This is an in-depth guide on how to calculate Return on Capital Employed (ROCE) ratio with detailed analysis, interpretation, and example. You will learn how to use its formula to assess a firm's profitability.

Definition - What is Return on Capital Employed Ratio?

One of the many tools you can use to measure a company’s profitability is the return on capital employed or ROCE ratio.

This ratio compares a firm’s net earnings from operations to the amount of its capital employed, in order to determine how much profit is being generated from each dollar of that capital.

The capital employed figure indicates the amount of capital investment that’s needed for a particular business to operate successfully.

In other words, it represents the combined amount of a company’s shareholder equity, plus its long-term liabilities.

Because it considers a company’s long-term debt obligations, the ROCE ratio takes a longer view of the firm’s continued financial viability.

Instead of simply giving you a picture of how efficiently the firm’s current assets or shareholder investment is producing a profit, the ratio gauges profit performance based on both equity and debt.

More...

ROCE Formula

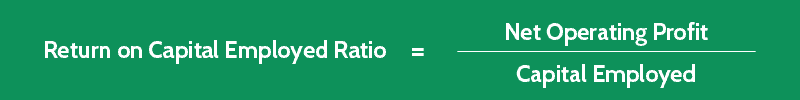

In order to calculate the return on employed capital for a business you wish to evaluate as a potential investment, you would use the following formula:

ROCE Ratio = Net Operating Profit / Capital Employed

A company’s net operating profit is essentially the amount of its earnings from operations, before interest and taxes (EBIT).

So how to calculate capital employed?

The capital employed figure can be calculated by subtracting the company’s current liabilities from its total assets.

- Capital Employed = Total Assets - Current Liabilities

Return on Capital Employed Calculator

Example

Now let's consider this example so you can understand how to work out return on capital employed and how to use this ratio in assessing a firm's profitability.

Company GG represents a promising investment for your portfolio, and you’d like to get a better sense of its potential for financial longevity.

In order to compare Company GG’s profitability for last year with that of three years ago, you gather the following information from its financial statements:

3 Years Ago | Last Year | |

|---|---|---|

Earnings before Interest and Taxes (EBIT) | $650,000 | $750,000 |

Total Assets | $1,200,000 | $1,500,000 |

Current Liabilities | $200,000 | $500,000 |

Using these figures and the given formula, you can now calculate the change in Company GG’s ROCE, like so:

(With Capital Employed = Total Assets - Current Liabilities)

Interpretation & Analysis

Now you understand clearly how to calculate this ratio, so the next question is: what does return on capital employed show?

The higher a firm’s ROCE result is, the more profit it’s creating out of every dollar of capital investment it uses in its operations.

If a company has a capital employed ratio value of 0.75 or 75%, for example, it means it’s generating a net return of 75 cents from every dollar of capital it employs.

So what is a good return on capital employed?

Generally speaking, a higher ratio result indicates that a business is making good use of its long-term financing strategy.

On the other hand, if a business is generating returns that are below the actual cost of carrying the long-term debt needed to produce those returns, it’s effectively losing money.

Remember that, while one firm may be far richer than another in terms of assets, if those assets aren’t contributing to a greater level of net profit then they may not be as valuable to you, as an investor, over the long-term.

Cautions & Further Explanation

One of the potential concerns when using this ratio to analyze a company’s inherent worth is the fact that many assets, and the resulting capital employed figure, decrease over time.

As fixed assets depreciate in value, a firm’s return on employed capital will gradually increase.

Because of this, companies that have been around for many years may show a higher ratio value than a newer business will.

You should bear this discrepancy in mind, and consider taking steps to account for it, when performing your calculations.

Always use a consistent version of the ROCE formula when comparing a business with its competitors, or when evaluating a single firm’s performance over a period of time.