.

Therefore, investors can use this ratio to predict potential future changes in the stock price based on the company's earnings growth potential.

Overall, the P/E ratio is a crucial tool for investors to determine a stock's value and make informed investment decisions.

Formula

So how is PE ratio calculated? To find the price-earnings ratio for a given company, you would use the following formula:

Price to Earnings Ratio = Market Value per Share / Earnings per Share

Using this calculation allows you to determine the trading value of a company’s stock for any given reporting period.

The trailing P/E ratio is what’s revealed when you use the most recent earnings per share figure from a firm’s last reporting period, while a leading P/E ratio is created when the earnings per share figure used is based on future predictions.

PE Ratio Calculator

Example

So now you know the PE ratio formula, now let's consider this example so you can understand exactly how to calculate price earnings ratio in real life.

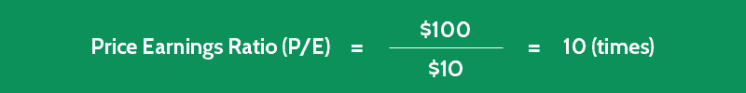

Assume that you are investing in Company JJ which has most recently reported an Earnings per Share (EPS) of $10 and its stock is currently selling at $100 a share.

By comparing the earnings per share with the current price of Company JJ’s stock, you can easily calculate the firm’s PE ratio, like so:

The result shows that the earnings per share equals 1/10 of the current share price.

Interpretation & Analysis

After completing the calculation of the P/E ratio, it is important to understand how to use this metric to assess whether a company's stock is cheap or expensive.

One way to do this is by analyzing the ratio of the S&P 500 index, which is a benchmark for the overall market's performance.

So, what is a good PE ratio?

Generally, the higher a company's stock price relative to its past or future earnings, the higher its P/E ratio will be.

This means that investors are willing to pay more for each dollar of earnings of that company.

For instance, if a business has a P/E ratio of 10, similar to Company JJ, it implies that investors are willing to pay ten times the value of its current earnings per share to own that stock.

A high P/E ratio could mean that a stock's price is high relative to its earnings, but it may also indicate that the market has high expectations for the company's future earnings growth.

In contrast, a low P/E ratio may suggest that the market does not expect significant earnings increases from the business.

Therefore, if a firm's price to earnings ratio is already high, there may be less chance for its stock price to increase further, even if its earnings continue to improve.

To sum up, analyzing a company's P/E ratio in the context of the S&P 500 and the company's stock price is essential in determining whether a stock is overvalued or undervalued.

While a high P/E ratio may indicate growth potential, it is crucial to evaluate other factors such as the company's financial health and industry trends to make informed investment decisions.

Cautions & Further Explanation

Evaluating a company's value by making use of the price to earnings (PE) ratio can be a tricky task, particularly if the shares of the business have been fluctuating considerably in price over the short-term.

Such fluctuations are often the result of rumors regarding a company's management, financial strategy, or future performance.

It is crucial to keep in mind that news items and speculation can have a significant impact on a firm's perceived value at any given point in time, and this will, in turn, affect its PE ratio.

Additionally, various market factors affect entire industries as a whole, so it is not enough to merely accept a promising or less promising PE ratio at face value.

One should compare potential investments with other companies in the same industry.

It is worth noting that some investors believe that using the PE ratio to evaluate a company's value is now outdated, and it is advised to avoid relying on this ratio alone.

To make a better investment decision, it is best to use other financial ratios like the PEG ratio and the PEGY ratio in conjunction with the PE ratio.

When using the PE ratio for valuing a company, it is important to determine whether the price is overvalued or undervalued by comparing it to the earnings growth rate of its earnings for a specified time.

This can be done by dividing the PE ratio by the growth rate of earnings.

A low relative to earnings PE ratio would indicate that a company is undervalued, while a high ratio would suggest that the company is overvalued.

However, investors must keep in mind that a company's past performance does not guarantee earnings growth in the future.

Therefore, it is essential to estimate a company's intrinsic value to make a sound investment decision.

In conclusion, while the PE ratio can be a useful tool for evaluating a company's value, it should be used in conjunction with other financial ratios and should not be the sole basis for making investment decisions.

Frequently Asked Questions

Q: What is the PE ratio, and how is it calculated?

The PE ratio, or price-to-earnings ratio, is a financial metric used to measure a company's valuation relative to its earnings. It is calculated by dividing the company's current stock price by its earnings per share (EPS) over the last 12 months.

Q: What does a high or low PE ratio indicate about a company?

A high PE ratio generally indicates that a company is overvalued, meaning that investors are willing to pay a premium for each dollar of earnings the company generates. A low PE ratio, on the other hand, may suggest that a company is undervalued and could be a good investment opportunity.

Q: How do you use the PE ratio to evaluate potential investments?

When evaluating potential investments, investors may compare a company's PE ratio to its industry peers or historical averages to determine if it is overvalued or undervalued. Additionally, investors may look for companies with a low PE ratio that have strong growth prospects or a history of consistent earnings.

Q: Are there any limitations or drawbacks to using the PE ratio?

Yes, there are some limitations to using the PE ratio as a valuation metric. For example, the PE ratio does not take into account a company's debt or other financial factors that may affect its valuation. Additionally, the PE ratio may not be useful for comparing companies in different industries, as earnings and growth prospects can vary widely across sectors.

Wrap-Up: Ignite Your Investment Strategy with PE Ratio

Congratulations on reaching the end of this informative blog on the importance of PE ratio in investment strategy.

You now have the opportunity to put your knowledge into action and make informed investment decisions that can lead to substantial returns.

Understanding PE ratio is crucial for any investor who wishes to make strategic and profitable investments.

By carefully analyzing a company's PE ratio, you can determine if it's overvalued, undervalued, or fairly priced.

This knowledge will help you make more informed decisions and avoid potential pitfalls.

Moreover, being an informed investor not only leads to better investment outcomes, but it also gives you a sense of confidence and control over your financial future.

So, take the time to research and analyze the PE ratio of potential investments.

Remember that context matters, and it's not just about the number.

It's worth noting that PE ratio is not the only ratio that investors use to evaluate a stock.

The PEG ratio measures the relationship between a stock's price-earnings ratio and its earnings growth rate over the past 12 months.

Additionally, a single ratio cannot provide all the necessary information about a stock.

Still, it's a useful tool to evaluate a company's performance and potential profitability.

As you continue your investment journey, keep in mind that the world of finance is continually evolving, and there's always more to learn.

Keep reading, analyzing, and investing.

With the right knowledge and strategy, you may become the next Warren Buffet.

In conclusion, understanding the PE ratio and other financial ratios is critical to making informed investment decisions.

By measuring a company's current stock price relative to its earnings, investors can determine its potential profitability.

But remember, investing requires continuous learning, so keep researching and analyzing to stay ahead of the game.