If you don't know what a broadening top chart pattern is, you're missing out on one of the most powerful indicators around.

I don't think you can read much into a chart without knowing how to spot this chart pattern...

How do you know when it appears?

And when is the best time to trade it? - Right after it has formed or right before it breaks through the resistance level?

If you want to know the answers to these questions, then read on!

What is a Broadening Top Pattern?

The broadening top is a technical analysis tool that you can use to identify potential trend reversals.

This pattern is usually found in strong uptrend markets (or sideways trending markets).

It is formed when the price of a security makes a series of higher highs and lower lows, creating a megaphone shape on the price chart.

While forming, the broadening top usually initiates a strong downtrend and terminates in a corrective move.

Therefore, it is extremely useful for day traders and swing traders of both trending and sideways markets.

When the market is bullish, a fakeout or "head fake" may occur. Therefore, you should be wary when price rises above the upper trendline.

Even though this formation often comes with a bearish implication, it has the characteristics of a typical broadening pattern. This means that breakouts can occur in both directions.

This pattern is also known as a megaphone top, reverse symmetrical triangle, or 5-point reversal pattern.

Broadening Formation

The broadening formation occurs much more frequently at bottoms than at tops, especially when the market is in a period of consolidation and high volatility.

It is created by a series of higher highs and lower lows that get progressively wider over time.

This expands the price range and makes the formation look similar to an expanding triangle.

The broadening formation is considered complete when the price breaks out of the widest part of the pattern.

This tells us that the market is losing momentum, and that is a clear sign that the current trend is about to reverse.

As you can see, there is not much difference between a broadening top and a broadening bottom.

These formations differ in the price trend that leads to the chart pattern. The broadening bottoms are often followed by an upward breakout, while the tops are more likely to reverse downward.

In my experience, tall patterns tend to do a better job than short ones.

But there is no general rule about this because every market is different, and some patterns are better than others depending on the circumstances.

Now let's have a look at some examples.

Example

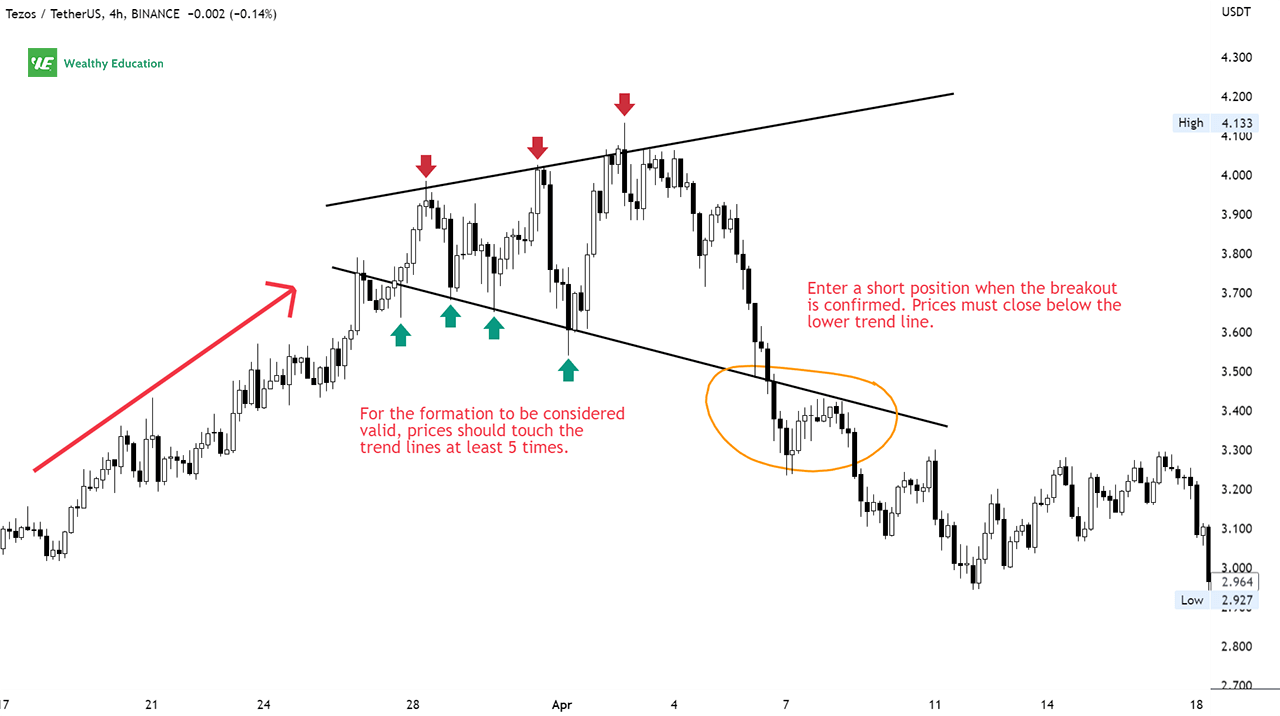

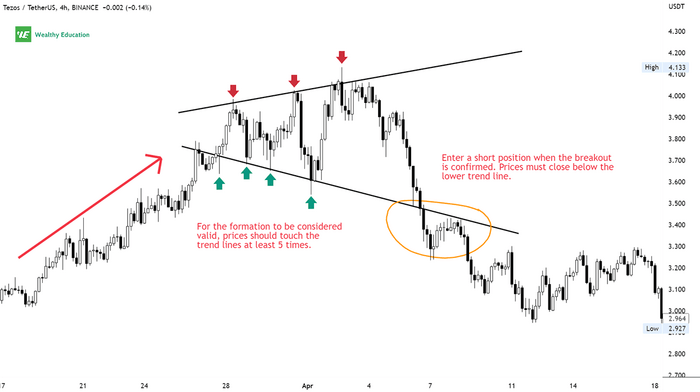

The broadening top formation appears on top of an uptrend. It indicates that the bulls are exhausted, and they need some rest after a long ride.

As you can see, the bulls push price up, but it fails to break through the top trendline. This signals that selling pressure is overwhelming, and that the bears are now in control.

As a result, the bears begin to take over and drive the price down. This formation is often followed by a sharp decline that lasts for several days.

However, be careful because it is not always this straightforward.

A pullback often occurs to test the support line once again before continuing the downtrend.

Therefore, make sure you have enough margin in your account to hold your short position for a bit longer in case the pullback happens.

Pullbacks hurt performance, but they can also strengthen the market momentum and drive the price down even further.

So don't worry! Just stick to your plan and prepare for the worst scenarios.

How to Trade Broadening Top

Broadening tops are often followed by a bearish move. Therefore, they're excellent setups for professional short sellers.

The key here is to look for a market that is in an uptrend, and then look for a series of highs and lows that are getting progressively wider.

The strategy for trading broadening formation breakouts is simple:

All you need to do is to wait for a downward breakout and then follow the trend to capture some profits.

A downward breakout occurs when the price breaks down through the lower trend line. The price usually declines steeply after it gets enough selling pressure.

To confirm the broadening top formation, you'll need to wait to see at least two minor highs and two minor lows. You can draw two diverging trend lines: one connecting the lows and one connecting the highs.

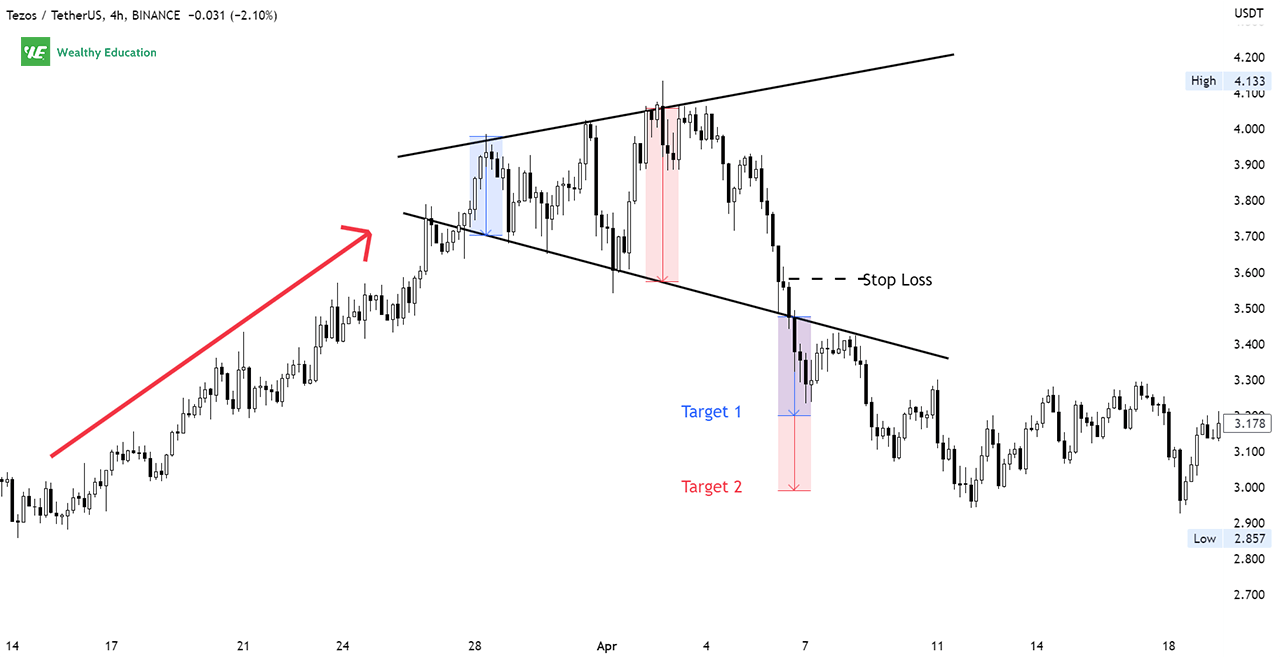

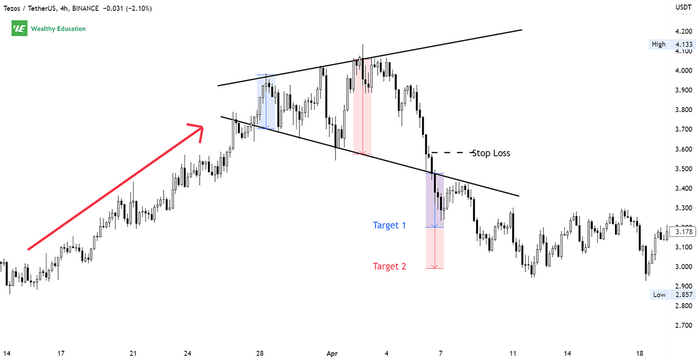

You'll need to identify the trendlines and watch the price closely. Once prices have broken the lower trend line and closed below it, you can go short and ride the trend down.

A stop loss will be set depending on your risk tolerance. Your target profit can be the height of the formation.

The Bottom Line

The broadening top is a bearish reversal pattern that is characterized by a wide range of price movements, which creates a widening effect on the chart.

This formation indicates that the bull market is losing steam and going to reverse to the downside.

You can trade breakouts right after the broadening top pattern forms.

But I suggest waiting for the formation to last for some time before jumping in. That way, you'll have a higher success rate and a lot more room to work with.

This pattern can be useful in identifying potential reversals in the markets.

However, you should keep in mind that no one pattern is perfect, and that other factors should be considered before making your trading decision.

No matter which method you choose, make sure you have a plan in place before entering the market.

Know your entry and exit points and stick to your plan.