This is an advanced guide on how to calculate Return on Net Assets Ratio (RONA) with thorough interpretation, analysis, and example. You will learn how to use its formula to assess a company's profitability.

Definition - What is Return on Net Assets Ratio?

The return on net assets ratio (RONA) is a financial performance measure that shows a comparison of a firm's net income to its net assets.

Generally, a higher result indicates that a company is making good use of its working capital and fixed assets to generate income and thus implies a higher profitability.

On the other hand, a low return on net assets ratio implies that the company and its management are not deploying the assets of a business in a valuable way.

This would be a cause for concern for a lot of investors who consider RONA as a vital metric in evaluating a company.

Fixed assets are typically one of the largest components of a business and converting them into revenue is important in developing an idea of a company's future and its ability to perform.

More...

RONA Formula

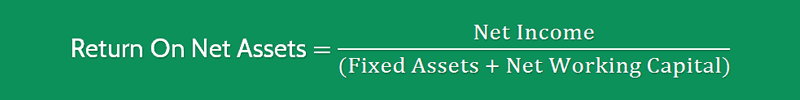

The formula to measure the return on net assets ratio is as follows:

Return On Net Assets = Net Income / (Fixed Assets + Net Working Capital)

So divide the Net Income of the business by the Net Assets (Fixed Assets plus Working Capital).

Net Assets = Fixed Assets + Net Working Capital

You can find these numbers on a company’s income statement and balance sheet.

Example

So now you know the RONA formula, let’s dive into a quick example.

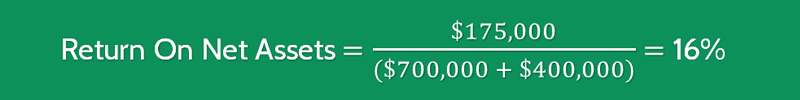

RFD Company is a manufacturing company and has $700,000 in fixed assets and $400,000 in working capital in a given period. In the same period, RFD generates $175,000 in net income.

To determine the working capital turnover we need to substitute into the formula:

The workings show that RFD Company generated a 16% return on its working capital combined with its fixed assets.

Interpretation & Analysis

As we can see, RFD Company is a manufacturing business that would be much more likely to have a vast outlay of investment in fixed assets.

As a result, a 16% return on total net assets would seem in general to be a poor result.

However, if we could see that the previous period generated a ratio of 10%, this might instead imply that the business is taking steps to become more efficient.

It’s slowly starting to convert its fixed assets and working capital into income which in turn would indicate increased profitability and improved performance.

If we looked at the wider industry and analyzed the return on total net assets of our two closest competitors, we would be able to evaluate the result further.

If their RONA ratios were 25% and 30%, we would have to consider that there is a real problem in generating revenue from the assets.

Cautions & Further Explanation

As with all performance ratios, the return on net assets ratio would need to be used alongside others to gauge a full perspective of the profitability and future of a business.

It is important to recognize that on its own, the result is without context and would need to be compared to previous years as well as other companies in the same industry.