This is a complete guide on how to calculate Long Term Debt to Equity Ratio with detailed interpretation, example, and analysis. You will learn how to use its formula to assess a business debt settlement capacity.

Definition - What is Long Term Debt to Equity Ratio?

The long term debt to equity ratio, also known as the long-term debt to capital ratio, is a capital structure ratio that throws light on the financial solvency of a company.

This ratio works by comparing a company’s long-term debt with its capital, thereby providing you insights on how the company finances its core operations (by using both equity and debt financing).

The long-term debt to debt ratio is different from the regular debt to equity ratio as we are only looking at the long term debt here (excluding any short term obligations that the company may have).

This ratio tells us about the respective claim of creditors and owners over the firm’s assets.

The ideal range for this ratio would depend on the industry in which the firm is operating as some industries utilize more debt financing than others.

For instance, financial institutions have a higher ratio as they borrow money to lend it further.

You will find that capital intensive industries have a higher ratio as compared to some other industries which are not as capital intensive.

However, as an investor, you will want to look for companies with a low long-term debt to capital ratio since you don’t want to risk your money in a high debt company.

More...

Formula

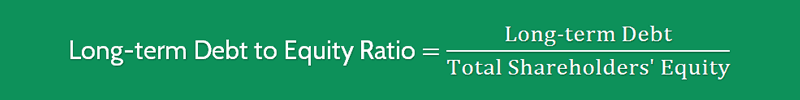

In order to calculate a company’s long term debt to equity ratio, you can use the following formula:

Long-term Debt to Equity Ratio = Long-term Debt / Total Shareholders’ Equity

The long-term debt includes all obligations which are due in more than 12 months.

Total shareholder’s equity includes common stock, preferred stock and retained earnings.

You can easily get these figures on a company’s statement of financial position.

Example

Okay now let’s consider a quick example, so you can see how easy it is to use this ratio to assess a company’s solvency.

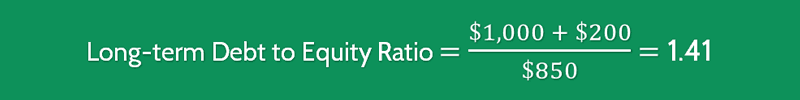

For example, you are investing in Company A which has $1,000M in long term loans and $200M in capital leases.

The company has $500M in common stock, $250M in preferred stock and $100M in retained earnings, which adds up the total value of its shareholders’ equity to $850M

By using the formula provided above, you can easily calculate this company’s long term debt to equity ratio, like so:

The ratio value of 1.41 indicates that this company’s long-term debt is much higher than its shareholders’ equity (41% higher).

Interpretation & Analysis

Generally speaking, a higher value of the long-term debt to total shareholders equity ratio represents a higher level of leverage.

This ratio helps companies in understanding how big a role debt plays in their capital structure and how future increase in interest rates could affect their profits.

It’s worth considering that companies with a higher ratio are considered riskier from both lenders’ and investors’ perspective.

A higher ratio would mean that lenders have a higher stake in the business. This simply means it will be much easier for a business to raise more funds from these lenders to expand its core operations.

Further lending for the firm would be difficult as the margin of safety is low for a new lender.

But at the same time, a higher debt means that the owner can retain control of the business.

On the other hand, a lower ratio indicates that the company is more being financed by its shareholders’ capital.

Investing in businesses with more equity than debt will be less riskier for you as an investor, as the company you are considering investing in doesn’t have a lot of debt burdens and it won’t easily be stuck with many financial issues.

So what’s a good long term debt to equity ratio?

A ratio of 1.0 indicates that the business long-term debt is equal to its shareholders’ capital.

Because we want this ratio is as low as possible, so a good long-term debt to equity ratio should be less than 1.0, and ideally should be less than 0.5.

That’s to say, the business should have the ability to settle its long-term debt by using less than 50% of its stockholders’ capital.

Cautions & Further Explanation

Since the value of the long-term debt to total equity ratio depends a lot on the industry that the firm is operating in, we cannot draw a conclusion whether a particular ratio is too high or too low.

One solution to this problem is to look at historical ratio figures for the company. Any significant change could indicate a red flag.

Comparison with other firms working in the same industry is also a good way to figure out whether a particular firm is highly levered.

Most of the times, we include preferred stock while calculating shareholder’s equity as preferred stock falls under the definition of equity (although it has some similarities with debt).

The final decision to include it or not depends on the objective of calculating the ratio.

If you are looking at the financial solvency of a company, then it must be included in equity calculation.

But, if you want to evaluate the gearing effect of dividends on company’s earnings, then preferred stock should be included under debt.

So, you should always be careful while deciding what to include and what to exclude while calculating these solvency ratios.