This is an ultimate guide on how to calculate Interest Coverage Ratio with detailed analysis, interpretation, and example. You will learn how to utilize this ratio formula to assess a business solvency.

Definition - What is Interest Coverage Ratio?

The interest coverage ratio, often known as times interest earned ratio, is a solvency ratio that employs a firm’s income statement data to evaluate its ability to pay interest.

This ratio is often used to measure the extent to which operating earnings (earnings before interest & taxes, or EBIT) can cover the company's interest expenses.

Generally speaking, the higher the ratio, the better can the business meet or cover its current interest payments.

In this article, we’ll dive into how to calculate this ratio and how to use it to effectively assess a company’s debt repayment ability.

More...

Formula

Okay, first of all, let's have a look at the interest coverage ratio equation:

Interest Coverage Ratio = Earnings before Interest & Taxes (EBIT) / Interest Expenses

The EBIT figure is used in this calculation because the company often makes interest payments out of its operating profit, or EBIT.

So how can we find the EBIT figure?

Simple. You can get a company’s EBIT by simply adding the interest expenses and taxes back to its net income.

EBIT = Net Income + Interest Expenses + Taxes

EBIT is also known as operating income, operating earnings, profit before interest and taxes (PBIT).

Example

Now let's consider a quick example so you can understand how to compute this ratio.

Let's say, you are looking to evaluate Company D's debt repayment capacity, and you'd like to know if this company's operating income can fulfill its current interest obligations.

After looking into the company’s income statement, you find the following information:

- Net Income = $120,000

- Interest Expenses = $50,000

- Taxes = $12,000

So how can you find the interest coverage of this company?

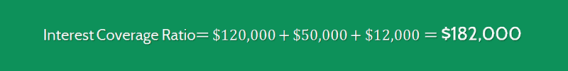

First of all, you’ll need to calculate the EBIT figure, by simply adding the interest expenses and taxes back to the net income, like so:

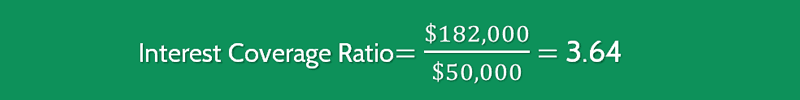

Then, you can use the above formula to calculate this ratio:

In this example, the ratio value is 3.64, which means Company D can easily cover its annual interest payments 3.64 times.

Or in other words, the company’s EBIT is 3.64 times higher than its annual interest expenses.

Interpretation & Analysis

So now we're done with the calculation, now let's find out how to use this ratio to assess a company's solvency.

As mentioned earlier, the higher the ratio, the better.

When a firm’s interest coverage ratio falls below 1.0, you should be careful when making your investment decision.

The ratio value of less 1.0 means that the business will not be able to cover or meet its interest payments when due, and this, of course, threatens the continued viability of the business.

Failure to make interest charges on time may bring a legal action by the company's creditors, possibly leading to bankruptcy.

So what is a good interest coverage ratio?

This ratio value varies from industry to industry. To be conservative with your valuation, you’ll need to compare a company’s ratio with the average industry’s ratio.

In general, the company’s interest coverage should be higher or equal to the industry average.

For example, the industry average is 6.5, so the company's ratio should ideally be 6.5 or greater.

If the ratio is much lower than the average industry, it’s further evidence that the business makes extensive use of creditors’ fund to finance its operations.

Cautions & Further Explanation

It’s worth noting that this ratio assumes that there are not any ongoing or upcoming principal payments on debt, and such principal payments can easily exceed the cash outflow required by interest payments.

So it can be misleading if you don’t take such payments into consideration when using this ratio to assess a company’s capacity to pay its debts.

When it comes to valuation of a company, using a single ratio is not enough.

In order to draw a truer picture of a company’s financial health, you should consider using this ratio with other solvency ratios, such as the debt service coverage ratio, or the debt to asset ratio.