This is a complete guide on how to calculate Cash Ratio with detailed analysis, interpretation, and example. You will learn how to use its formula to assess a firm's liquidity.

Definition - What is Cash Ratio?

The cash ratio is one of the most useful liquidity ratios that you can use to gauge a company’s capacity to cover its short-term debts by using its cash and cash equivalents.

Compared to other liquidity ratios, such as the current ratio and acid test ratio, the cash ratio is more prohibitive since it will only consider cash and cash equivalents as the liquid asset of the company.

Accounts receivable and inventory are left out of the equation since these assets need to be sold or collected before they can be converted to cash.

While the assets as mentioned above bear a price, they may be subject to impairment. At the same time, the price of these assets cannot be determined right away.

Simply put, other current assets are not as good as cash since it’s the company’s most liquid asset.

This ratio is particularly useful when it’s used to determine what percentage of a company’s short-term obligations can be covered by cash alone.

In general, the higher the ratio, the more liquid the company is.

More...

Formula

You can easily calculate the cash ratio using by adding cash and cash equivalents, and then dividing the sum by the entity’s total liabilities, like so:

Cash Ratio = Cash & Cash Equivalents / Total Current Liabilities

In most cases, companies present cash and cash equivalents as a single line item in their statement of financial position.

Cash includes petty cash and the company’s cash in bank.

Cash equivalents could include treasury bills, commercial papers, marketable securities, short-term government bonds, and money market funds which could all be converted to cash within 90 days.

Example

Now that you know the exact formula for computing this ratio, let’s consider a quick example so you can see how it’s used to evaluate a firm’s liquidity.

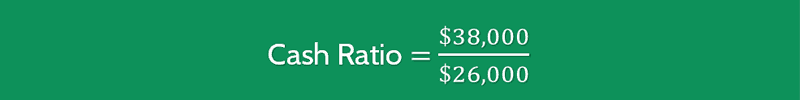

For example, you’re considering investing in Company X which has $38,000 in cash & cash equivalents, and $26,000 in total current liabilities.

Based on the data above and by using the given formula, you can calculate Company X’s cash coverage ratio as follows:

From the example above, Company X can easily pay its short-term obligations 1.46 times by using its current cash & cash equivalents.

Interpretation & Analysis

Also known as the cash coverage ratio, or the current assets to current liabilities ratio, the cash ratio measures a firm’s ability to pay off all of its current liabilities without selling off its assets.

In general, the higher the ratio, the more liquid the business is.

A ratio value of equal to 1.0 indicates that the business cash and cash equivalents are enough to pay off all of its short-term debts.

So what is a good cash ratio?

For most creditors and investors, a ratio of more than 0.50 is considered a good indication that the company can instantly pay off 50% of its short-term obligations.

However, you should keep in mind that using this ratio alone is not enough to draw a clear picture of a company’s financial health.While a ratio of greater 0.50 looks good to creditors and investors, it could be impractical to certain industries.

Companies in the capital goods sectors, transportation, energy, services, and basic materials might find it impractical to maintain high cash reserves.

Meanwhile, companies in technology, healthcare, and financial industry might have a higher ratio value.

Cautions & Further Explanation

Similar to other liquidity ratios, there is no general standard value for this ratio.

In order to use this ratio effectively, you will need to compare the cash ratio of a business with that of its competitors and the industry average values.

In some cases, having a low ratio is not a bad sign. That’s because some businesses may have a high balance in current liabilities.

At the same time, having a high ratio should not be interpreted as a good sign right away.

Having a high ratio could also be a red flag as that indicates the company’s cash management is inefficient, and the company’s management might have failed to utilize their business resources to produce more revenue and cash flow.