This is a complete guide on how to calculate Days Working Capital Ratio with detailed interpretation, example, and analysis. You will learn how to use its formula to assess a company's efficiency.

Definition - What is Days Working Capital?

The days working capital of a company is the average number of days the business takes to convert its working capital (WC) into revenue.

It reflects how efficient the company is at managing its short-term liquidity position and is a standard measure of the overall health of a business.

A high number of days working capital suggest that the company takes more time to convert its working capital into sales and is subsequently less efficient.

On the other hand, the fewer the working capital days, the better as it implies that the company is much more efficient.

Investors would use days working capital as a valuable tool when appraising a business.

More...

Formula

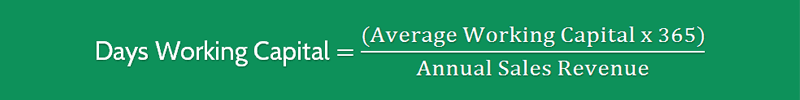

The formula to measure the days working capital of a company is as follows:

Days Working Capital = (Average Working Capital x 365) / Annual Sales Revenue

So multiply the average working capital (current assets - current liabilities) that the company has available by 365 and divide by the annual sales revenue.

You can find these numbers on a company’s financial statements.

Example

Now that you know the Days WC formula, let’s consider a quick example.

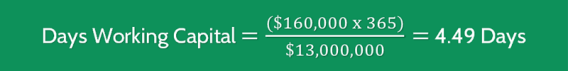

QSE Company has total current assets of $250,000 and total current liabilities of $90,000. Revenue was $13,000,00 for the year.

To determine the working capital days for the company we need to substitute into the formula:

This suggests that QSE Company takes around four and a half days to convert its working capital into sales revenue.

Interpretation & Analysis

To provide sufficient context to this number, you would need to analyze whether this figure is increasing or decreasing over time and also compare it to other companies within the same industry as there might be a standard to use as a benchmark.

If the days working capital are declining, then this is seen to be positive as it implies the company is able to free up cash stuck in working capital, quicker.

A good business would always try to shorten the days working capital as much as it could in order to improve its liquidity position in the short term and also increase its efficiency.

If, on the comparison of similar business and previous results, QSE Company wanted to reduce its working capital days, it could do so by shortening its working capital cycle (buying goods > manufacturing > sales > revenue) and thus convert its working capital into revenue quicker and more efficiently.

QSE could collect revenue from customers quicker by reducing credit periods, increasing sales and improving manufacturing processes.

Cautions & Further Explanation

You need to be careful when using this metric as a number of factors can give a misleading result.

At the period of time that the company calculates its days working capital, a number of different things may be happening.

These might include seasonality of products, shelf life and unexpected events which may have an effect on the working capital cycle of the company and thus suggest issues that might not really be there.