This is a complete guide on how to calculate Sales to Current Assets ratio with detailed interpretation, analysis, and example. You will learn how to use its formula to assess a company's liquidity.

Definition - What is Sales to Current Asset?

The sales to current assets ratio is a financial calculation that can help you determine how efficiently a company is making use of its current assets to generate revenue.

Current assets in this case would include the combined total of cash, marketable securities, receivables, inventory, and any prepaid expenses.

The sales to current asset ratio will give you the most meaningful measure of liquidity when it’s used to analyze businesses that hold a significant amount of inventory.

Because this ratio value can vary widely, the comparison of net sales amounts with current assets is best used to spot trends over a number of accounting periods for the same company, or to compare multiple companies within the same industry.

More...

Formula

You can use the following formula to calculate an organization’s sales to current asset ratio:

Sales to Current Asset Ratio = Net Sales / Current Assets

The net sales amount used in the ratio would be based on the period being assessed, but you would usually consider a company’s annual sales figure.

Read also: Sales to Working Capital - Formula, Example & Analysis

Sales to Current Assets Calculator

Example

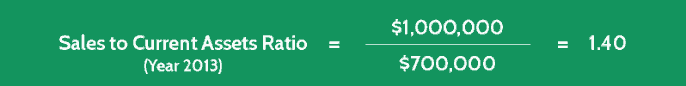

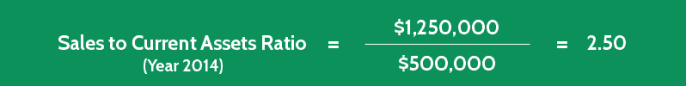

Let’s look at an example of a firm you may be considering as an investment.

Company E has been in business for a number of years, and you’d like to determine whether its financial performance is improving or deteriorating in terms of how effectively its assets are supporting its revenues.

Company E’s current assets and annual net sales for the past three years look like this:

Year 2013 | Year 2014 | Year 2015 | |

|---|---|---|---|

Current Assets | $700,000 | $500,000 | $200,000 |

Net Sales | $1,000,000 | $1,250,000 | $1,500,000 |

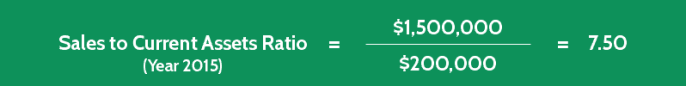

By using these figures and the given formula, you can easily calculate Company E’s sales to current asset ratio for the three progressive years as follows:

This somewhat exaggerated example demonstrates a couple of key points. At first glance, the ratio values appear fairly meaningless when each of them is considered in isolation.

But when you examine all three results together you can see that Company E is displaying a disturbing trend, where its sales to current asset ratio value has increased significantly over the past three years.

Although its sales have risen steadily over the same period, Company E has been supporting and generating those sales with fewer available assets each year.

This could indicate a precarious and unstable financial situation.

Interpretation & Analysis

A high sales to current assets ratio often means that a business is running with insufficient working capital (current assets minus current liabilities) to fund its day-to-day operations.

This in itself doesn’t make for a very sustainable, long-term financial environment.

But when the ratio value shows an increase over a period of time, it can indicate a steady decline in anything from production, to adequate inventory levels, to a company’s ability to collect from its customers.

In other words, the business could have a major liquidity problem, and may soon have trouble servicing its current debts.

Cautions & Further Explanation

When you make use of this ratio in your investment analysis of a company, you should keep in mind that it’s not very useful in certain circumstances.

Businesses like drop-ship companies that carry no inventory of their own, and firms that conduct their sales primarily through credit card transactions with few resulting receivables, would both show low current assets and subsequent high sales to current asset ratios.

In both these cases, these figures would be justified, and therefore couldn’t be viewed as an indication of poor liquidity.