This is an ultimate guide on how to calculate Financial Leverage Index with detailed analysis, interpretation, and example. You will learn how to use its formula to examine a company's capital structure.

Definition - What is Financial Leverage Index?

Financial Leverage Index is a solvency ratio that can help us find out how well a company is using leverage to increase return on its equity.

It basically tells us how effective the firm is in using leverage in its capital structure.

To understand this ratio, we need to understand how leverage affects return on equity for a firm.

To explain this concept, let us talk about a slightly different scenario. Let us assume that you have to purchase a house worth $1,000 which you intend to rent out.

The after-tax cash benefit you will receive through rent is $100. So you get 10% return on your equity ($100 / $1,000).

Now assume that your friend loans you $800 and the interest that you have to pay him amounts to $40. So you need to put in only $200 from your pocket.

Your income comes down by $40 (as you pay interest on the loan you get from your friend) to $60. Now your return on equity becomes 30% ($60 / $200).

So you see that you were able to use leverage as a ‘lever’ to increase the return on equity from 10% to 30%.

That is exactly how leverage helps a firm increase return on shareholder’s equity.

More...

Formula

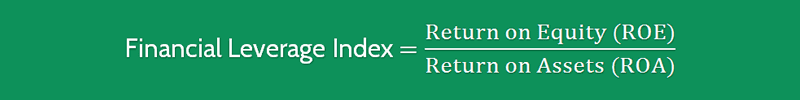

Now that we have understood what Financial Leverage Index signifies, let us look at the formula to calculate it.

Financial Leverage Index = Return on Equity / Return on Assets

This ratio can be easily calculated by taking the return on equity ratio and dividing it by the return on assets ratio.

You can use the following formulas for calculating the ROE and ROA ratios:

You can learn more about how to use the ROE ratio here and how to use the ROA ratio here.

Example

Okay now let’s take a look at a quick example so you can see exactly how to use this ratio to evaluate a firm’s solvency.

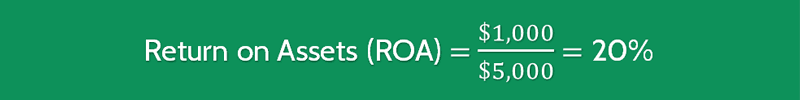

For instance, you are looking to invest in firm A that has $1,000 of net income. It has $5,000 in total assets and total shareholder’s equity is $2,000.

First we’ll need to find its ROE and ROA ratios, like so:

After having these figures, we simply use our provided formula to calculate the financial leverage index of this company:

So what does the financial leverage index of 2.50 mean? Let’s find out in the next section.

Interpretation & Analysis

Generally speaking, this ratio compares a company’s rate of return on equity to its rate of return on assets.In the example above, the return on equity is significantly higher than the return on assets (by a multiple of 2.5).

This means that equity base is considerably smaller compared to the asset base.

The firm has been able to successfully use leverage to magnify the returns to its shareholders (similar to the example we discussed in the introduction above).

An increasing index indicates that additional debt has been beneficial to the company.

At the same time, if the financial leverage index is decreasing with time, it indicates that the firm has not been able to use leverage to its benefit.

You can get more clarity on the reasons behind this observation by going through the financial statements of the firm.

Cautions & Further Explanation

We have to be careful when dealing with leverage. Leverage increases the variance in expected returns.

The fixed interest payments can become a problem if plans do not work out as expected. Thus, leverage brings along higher risk.

A firm has to be careful in figuring out the optimal leverage limit where the additional risk is commensurate with the possibility of higher returns.