This is a detailed guide on how to calculate Return on Average Capital Employed Ratio (ROACE) with in-depth analysis, interpretation, and example. You will learn how to use its formula to assess a business profitability.

Definition - What is Return On Average Capital Employed Ratio (ROACE)?

To analyze what the profitability of a company is, based on the investments it has made, we can use the return on average capital employed ratio (ROACE).

This is different to the return on capital employed ratio (ROCE) because it takes into account the average of the working capital of a given year as opposed to simply using the closing figure shown at the end of the period.

A higher ratio is better as it suggests a company is much more efficient at gaining profits from a small portion of capital assets whereas those businesses that struggle to make the conversion will have a lower return.

This ratio is especially useful when analyzing companies who operate in capital intensive industries and is vital for investors when trying to determine the performance capabilities and profitability of the business.

More...

Formula

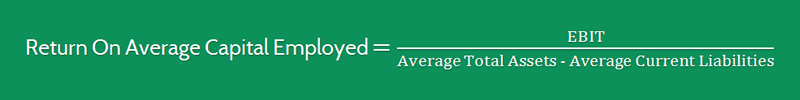

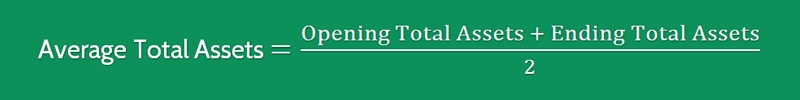

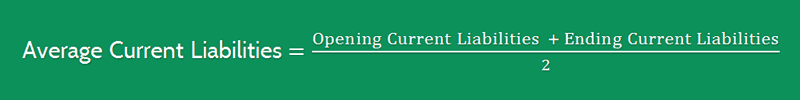

The formula to measure the return on average capital employed is as follows:

Return On Average Capital Employed = EBIT / (Average Total Assets - Average Current Liabilities)

The ROACE is arrived at by dividing the earnings before interest and taxes (EBIT) of a business by the average of its total assets less the average of its current liabilities.

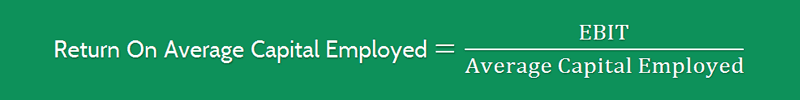

Another formula for calculating this ratio looks like this:

Return On Average Capital Employed = EBIT / Average Capital Employed

Average Capital Employed = (Beginning Capital Employed + Ending Capital Employed) / 2

You can find these numbers reported on the balance sheet and income statement of a company.

Example

Okay now let’s take a look at a quick example so you can understand clearly how to compute this ratio.

Company JSD has $700,000 in total assets and $350,000 in current liabilities at the start of the year.

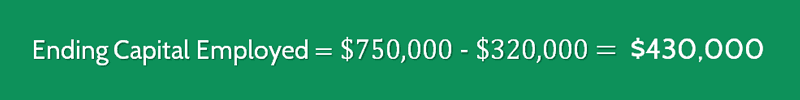

At the end, it is left with $750,000 in total assets and $320,000 in current liabilities.

During the year, Company JSD earned $150,000 in revenue and had $80,000 in operating expenses.

To determine the ROACE ratio of this company, we need to substitute into the formula:

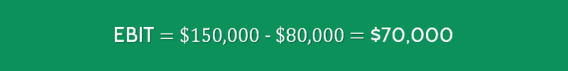

First we calculate the Earnings before Interest & Taxes (EBIT):

Next we calculate the Average Capital Employed:

Then, we substitute into the ROACE formula:

So Company JSD has a ROACE ratio of 17.95%.

Interpretation & Analysis

From the calculations, we can see that JSD Company's return on average capital employed is 17.95%.

We would need to compare this to previous year results and competitors within the same industry to determine if we are, or need to become, efficient.

If we found that a return of 17.95% was higher than previous years or higher in comparison to competitor results, then it would suggest the company is much more efficient at gaining profits from a small portion of capital assets.

Cautions & Further Explanation

You need to be careful when applying the ROACE ratio especially when the intention is to use it to determine an investment since capital assets are exposed to depreciation.

This means that an asset depreciating will make the return increase because it is less valuable so even if the same amount of profit is being made, we would be misled into thinking the return is higher.