This is an ultimate guide on how to calculate Return on Sales (ROS) ratio with in-depth interpretation, analysis, and example. You will learn how to use its formula to evaluate a company's profitability.

Definition - What is Return on Sales Ratio (ROS)?

The return on sales ratio gives you an effective way to measure the efficiency with which a company converts its revenues into profits.

Essentially an assessment of a firm’s financial performance, the ROS ratio shows you how much of a company’s operational income is actually yielding a net gain.

This profitability ratio is particularly useful when evaluating a potential investment opportunity because it allows you to compare companies within the same industry, regardless of their size.

By comparing earnings to net sales, the ratio calculates the return on net sales as a percentage that can also be used to conveniently analyze the operational efficiency of the same business, over a range of reporting periods.

More...

Formula

When you want to determine the return on sale ratio for a specific company, you can use the following formula:

Return on Net Sales Ratio = Earnings Before Interest & Taxes / Net Sales

A company’s EBIT figure is also known as its operating profit, since it’s based only on net income that’s derived from regular business operations.

By excluding interest and taxes as operational expenses, the ROS ratio gives you a result that’s more representative of the profits generated from a firm’s core operations.

Return on Sales Calculator

Example

Now you know the formula for finding this ratio, let's take a look at the ROS example below.

Perhaps you believe that Company HH would make a good addition to your investment portfolio.

To take a closer look at its profitability and financial performance from last year, you gather the following information from Company HH’s financial statements:

- Net Earnings = $750,000

- Interest Expense = $20,000

- Taxes = $30,000

- Net Sales = $1,000,000

How do you calculate return on sales of this company?

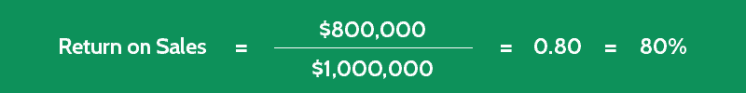

Using these figures and the ROS formula, you can now calculate Company HH’s rate of return on sales, as follows:

(With the EBIT = Net Earnings - Interest Expense - Taxes)

Interpretation & Analysis

The higher the return on sales percentage is, the more profit a business is generating directly from its sales, as opposed to from other sources of potential income, such as the interest on any investments.

So what is a good return on sales ratio?

Overall, the result of the return on net sales ratio shows you how efficiently a company is producing or providing its goods or services to the market.

At the same time, it serves as an indication of just how effective that company’s management team is at running the business, since producing the same level of net sales with fewer operational expenses will result in a higher return.

In either case, this ratio can provide you with particularly meaningful information when you study the results for a specific business over a period of time.

If you notice that profits are falling off regardless of the fact that overall sales are increasing, for example, it could be an indication that the company is being forced to take advantage of less profitable sales opportunities in order to grow.

This is not a positive trend, since it can reflect either poor planning on the part of management, or the over-saturation of more lucrative markets.

Cautions & Further Explanation

It’s important to recognize that many companies have both cause and method for presenting a higher return on net sales result than may be warranted.

Depending on the accounting practices used, a firm’s earnings and expenses for a given period can be tweaked to appear higher and lower, respectively, than they should be.

These enhancements are simply based on timing where the reporting of finances is concerned, but the end result can be a skewed return on net sales figure that looks more attractive than it is.

As an investor, you should always make a point of being as thorough as possible in your investment analyses, and confirming any conclusions you come to about a particular business by making use of as many different financial ratios as possible.