This is a detailed guide on how to calculate Times Interest Earned (TIE) ratio with thorough interpretation, example, and analysis. You will learn how to use its formula to determine a business debt repayment capacity.

Definition - What is Time Interest Earned Ratio?

The times interest earned ratio is a calculation that allows you to examine a company’s interest payments, in order to determine how capable it is of meeting its debt obligations in a timely fashion.

Also known as the interest coverage ratio, this financial formula measures a firm’s earnings against its interest expenses.

As one of solvency ratios available for evaluating an organization’s debt-servicing ability, the times interest earned ratio offers a relatively refined point of view because it highlights the affordability of a company’s interest payments only.

When you use the TIE ratio to examine a potential investment, you’ll discover how close to the line a business is running in terms of the cash it has left over after its interest expenses have been met.

The better a company is at paying its bills on time, without disrupting the efficiency of its regular business operations, the more likely it is to generate the consistent profits needed to fund your investment returns.

More...

TIE Formula

How do you calculate times interest earned? To find the TIE ratio for a business you’re considering as a possible investment, you would use the following formula:

Time Interest Earned Ratio = EBIT / Interest Expenses

The EBIT figure for the time interest earned ratio represents a firm’s average cash flow, and is basically its net income amount, with all of the taxes and interest expenses added back in.

EBIT is used primarily because it gives a more accurate picture of the revenues that are available to fund a company’s interest payments.

Read also: Working Capital to Debt - Formula, Example & Analysis

Times Interest Earned Calculator

Example

So you now know the TIE ratio formula, let's consider this example so you can understand how to find times interest earned in real life.

Perhaps you’re considering buying stock in Company W, and you’d like to evaluate the risk factor associated with its time interest earned ratio.

When you study Company W’s financial statements, you discover the following information:

- Net Income = $1,000,000

- Interest Expense = $500,000

- Taxes = $100,000

You can now use this information and the TIE formula provided above to calculate Company W’s time interest earned ratio.

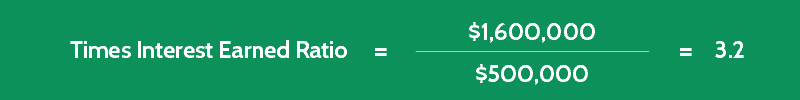

The TIE ratio can be calculated by taking the company's EBIT and dividing it by the Interest Expenses, as follows:

(With the EBIT = Net Income + Interest Expense + Taxes)

This example illustrates that Company W generates more than three times enough earnings to support its debt interest payments.

Interpretation & Analysis

The significance of the interest coverage ratio value will be determined by the amount of risk you’re comfortable with as an investor.

So what is a good times interest earned ratio?

Any ratio result equal to or less than 1 tells you that, not only does a business not have the excess cash available to repay the principal on any loans it may be carrying, it doesn’t even have the income to cover the interest payments on those debts.

This can be interpreted as a high-risk situation since the company would have no financial recourse should revenues drop off, and it could end up defaulting on its debts.

When the times earned interest ratio is comfortably above 1, you can feel confident that the firm you’re evaluating has more than enough earnings to support its interest expenses.

Not only does this translate into more money available to repay the principal on its loans, it also means there’s more cash to put toward expanding operations and increasing investor value.

As a point of reference, most lending institutions consider a time interest earned ratio of 1.5 as the minimum for any new borrowing.

Cautions & Further Explanation

While this ratio does show you how much of a company’s leftover earnings are available to pay down the principal on any loans, it also assumes that a firm has no mandatory principal payments to make.

Because it considers debt interest only, the result of the time interest earned ratio can be extremely misleading if you don’t also take any upcoming or ongoing debt principal payments into account in your investment analysis.